Truth

Wisdom

Honor

Chronicle

Leadership

Keshequa

VOTE

Tuesday, May 19, 2009

Noon – 9:00 p.m.

Middle/High School Lobby

Absentee Ballots Due by 5 p.m.

MS Chorus, HS Band, K V V, Women’s

Choir, HS Jazz Concert on May 19 at

7:00 pm in Nunda Auditorium.

Budget Issue, May 2009

www.keshequa.org

stabilization funds for schools, we will review our needs and

programs in order to take full advantage of the funding.

Our Pre-Kindergarten program remains for next year,

as the state continues to fund early childhood education.

This budget also includes funding for a District School

Resource Officer. We look forward to increasing the number

of Advanced Placement courses offered and working with

area community colleges to provide more opportunities for

students to earn college credit in high school.

While budgets are prepared on an annual basis, it is

important to also plan for the longer term. This year you

will decide on two propositions that address the long term

planning undertaken by the District. One is to purchase

busses as part of the replacement cycle adopted several

years ago. Newer vehicles enhance student safety, reduce

maintenance and repair costs, and afford greater trade-

in value. Another proposition is to establish a Building

Capital Reserve Fund. You can read more about this in this

newsletter under the column “Managing for the Future.”

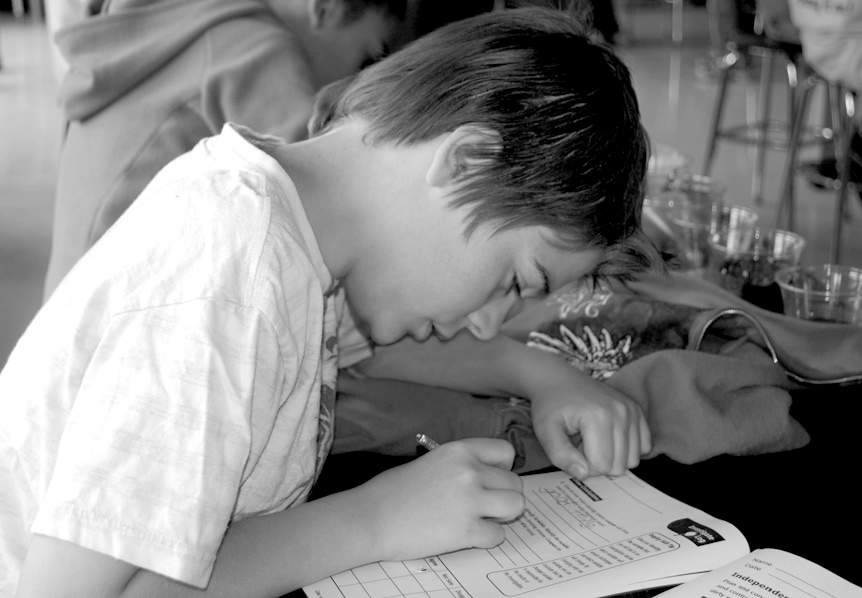

Student achievement remains the focus of our District, and

our proposed budget reflects that commitment. Declining

enrollment, flat state aid, increased state mandates, and

uncertain economic times require us to respond, not merely

react, in thoughtful ways to control spending. As we work

to minimize the impact of revenue loss we will strive to

maximize the quality of service and program by finding new

approaches in delivering excellence in education for our

community.

Dear District Residents,

On behalf of the Board of Education, we present the

proposed school budget for the 2009-2010 school year. The

budget process this year has been a particularly challenging

one for all schools given the national economic climate and

the deficits faced by New York State. Since December, we

have worked hard to create a spending plan that is driven

by the needs of our students and that respects the needs

of our community. Our proposed budget in the amount of

$18,365,500 represents an increase of 1.59% compared to

the 2008-2009 plan. If we exclude the debt service for the

EXCEL Capital project, which is offset by state building aid,

our operating budget is actually $17,531,689, or a decrease

of 1.30% from the current year. Our budget proposal

projects no increase in the tax levy.

