RESET

The RESET selection permits the user to return to already entered data and make changes to that data. The RESET command will only work with data being entered on existing, open schedules. The RESET selection will not allow the user to make changes to data on closed schedules.

DELETE

The DELETE selection deletes the selected entry from the existing schedule. The DELETE command will only work with data being entered on existing, open schedules.

CANCEL

The CANCEL selection stops the current action and returns the user to the beginning of the action to start over.

EXIT

The EXIT selection returns the user to the ACCOUNTING MANAGER main screen.

Other Maneuvering Commands

In addition to the Navigation and Update Panel, ACCOUNT MANAGER will provide the user with on-screen prompts to guide the user through the program. These prompts will generally be located in the lower left hand corner of the screen, prompting the user to make a selection or strike a particular key.

When operating within data entry and query modules, the F1 and F6 function keys may also be used to maneuver through the program. These two keys do the following:

F1 - Opens online help service

F6 - Displays a list of all available items in a Look-Up browser (magnifying glass)

Functions

Functions

The ACCOUNTING MANAGER program can be broken up into five different sections or functions. Each function has its own specific purpose in the program. Similar operations have been grouped together to simplify ACCOUNTING MANAGER’S operation.

The five functions consist of routines for:

Data Entry – All data to be entered into ACCOUNTING MANAGER is input through the Data Entry functions. Individual sections are used for the input of cash receipts, cash disbursements, journal entries, purchase orders, and budget transfers.

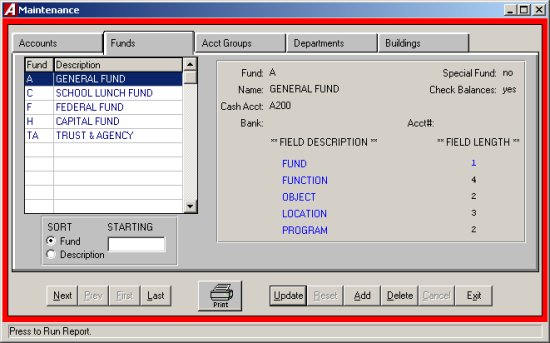

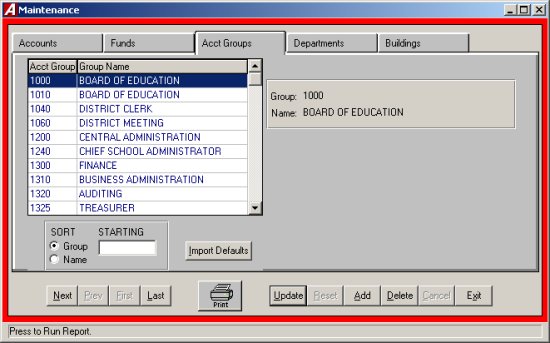

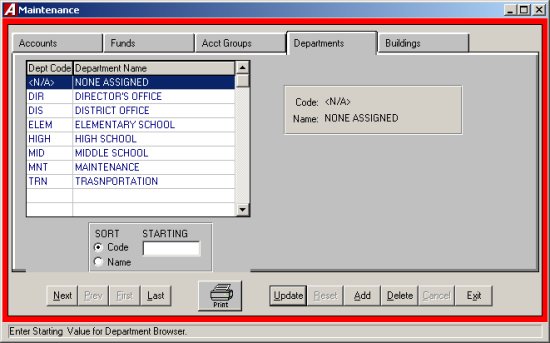

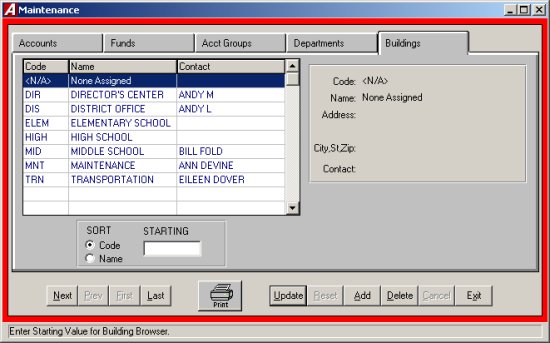

Maintenance – The maintenance function enables the user to work with individual accounting codes and maintain the system’s schedules. The user can create, edit, and delete specific account codes, create and edit individual funds, specify special codes, and customize accounts to special needs. Schedules can be opened, edited, and closed all through the maintenance module.