Due to declining enrollment, we have made some

reductions in staff. These positions include a Library

Media Specialist, a .5 Social Studies Teacher, six Teaching

Assistants, and a Literacy Coach. We continue to consolidate

class sections at the Elementary level. The federal stimulus

funds have enabled us to make fewer reductions than

originally planned, and will help serve as a bridge over

the next two years of flat state aid. One of the goals of the

stimulus package is to increase student achievement. We

will be using a portion of those funds to expand our Pupil

Support Services, with the addition of a .5 position, to work

with at risk students and increase outreach to families. As we

receive more guidelines about the implementation of these

Sincerely,

Anita Buchinger, President, Board of Education

Marilyn Capawan, Superintendent

Page 2

Keshequa Chronicle

Write-in Candidate ________________________________________________

PROPOSITIONS & BOARD CANDIDATES

Back to top

The Keshequa School District Budget Vote is May 19, 2009, 12:00 noon – 9:00 p.m.

PROPOSITION #1:

RESOLVED,

that the Board of Education of the Dalton-Nunda Central School

District, be and hereby is authorized to expend the sum of $18,365,500 during the

2009-10 school year and to levy the necessary tax thereof.

This approves the budgeted

appropriations for the 2009-10 fiscal

year.

Propositions

Explanations

Election of Board of Education Members – Vote for Tree

Te two candidates with the most vote counts will be elected to four-year terms.

Te candidate with the third most vote counts will be elected to the one-year term.

?

Amy Bugman

?

John Gordinier

?

Ken Forrester

?

Todd Galton

?

Jennifer Reichard

Ballot

what you’ll vote for…

PROPOSITION #2:

RESOLVED,

that the Board of Education

of the Dalton-Nunda Central School

District, be and hereby is authorized

to undertake the acquisition of school

busses all at an estimated maximum

aggregate cost of $200,000, less any

trade-in value.

This authorizes the District to borrow

funds for the purchase of new busses dur-

ing the 2009-10 fiscal year.

The District continues to follow its long-

range bus replacement plan. This schedule

was created to maintain the integrity

of the bus feet, increase the safety of

our students, and minimize the cost to

taxpayers. This year, the plan includes the

replacement of two 66-passenger busses

with the purchase of one 60-passenger

bus and one 66-passenger bus.

State aid covers approximately 80% of the

total cost of the new busses.

PROPOSITION #3:

RESOLVED,

that the Board of Education of the Dalton-Nunda Central School District

is hereby authorized to establish a Capital Reserve Fund pursuant to Section 3651

of the Education Law (to be known as the “Building Capital Reserve Fund”), with

the purpose of such fund being to finance site work, reconstruction and equipping

of school buildings and facilities, and costs incidental thereto, the ultimate amount

of such fund to be $1,000,000, plus earnings thereon, the probable term of such

fund to be 10 years, but such fund shall continue in existence until liquidated in

accordance with the Education Law or until the funds are exhausted, and the sources

from which the funds shall be obtained for such Reserve are (i) an initial deposit of

up to $600,000, and (ii) amounts from budgetary appropriations from time to time,

and (iii) unappropriated fund balance made available by the Board of Education from

time to time, and (iv) New York State Aid received and made available by the Board of

Education from time to time, all as permitted by law.

This authorizes the establishment of a

Capital Reserve fund for future capital

renovations, repairs and improvements to

District facilities.

The establishment and funding of this

reserve fund is in alignment with the long

term financial planning of the District.

Back to top

Tovote

you must be

■

a United States citizen;

■

at least 18 years old;

■

a resident of the school Dis

-

trict for at least 30 days prior

to the voting date.