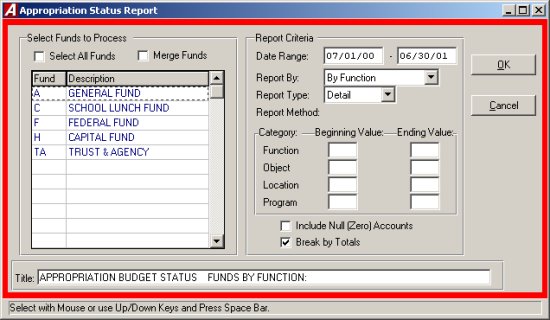

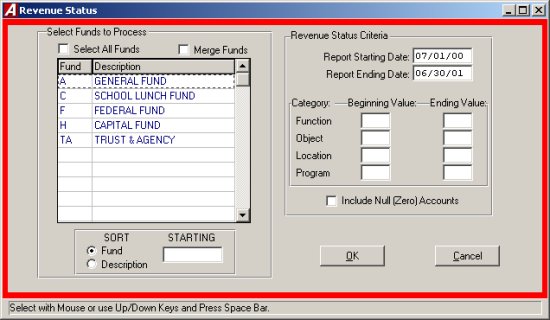

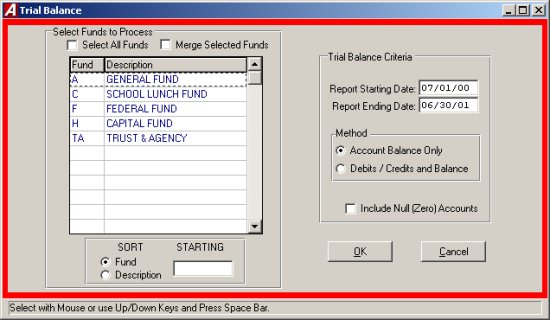

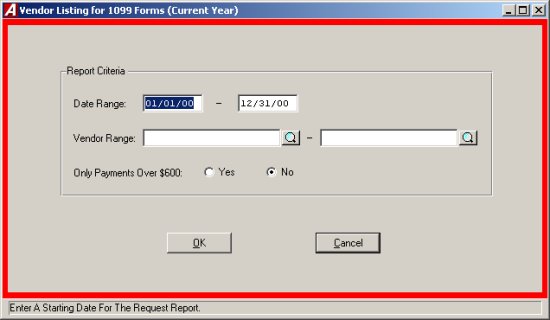

Output Reports – The output reports function provides a variety of standard reports, which the user may either display, on screen, print to a text file or a printer. Output reports include appropriation and revenue status reports, trial balances, individual account code transactions, entire open or closed schedules, vendor histories, and purchase order reports.

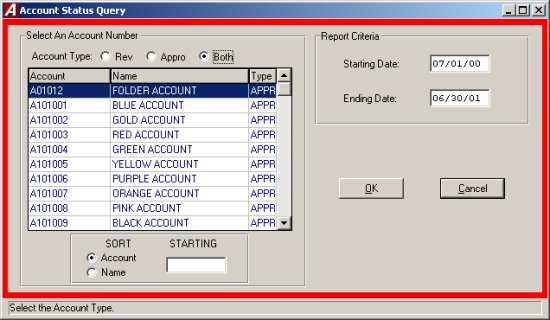

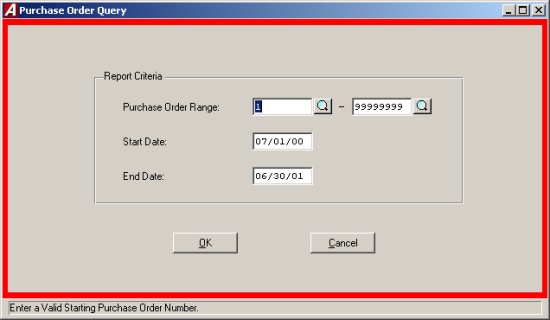

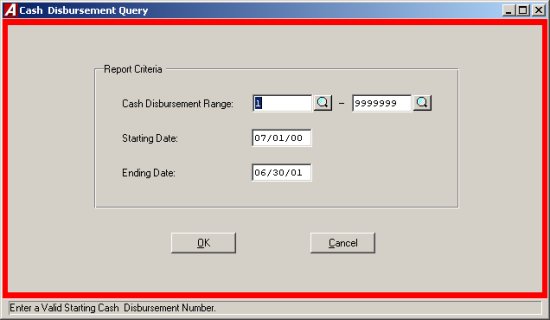

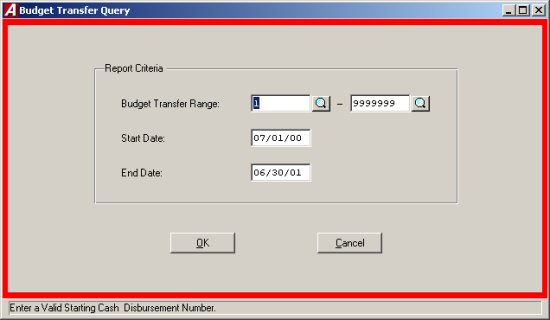

Query Info – The query function allows the user to search for information for a specific data item or items, such as an individual cash receipt, individual check, or a series of journal entries. The user can define the search criteria to customize the search or select the built in defaults and query all data entries.

Utilities – The utilities function allows the user to run special routines, including opening entry, routine maintenance, diagnostic, custom and year-end routines.

Schedules

Schedules

The organization of data and information in ACCOUNTING MANAGER is based on the use of schedules. Schedules are the grouping of similar transactions into manageable segments, as determined by the user, for single general ledger postings. They operate similar to schedules as used in manual accounting systems.

Organization by schedules allows the user to effectively cross-reference all source transactions into the accounting system. Schedules also allow the user to concurrently maintain records for multiple accounting periods.

All schedules, for both current and past accounting periods, can be accessed with just a few simple clicks. Schedules may be printed to provide a hard copy document, as a text file or viewed visually on screen.

Schedules can be created for:

· Cash Receipts

· Cash Disbursements

· Journal Entries

· Purchase Orders

· Budget Transfers

Open and Closed Schedules

Open and Closed Schedules

Schedules may be used for any time period the user desires. All current schedules are referred to as being "open". All past schedules are referred to as being "closed", and are closed by the user periodically on the Schedule Maintenance screen (Please refer to Maintenance –> Close & Post Schedules).

Accounting Tips:

0 Although schedules may be used for any time period the users desire, it is recommended that schedules be used monthly, at most. Depending upon the size of the accounting operations of the entity, the user may require using schedules for smaller or longer time periods.

Monthly schedules, however, will ensure that transactions for the entire month are organized together and posted on a timely basis. Monthly procedures can simplify standard reporting and reconciliation to outside information. (Please refer to Appendix A, Sample Monthly Procedure)

Open schedules are generally for the current and most recent preceding period. All data entered in current schedules may be changed, edited, and corrected through the respective menus. The data entered in the current schedules remains active until the schedules are closed. When closed, all entries on the schedule are posted to their proper accounts in both the general ledger and the subsidiary ledger. A user may have an unlimited number of open schedules at any one time.

Closed schedules are schedules that have been closed by the user. Once closed, the data in a schedule CANNOT BE CHANGED. Any corrections for errors in prior, closed schedules must be recorded in the current period in an existing, open schedule, most commonly as a journal entry. Once closed, all account data is posted to the appropriate accounts. Closed schedules can be accessed for review on screen or printed at any time.