Budget Issue May 2009

Page 3

Expenditures

Administrative - 10%

Program - 61%

Capital - 29%

Back to top

Revenues

Appropriated Fund Balance - 4%

2008-2009

2009-2010

Difference

State Aid

$12,804,900

$13,366,800

$561,900

Property Taxes

$4,283,700

$4,283,700

0

Appropriated

$820,000

$685,000

($135,000)

Fund Balance

Interfund

0

0

0

Revenues

Other Revenues

$169,000

$30,000

($139,000)

Total Projected

$18,077,600

$18,365,500

$287,900

Revenues

Your own tax depends upon three main factors:

1) Where you live; 2) Changes in property assessments and final

equalization rates; and 3) Your participation in STAR (i.e., senior

citizens are eligible for STAR reductions of up to $60,100 while

non-senior homeowners are eligible for STAR reductions of up

to $30,000. Businesses and rental properties are not eligible for

STAR).

Assessed value..................................................$100,000

STAR deduction..................................................$29,400

Net assessment ..................................................$70,600

Est. 2009-10 tax rate/$1,000

.......................................$20.54

2008-09 tax rate per $1,000

.........................................$20.54

Difference .............................................................($0.00)

Est. Tax Decrease....................................................$0.00

Back to top

$

100,000

for a home

assessed at

State Aid - 73%

Property Taxes - 23%

Back to top

PROPOSED BUDGET 2009-2010

2008-2009

2009-2010

Difference

Administrative

$1,670,986

$1,803,124

$132,138

Program

$11,705,278

$11,204,930

[$500,348]

Capital

$4,701,336

$5,357,446

$656,110

Total

$18,077,600

$18,365,500

$287,900

Back to top

Absentee Ballot Information

Applications for absentee ballots may be obtained from District Clerk Tammy Clark during school hours, 8:00 a.m.

to 4:00 p.m. The District Clerk must receive completed absentee ballots no later than 5 p.m. on Tuesday, May 19,

2009.

Assessed value....................................................$50,000

STAR deduction..................................................$29,400

Net assessment ..................................................$20,600

Est. 2009-10 tax rate/$1,000

.......................................$20.54

2008-09 tax rate per $1,000

.........................................$20.54

Difference .............................................................($0.00)

Est. Tax Decrease.....................................................$0.00

Back to top

$

50,000

for a home

assessed at

Page 4

Keshequa Chronicle

PROPOSED BUDGET 2009-2010

The Administrative Component consists

of the following expenditures:

• Board of Education expenses and dues

• District Office and administrative expenses

• Expenses, salaries and benefits for other

administrators and supervisors

• Business Office and District Clerk expenses

• All legal, insurance, auditing, and other

professional services

• District portion of BOCES administrative

costs

• Consulting services costs

• Staf development expenses

• District expenses for newsletter, postage,

and mailings

State law requires the District to analyze spending by breaking our school budget into three basic components:

Administrative, Instructional, and Capital Programs. This is referred to as the three-part budget.

The capital component consists of the fol-

lowing expenditures:

• All transportation capital debt service

payments

• Annual debt service obligations for capital

projects

• All facility costs, including utilities

• Operation and maintenance expenses

• Salaries and benefits for maintenance staf

• Costs associated with community use of

school facilitie

s

The Instructional Program component

consists of the following expenditures:

• Salaries and benefits for all teachers,

teaching assistants, and teacher aides

• Salaries and benefits for the bus drivers

• All transportation expenses

• BOCES Special Education and Occupational

Education costs

• Instructional supplies, textbooks,

computers, software and paper expenses

• Costs for extra-curricular activities and

interscholastic sports

• Instructional contractual expenses

ADMINISTRATIVE

Total Dollars - $1,803,124 or 9.82%

INSTRUCTIONAL

Total D

PROGRAM

ollars – $11,204,930 or 61.01%

CAPITAL

Total Dollars - $5,357,446 or 29.17%

2008/09

2009/10

Percent

Budget

Proposed

of Budget

Proposed Administrative Budget

Board of Education .......................................$27,906 .................$28,409 ...................2%

Central Administration.................................159,070 .................163,430 ...................9%

Finance ..........................................................277,356.................282,030 .................16%

Legal Services ..................................................61,131 ...................49,741 ...................3%

Central Services

(data processing)

.......................216,033 .................212,847 .................12%

Special Items

(insurance & BOCES adm.) ...............

277,701 .................306,402 .................17%

Supervision

(regular schools & curriculum)

.............451,734 .................541,023 .................30%

Employee Benefits .........................................200,055 .................219,242 .................12%

Total...............................................

$1,670,986

........ $1,803,124

........... 100%

2008/09

2009/10

Percent

Budget

Proposed

of Budget

Proposed Instructional Program Budget

Central Services

(data processing - instructional)

.. $205,088 ...............$222,457 ...................2%

Teaching Regular School............................4,211,650 ..............4,070,486 .................36%

Teaching Special Ed. & Occ. Ed. .................2,553,893..............2,367,565.................21%

Summer School ...............................................22,786 ...................29,375...................0%

Library & Computer Technology ..................424,663.................306,586 ...................3%

Pupil Services

(guidance, health serv., athletics)

........ 639,800 .................682,588...................6%

Pupil Transportation ....................................888,755 .................845,770 ...................8%

Community Services..........................................8,500 .....................6,000 ...................0%

Employee Benefits ......................................2,740,143 ..............2,644,103 .................24%

Interfund Transfers ........................................10,000

...................30,000 ...................0%

Total.............................................

$11,705,278

...... $11,204,930

........... 100%

2008/09

2009/10

Percent

Budget

Proposed

of Budget

Proposed Capital Budget

Operation of Plant ...................................$1,164,600

........... $1,154,672 .................22%

Maintenance of Plant....................................383,640 .................544,160 .................10%

Employee Benefits .........................................176,842 .................185,863 ...................3%

Debt Service ...............................................2,976,254..............3,472,751 .................65%

Total...............................................

$4,701,336

........ $5,357,446 ........... 100%

2008/09

2009/10

Budget

Proposed

Total Proposed Budget...................

$18,077,600

...... $18,365,500

Budget Issue May 2009

Page 5

2009-2010 Anticipated Revenues

Budget Proposed Budget

2008-09

2009-10

%

Real Property Tax....................................$4,283,700 .......$4,283,700 ..........23%

Interest & Penalties on Real Prop. Tax ........$15,000

............$10,000

............0%

Interest...........................................................$44,000

............$20,000

............0%

Rental of Equipment.................................................0 ........................0 ............0%

Refund of Prior Year Expenses....................$80,000

........................0 ............0%

Miscellaneous Revenues...............................$30,000

........................0 ............0%

Basic Formula Aid .................................$12,804,900

.....$13,366,800 ..........73%

Federal Aid: Medicaid Reimbursement.........................0 ............................0 .............0%

Interfund Revenue............................................................0 ............................0 .............0%

Appropriated Fund Balance..............................$820,000

.............$685,000

.............4%

Total Revenues.................................... $18,077,600

.... $18,365,500

.......100%

Fund Balance and Reserve Funds

Back to top

Managing for the Future

The Establishment of a

Building Capital Reserve

Fund

The Audit/Finance

Committee of the Board

has completed their re-

view of all of the District’s

Reserve Funds and has de-

veloped a long-range fund

balance and reserve fund

strategy. The Committee

has recommended, and

the Board has approved

a proposition to be put

before the voters, for the

establishment of a Capital

Reserve Fund.

Due to the conservative fiscal

management over the past several

years, the District is in a position for

the first time in many years to estab-

lish a Capital Reserve Fund for the

future renovation, repairs and capital

improvements of District facilities.

Just as homeowners are aware of the

need to continually maintain and

update their property, the District

must also continually maintain and

update school grounds, buildings and

structures. The total replacement

costs for District owned buildings are

currently valued in excess of $45 mil-

lion. This is a considerable investment

not only for the District

but for the community as

a whole. It is appropri-

ate for the Board to plan

for the future costs of

maintenance and repairs

for these assets.

We are currently in

the midst of a capital

project approved by the

voters in the amount

of $9,030,000. These

moneys are being used

for items such as energy

upgrades, handicapped

accessibility improve-

ments, roof repairs, and interior

upgrades. However, there are future

needs that have been identified that

are not included in the current proj-

ect. This new reserve fund will allow

the District to better leverage state

aid for these and other items in future

projects. In addition, by utilizing

these cash reserves, future borrowing

costs can be avoided, saving future

principal and interest costs.