Cash Receipts

Cash Receipts

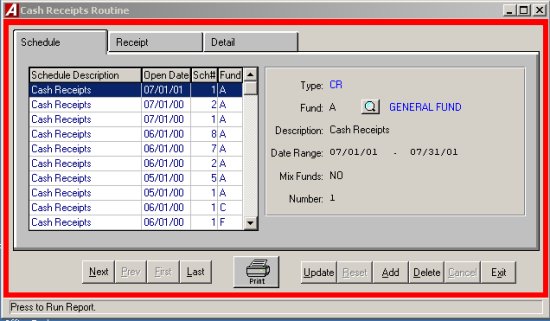

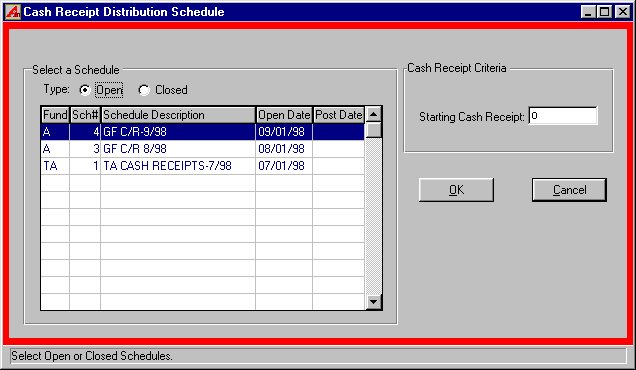

The cash receipts module is the first segment of the data entry module. This segment should be used for entering data from the treasurer’s individual cash receipts for the particular period. To enter the cash receipts module, select Data Entry then Cash Receipts from the ACCOUNTING MANAGER main menu or simply click the Cash Receipts button. For a screen image please click Cash Receipts.

Adding a new Cash Receipts Schedule

· Click the ADD button from the update panel.

· Enter the Fund type for this schedule or click the magnifying glass to select from a list of available funds.

· Enter a description for this schedule and press tab.

· Enter the date range for this schedule.

· Enter "YES" to allow the user to mix funds or "NO" for only one fund on this schedule and press tab.

· ACCOUNTING MANAGER will automatically enter the next schedule number. You can accept the number or change it to another unused reference number.

·

Click SAVE to lock in the record. Entering an Cash Receipt

·

Select an open schedule to record the cash receipts in. Use the mouse to select the desired schedule. If no schedules are open, ACCOUNTING MANAGER will direct you to open a new schedule (Adding A New Credit Receipts schedule).

Each cash receipt has two parts. The first part is the information part of the cash receipt, which records the amount, the date, the cash receipt number and a brief description. The second part is the Details tab where the account code distribution of the cash receipt takes place.

·

Click the Receipt tab.

·

Click ADD from the Update panel.

·

ACCOUNTING MANAGER will automatically enter the Cash Receipt number, the user can accept this number or enter an unused cash receipt number and press TAB (for entering a batch of cash receipts, simply enter the first cash receipt number, ACCOUNTING MANAGER will automatically enter the subsequent cash receipt numbers).

Accounting Tips:

0

An alternative system-wide default number may also be used. (Please refer to System Manager to see how to change this option)

·

Enter the Cash Receipt date and press TAB.

Accounting Tips:

0

The date of the cash receipt is the basis ACCOUNTING MANAGER uses in preparing all relevant reports. All cash receipts should be dated for the date of the actual cash receipt, and not for the date of entry into the computer system.

·

Select "YES" or "NO" to invoke the customer tracking feature. If yes, enter the customer number or click the magnifying glass to select from a list of available customers. If the customer in not in the list you can add a new customer by clicking the add button. (For more information on adding a new customer please refer to Customer Maintenance).

·

Enter the amount of the Cash Receipt and press tab.

·

Enter the description and click SAVE to lock in the record and move to the Detail tab.

Entering the Detail

·

Enter the first account to be debited and press TAB (Press F6 or double click the entry box to display a listing of available accounts).

·

Enter the first dollar amount to be debited and press enter. Accounting Manager will ask, "Liquidate an existing Purchase Order?" Click "YES" or "NO". If "YES" is clicked enter the Purchase Order Number or click the magnifying glass to select from a list of available Purchase Orders. Then enter the amount to be liquidated and click "OK". If "NO" is clicked enter the Vendor Number or click the magnifying glass to select from a list of available vendors. If the vendor is not in the list you can add a new vendor by clicking the add button. (For more information on adding a new vendor, see Vendor Maintenance).

·

Enter additional debits in the same manner.

·

Enter the first account to be credited and press TAB twice (Press F6 or double click the entry box to display a listing of available accounts).

·

Enter the first dollar amount to be credited and press TAB. Accounting Manager will ask, "Liquidate an existing Purchase Order?" Click "YES" or "NO". If "YES" is clicked enter the Purchase Order Number or click the magnifying glass to select from a list of available Purchase Orders. Then enter the amount to be liquidated and click "OK". If "NO" is clicked enter the Vendor Number or click the magnifying glass to select from a list of available vendors. If the vendor is not in the list you can add a new vendor by clicking the add button. (For more information on adding a new vendor, see Vendor Maintenance).

·

Enter additional credits in the same manner.

If the "Allow Cash Receipts Detail Descriptions" field is flagged in System Parameters—Preference Maintenance, enter a description. (Please refer to System Manager to see how to turn on the description setting.)

Accounting Tips:

0

The New York State Comptroller prescribes the use of control accounts in this case the 980 Revenue Control Account – in making entries. The control account requirement may be changed. (Please refer to System Manager to see how to change this option)

When the entry is balanced and complete ACCOUNTING MANAGER will provide the following prompt:

Distribution is Balanced Do you want to continue?

Accounting Tips:

0

ACCOUNTING MANAGER will indicate if the entry is out-of-balance by the totals bar at the right of the screen. If the entry is in balance, all three totals will indicate $0.00. If the entry is out-of-balance, the totals will indicate the dollar amount. Positive amounts indicate excessive debits while negative amounts indicate excessive credits. If the entry is left with no distribution, the receipt will appear in red on the schedule listing.

·

Click "YES" to continue adding more entries or "NO" to stop and save the information and return to the Receipts tab.

Finding an existing Cash Receipt

In order to edit/change or delete a cash receipt, it is necessary to locate it. Select the Schedules tab. Use the scroll bar to select an open schedule from the list, then click the Cash Receipt tab and use the scroll bar to select the cash receipt from the listing.

Editing/Changing a Cash Receipt

ACCOUNTING MANAGER provides the user with the ability to edit and change the information provided on individual cash receipts already entered into the current schedule.

·

Select the individual Cash receipt from the schedule listing.

·

Click the UPDATE button.

·

Press TAB until the information to be changed is highlighted.

·

Enter the correct data and click SAVE. ACCOUUNTING MANAGER will automatically replace the old data and bring you directly to the Detail tab to revise the information.

·

Select the detail line from the detail listing and click UPDATE.

·

Click the account or amount you want to change and enter the new information and click SAVE. Once the entries are in balance click "NO". ACCOUNTING MANAGER will automatically replace the old data and return to the Receipt tab.

Removing a Cash Receipt

Users can remove a cash receipt or detail line from any open schedule, essentially voiding the transaction entirely. In order to delete a Cash Receipt the user must have: 1) no detail entries or 2) delete all detail entries before they are allowed to delete the Cash Receipt.

Detail

·

Select the individual Cash Receipt from the listing.

·

Select the Detail tab. Select the Detail line you want to delete.

·

Select the DELETE button from the update panel.

·

ACCOUNTING MANAGER will ask you, "OK to delete the selected detail record?"

·

Click "YES" to remove the detail line.

·

Click "NO" to keep the detail line.

·

Repeat until all detail lines are removed

Cash Receipt

·

Select the individual Cash Receipt from the listing.