The creation and the setting aside

of funds has been recommended for

several years by the District’s external

auditors as well as the District’s fiscal

advisors, and is considered prudent

fiscal management and stewardship

of public funds.

Page 6

Keshequa Chronicle

KCSD BOARD CANDIDATES

The Right Person Makes A Difference

What qualities, skills, and experience should you look for in a school board candidate? Here are some

questions to consider.

• What are the candidate’s vision and goals for high aca-

demic achievement for all students?

• Does the candidate inspire parents and other stakehold-

ers to have confidence in the local public schools?

• Does the candidate understand that the school board’s

role is about the big picture – setting the direction for

the District, and providing oversight and accountability

– rather than day-to-day management?

• Does the candidate focus on one issue or discuss a broad

range of school District concerns?

• Does the candidate’s approach make it likely that he or

she will be able to work effectively with the rest of the

board to get things done?

Mrs. Amy Bugman

Family:

I am married to Glenn Bugman (“Bugsy”) and we

have one son Chase who will be attending Dalton Elemen-

tary in the fall.

Education:

I have earned a Bachelor of Science in Educa-

tion from Buffalo State College, and a Master of Science

in Exceptional Education degree from St. Bonaventure

University.

Employment:

In the past five years I have worked as a

substitute teacher in Keshequa and Dansville. I have also

worked for Livingston-Wyoming ARC as a Habilitation

Specialist. Currently, I am a stay at home mom.

Qualifications and Activities:

I am a member of St.

Luke’s Catholic Church, New York State Reading Associa-

tion, and the Niagara Frontier Reading Council.

Personal Statement:

I would like to serve as a board

member to whom you can express your concerns and offer

your suggestions as a parent, teacher, student, or commu-

nity member. Not only will I actively listen, I will also see

to it that action is taken. As a District, I feel our main con-

cern at this point should be improving student achieve-

ment. I feel I have the time, the educational background,

and the drive to positively collaborate with school officials

in order to see that Keshequa students receive an educa-

tion equal to those at the highest ranked schools.

John W. Gordinier

Family:

Karla, Special Education teacher at Letchworth

Central School; Brian, 18, KCS senior; Sam, 16, KCS

sophomore; Shannon, 13, KCS seventh grader; Tessa, 11,

KCS sixth grader.

Education:

SUNY Albany – B.S. in Biology

Employment:

Eastman Kodak Co. for 15 years – senior

research technician; self employed as childcare giver,

painter, artist, roofing and siding; current collections as-

sistant at Rochester Museum and Science Center and Sum-

mer Recreation Director.

Qualifications and Activities:

Currently six years on the

Board with many workshops and seminars. Coaching base-

ball, soccer, helping with basketball. Volunteer for Habitat

for Humanity, Guitar Club, Art Club at Dalton, school and

community plays.

Personal Statement:

I enjoyed the past six years serv-

ing the students and citizens of the Keshequa District and

look forward to serving this community in many endeav-

ors in the future.

• Will the candidate enhance the mix of skills and backgrounds

community?

• Does the candidate have the commitment to do what is right for

Budget Issue May 2009

Page 7

Jennifer Reichard

Family:

Bruce, a son Patrick who is a student at SUNY

Oswego, a daughter Amanda who is a junior at Keshequa.

Education:

Graduate of Mount Morris Central School

Employment:

Secretary for the International Student

Services at SUNY Geneseo.

Qualifications and Activities:

Judge for Odyssey of the

Mind, community member for the Policy Committee at

Keshequa.

Personal Statement:

I have attended our District’s

school board meetings for the last several years and have

been a steadfast advocate for the children and for the

taxpayers. I would welcome the opportunity to be on the

board and to help make changes to improve the District.

As a District we are spending more than 18 million dollars

on less than 850 kids and have the lowest graduation rate

in the county. We can do better, and I want to help. We

have an obligation to provide a safe learning environment.