·

Select the DELETE button from the update panel.

·

ACCOUNTING MANAGER will ask you, "Delete this receipt?"

·

Click "YES" to remove the receipt.

·

Click "NO" to keep the receipt.

Accounting Tips:

0

Removing a cash receipt in ACCOUNTING MANAGER must be accomplished in these two series of steps. This safeguards accidental erasure of the entire cash receipt data in the cash receipt process.

Printing a Cash Receipt

To print a Cash Receipt click the PRINT icon located at the bottom of the screen.

·

Select the print size for the receipts.

·

Enter the receipt range or accept the default.

·

Enter the date range or accept the default.

·

Enter the number of copies of each receipt.

·

Click "OK to run the report and send it to the report viewer. Review the report for errors. When the report is ready to print click the print icon from the menu bar. Exiting the Cash Receipts Module

Selecting EXIT from the Update Panel will return the user to the ACCOUNTING MANAGER main screen.

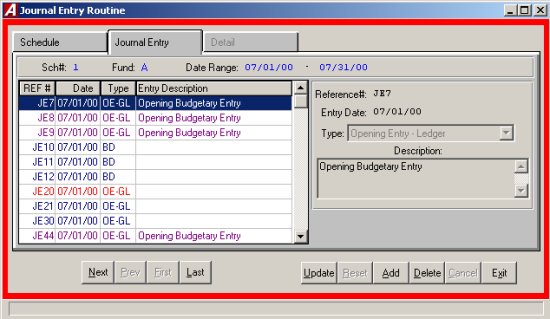

Journal Entries

The Journal Entries function is the third segment of the data entry menu. This segment should be used for entering journal entries into the system. Built in defaults prevent the user from entering out-of-balance entries into the system. To enter the Journal Entries Module, select Journal Entries form the Data Entry menu.

Selecting a Schedule

Select an open schedule in which to record the journal entries. Use the cursor keys or the scroll bar to select the desired schedule. If no schedules are open, ACCOUNTING MANAGER will direct you to open a new schedule.

Parts of the Journal Entry

Each Journal Entry has two parts. The first part is the information part of the journal entry, which records the journal entry number, the date, the type of journal entry, and a brief description. The second part is the account code distribution of the journal entry.

Entering a Journal Entry

After selecting a schedule, ACCOUNTING MANAGER will display a listing of all journal entries in that schedule. Journal Entries displayed in RED have no detail accounting records.

·

Click ADD from the Update panel

·

A journal entry number is automatically assigned. To change from the default setting simply type in the new reference number and press TAB.

·

Enter the journal entry date.

Accounting Tip:

0

As with all data in ACCOUNTING MANAGER, the date of the journal entry is the basis for all reporting purposes. All journal entries should be dated for and correspond with the schedule it is being entered on.

·

Select the type from the drop down list. The user must choose from between a Standard, Budgetary, or Opening entry.

Types of Journal Entries:

Standard Journal Entry To record all typical journal entries occurring during the fiscal year to record or correct accounting data.

Budgetary Adjustment To record budgetary journal entries, amending the budgets of revenue and appropriation accounts.

Opening Entry – Ledger To record all opening general ledger balances.

Opening Entry – Subsidiary To record all opening subsidiary budgets and budgetary general ledger account codes.

·

Enter in a description for the entry and click SAVE.

This completes the information part of the journal entry. Click the DETAIL tab and ACCOUNTING MANAGER will advance to the second part of the journal entry to make the account distributions.

·

Select ADD from the update panel.

·

Enter the first account to be debited (Press F6 or double click the textbox to view a list of all available accounts).

·

Enter the first dollar amount to be debited and press TAB. ACCOUNTING MANAGER will ask for a vendor number for any posting to subsidiary appropriation accounts.

·

Enter additional debits in the same manner.

Accounting Tips:

0

The New York State Comptroller prescribes the use of control accounts in this case the 980 Revenue Control Account – in making entries. The control account requirement may be changed. (Please refer to SYSTEM MANAGER to see how to change this option.)