To accomplish this we need to crack down on discipline

and good teachers must be supported. We are blessed with

great kids who deserve more, and I want all of our chil-

dren to have opportunities! Working in SUNY Geneseo’s

International Student Services Office I see first hand just

how competitive it is for our kids. We need to do a better

job preparing our kids to compete in an ever-changing

world by offering additional Advanced Placement and

college level courses. I feel we need realistic, timely solu-

tions and greater accountability. We have to be careful not

to allow students to fall through the cracks and to take

care of those that have been overlooked by offering a GED

program and helping them find work. All of our kids need

to be treated fairly. Decisions need to be based on what

is best for each child not just a select few. Finally, please

know I will never vote yes to an administrative bonus for

employees earning over 100,000 dollars a year. This is a

poor community. We can’t afford it. Every dollar spent on

a bonus is a dollar taken away from a child. I know that I

can make a difference. I am asking for your vote. Thank

you for your consideration and God bless.

Ken Forrester

Family:

Daughters – Emily and Taylor

Education

: B.S. – Finance, SUNY Brockport; MBA - Alfred

University

Employment:

Commercial loan officer – Steuben Trust

Company

Qualifications and Activities:

Board Member of Cornell

Cooperative Extension, exempt member of Nunda Fire

Department, member of Dalton United Methodist Church

Personal Statement:

Education is vital to our communi-

ty’s future. I want to work with all stakeholders to improve

the education of our students and make Keshequa Central

School a model for other Districts to emulate.

Todd M. Galton

Family:

I have been married to my wife, Meg, for 18

years. We have two children. Our son, Cooper, is 12 years

old and he is in seventh grade. Our daughter, Allison, is six

and she is in first grade.

Education:

I graduated from Keshequa Central in 1988.

I attended SUNY Morrisville and received an associate’s

degree in Applied Science (Dairy Husbandry).

Employment:

For the past 19 years, I have been a self-

employed dairy farmer.

Qualifications and Activities:

Dec. to present – filling

vacant school board seat; operate a successful dairy busi-

ness; vice president of Conesus Dairy Co-Op; volunteer

coach for soccer (past), baseball (past), and basketball

(present).

Personal Statement:

I feel fortunate to have received a

solid educational foundation. I think it is our responsibil-

ity to ensure the best education and opportunities for the

children in our community.

The concert scheduled for May 7 has been moved to

June 9, 2009 at 7:00 p.m.in the Nunda Auditorium at 7:00.

Performances will be by Middle School Band, High School

Chorus, Select Chorus, and Middle School Jazz Band.

Page 8

Keshequa Chronicle

???????????????????????????????

?

??????????????????????

??

??

??

??

???

???

??

??

??

????

??

???

???

??

??

??

????

??

??

???

???

???

???

??????????????

??????????????????????

??????

??

???

???

??

??

??

???

???

????

????

??

??

??

??

????????

??

???

???

? ??????????

??????????????????????

??

??

???

???????

??

??????

??

??

??

??

??

??

??

????

????

???

???

??

??

??

??

??????????

?????????????????????

??

??

??

??

??

??

???

???

??

??

??

??

??

?????

?????

??

??

?????

????

???

??

??

??

??????

??????????????????

?

?

?????????????????????????????????????

????????

?????

?????????

?????????

?????????

?????????

?????????

???

??????

????????

????????

????????

????????

?????

?????

?????

????

????

?????

?????

????

?????

?????

?????

????

????

?????

?????

????

????

?????

?????

?????

????

?????

?????

????

?

?

????????????????????

??????

?????

?????????

?????????

?????????

?????????

?????????

???

??????

????????

????????

????????

????????

?????

?????

????

????

?????

?????

????

????

?????

?????

?????

????

?????

?????

????

????

?????

?????

????

????

?????

?????

????

????

?

?

??????????????????????????????

??????????????????????????????????????????????

?????????????

?????????????

?

?????

?????

?????

?????

?????

?????

?????

????

?????

?????

?????

?????

?????

?????

?????

?????

??????

?????

?????

?????

?

?

????

?

???

?????

?

?

?????

?

?

????????

?

??????????

???????

?

???????

???????????

?

????????????

???????????

?

???????

???????????????

?

???????????????

????????????

???????????????

???????????

??????????????

????

????

?????

?????

?

???????????????????????????????????????????????

??????????????????????

????????

??

??

??

??

??????

??

??

??

??

??

??

??

??

??

????

??

??

??

???????

??????

Budget Issue May 2009

Page 9

The New York State School Report Card Fiscal Accountability Supplement for Dalton-Nunda

Central School District (Keshequa)

New York State Education Law and the Commis-

sioner’s Regulations require the attachment of

the NYS School Report Card to the public school

District budget proposal. The regulations require

that certain expenditure ratios for general educa-

tion and special education students be reported and

compared with ratios for similar Districts and all

public schools. The required ratios for this District

are reported at left.

The New York State School Report Card Information about Students with Disabilities for

Dalton-Nunda Central School District (Keshequa)

New York State Education Law and the Commissioner’s Regulations require the attachment of the NYS School Report Card to the public school District budget proposal. These regulations

require that the percentage of students with disabilities receiving services outside of general classroom settings and the classification rate of students with disabilities for the District be

reported and compared with percentages for similar Districts and all public schools. The required percentages for this District are reported below.

School-age Students with Disabilities Classification Rate

This rate is a ratio of the count of school-age students with disabilities (ages 4-21)

to the total enrollment of all school-age students in the school District, including

students who are parentally placed in nonpublic schools located in the school

District. The numerator includes all school age students for whom a District has

Committee on Special Education (CSE) responsibility to ensure the provision of

special education services. The denominator includes all school age students who reside in the District (in the case of parentally placed students in nonpublic schools, it includes the number

of students who attend the nonpublic schools located in the school District).. Source data are drawn from the Student Information Reporting System (SIRS) and from the Basic Education

Data System (BEDS).

Instructional Expenditures for General Education are K-12 expenditures for classroom instruction (excluding Special Education) plus a proration of building level administrative and instruc-

tional support expenditures. These expenditures include amounts for instruction of pupils with disabilities in a general education setting.

The pupil count for General Education is K-12 average daily membership plus K-12 pupils for whom the District pays tuition to another school District. This number represents all pupils,

including both those classified as having disabilities and those not so classified. For Districts in which a county jail is located, this number includes incarcerated youth to whom the District

must provide an education program.

Instructional Expenditures for Special Education are K-12 expenditures for students with disabilities (including summer special education expenditures) plus a proration of building-level

administrative and instructional support expenditures.

The pupil count for Special Education is a count of K-12 students with disabilities as of December 1, 2006 plus students for whom the District receives tuition from another District.

Expenditures Per Pupil is the simple arithmetic ratio of Instructional Expenditures to Pupils. The total cost of instruction for pupils with disabilities may include both general and special

education expenditures. Special education services provided in the general education classroom may benefit students not classified as having disabilities.

District expenditures such as transportation, debt service, and District-wide administration are not included in these values. The numbers used to compute the statistics on this page were

collected on the State Aid Form A, the State Aid Form F, and the School District Annual Financial Report (ST-3).

Similar District Groups are identified according to the Need-to-Resource-Capacity Index defined and used in the Annual Report to the Governor and Legislature on the Educational Status of

the State’s Schools.

The source data for the statistics in this table

were reported through the Student Information

Repository System (SIRS) and verified in Verifica-

tion Report 5.. The counts are numbers of students

reported in the least restrictive environment catego-

ries for school-age programs (ages 6-21) on Decem-

ber 3, 2007. The percentages represent the amount

of time students with disabilities are outside general

education classrooms, regardless of the amount

and cost of special education services they receive.

Rounding of percentage values may cause them to

sum to a number slightly different from 100%.

20% or less

71

59.2%

56.7%

21% to 60%

24

20.0%

18.1%

More than 60%

19

15.8%

18.9%

Separate Settings

6

5.0%

4.4%

Other Settings

0

0.0%

1.8%

Student Placement–

Counts of

Percentage of

Percentage of

Time Outside a

Students with

Students with

Students with

Regular Classroom

Disabilities

Disabilities*

Disabilities

Student counts as of

This District

Statewide

December 3, 2007

Instructional Expenses

$7,431,031

$3,103,011

Pupils

896

135

Expenditures Per Pupil

$8,294

$22,985

Instructional Expenses

$1,437,946,953

$490,687,373

Pupils

171,657

26,143

Expenditures Per Pupil

$8,377

$18,769

Instructional Expenses

$26,085,780,736

$9,685,884,288

Pupils

2,750,202

405,309

Expenditures Per Pupil

$9,485

$23,898

2007-2008 School Year

General Education

Special Education

Tis

School

District

Similar

District

Group

All Public

Schools in

NY State

Back to top

KCS SCHOOL REPORT CARD

2007-08

Tis District

Statewide

Resident Classification Rate

13.65%

12.6%

Similar District Group Description: High Need/Resource Capacity Rural

NONPROFIT

ORGANIZATION

US POSTAGE

PAID

PERMIT NO. 1

NUNDA NY 14517

School Board Members

Anita Buchinger, President

Paul Jackson, Vice-President

Mark Ewing

Todd Galton

John Gordinier

Lori Gray

Barbara Waddle

Marilyn Capawan,

Superintendent

Dominic Aloisio,

Business Administrator

KESHEQUA CENTRAL SCHOOL District BUDGET NOTICE

Basic STAR Exemption Impact:

Estimated Basic STAR Exemption Savings:

Copies of the popular budget may be obtained from the District

Absentee Ballots

Absentee ballots may be applied for at the District Clerk’s o-f

fice. A list of absentee voters is available for public inspection

in the office of the District Clerk between the hours of 8:00

a.m. and 4:00 p.m. and each Monday through Friday until

and including May 19, 2009. Persons designated by the Liv -

ingston County Board of Election as “permanently disabled”

pursuant to the provision of the election law will automati-

cally receive an absentee ballot. Absentee ballots must be

filed with the District Clerk by 5 p.m. on the day of the vote,

May19,2009.

OVERALL BUDGET PROPOSAL

Total Budget amount

$18,077,600

$18,365,500

$18,220,717

Increase/decrease for the 2009-10 school year

$287,900

$143,117

Percentage increase (decrease) in each proposed budget

1.59%

0.79%

Change in the consumer price index

3.80%

Resulting est. property tax levy for the 2009-10 school year

$4,283,700

$4,283,700

Administrative component

$1,773,988*

$1,803,124

$1,708,341

Program component

$11,602,276*

$11,204,930

$11,172,930

Capital component

$4,701,366

*

$5,357,446

$5,339,446

Budget proposed

for the 2009-09 school year

Contingency budget for

the 2009-10school year*

Budget adopted

for the 2009-10 school year

Budget proposed

for the 2009-10 school year

• According to State Regulations, the District must prepare a contingent budget so that

contingent budget and the District proposed budget. The state allows two budget votes before the contingent budget must be implemented. To satisfy a contingent

budget, the District would not have to reduce its proposed budget in total. However, the District would have to remove certain equipment expenditures and adjust

the administrative expenditures to be in compliance with state regulations.

* Persuant to Chapter 640 of the Laws of 2008 regarding the calculations of certain administrative positions, the base year administrative and program components

have been adjusted due to the reallocation of administrative salaries.

The annual budget vote for the fscal year 2009-10 by

the qualifed voters of the Keshequa Central School Dis-

trict, Livingston County, New York, will be held at the

Middle/High School Lobby, Nunda, on Tuesday, May 19,

2009, between the hours of noon and 9:00 p.m., prevail-

ing time, at which time the polls will be opened to vote

by voting ballot or machine.

Keshequa Central School

P.O. Box 517

Nunda, New York 14517-0517

Budget Newsletter May 2009

Basic STAR tax savings

$603.88

Back to top