·

Enter the first account to be credited and press TAB twice, until the credit column is highlighted.

·

Enter the first dollar amount to be credited and press TAB.

·

Enter additional credits in the same manner.

·

If the description setting is turned on then enter the desired description and press SAVE (for more information, please refer to SYSTEM MANAGER, System Parameters).

When the entry is in balance and complete, ACCOUNTING MANAGER will allow you to save the entry.

Accounting Tips:

0

ACCOUNTING MANAGER will indicate if the entry is out-of-balance by the totals bar at the bottom of the screen. If the entry is in balance, all three totals will indicate $0.00. If the entry is out-of-balance, the totals will indicate the dollar amount. Positive amounts indicate excessive debits while negative amounts indicate excessive credits.

After all entries have been made click EXIT to return to the ACCOUNTING MANAGER main screen.

Find an Existing Journal Entry

In order to edit/change or delete a journal entry, it is necessary to locate it. To find an existing Journal Entry use the scroll bar to locate journal entries on open schedules.

Editing/Changing a Journal Entry

ACCOUNTING MANAGER provides the user with the ability to edit and change the information provided on an individual journal entry already entered into the current schedule.

·

Select the individual journal entry from the schedule listing.

To change the Information Part of a Journal Entry

·

Select UPDATE from the update panel to change the information part of the journal entry.

·

Press TAB until the desired information to be changed is highlighted.

·

Enter in the correct data and click SAVE. ACCOUNTING MANAGER will automatically replace the old data. The journal entry reference number cannot be changed.

To Change the Accounting Detail of the Journal Entry

·

Select the DETAIL tab to change the account detail of the journal entry.

·

Select the account line from the detail listing.

·

Select UPDATE from the update panel.

·

Press TAB until the information to be changed is selected.

·

Enter in the correct data and click SAVE. ACCOUNTIN MANAGER will automatically replace the old data and return to the detail listing.

·

Select EXIT to return to the ACCOUNTING MANAGER main screen.

Removing a Journal Entry

User can remove a journal or detail line from any open schedule, essentially eliminating the journal entry entirely. Detail

·

Select the individual journal entry from the schedule listing.

·

Select the DETAIL tab; select the detail line to be deleted.

·

Select DELETE from the update panel.

·

ACCOUNTING MANAGER will ask you, "Ok to delete the selected detail record?"

·

Click "YES" to remove the detail line.

·

Click "NO" to keep the detail line.

·

Repeat until all accounting detail lines are removed.

·

Select EXIT to return to the ACCOUNTING MANAGER main menu.

Journal Entry

·

Select the individual journal entry from the schedule listing.

·

Select DELETE from the update panel.

·

ACCOUNTING MANAGER will ask you, "Delete this entry?"

·

Click "YES" to remove the journal entry.

·

Click "NO" to keep the journal entry.

Accounting Tips:

0

Removing a journal entry in ACCOUNTING MANAGER must be accomplished in these two series of steps. This safeguards against accidental erasure of the entire journal entry.

Exiting the Journal Entry Function

Selecting EXIT from the update panel will return the user to the ACCOUNTING MANAGER main screen.

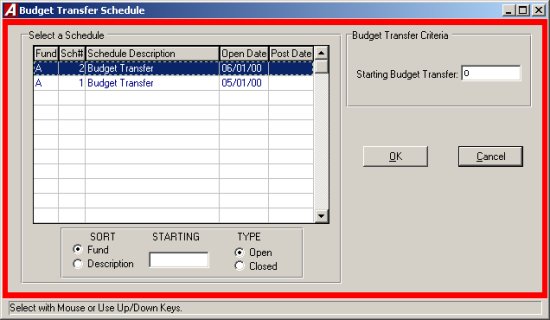

Budget Transfers

The budget transfers function is the fifth segment of the data entry menu. This segment should be used for recording budget transfers between budgetary appropriation accounts. This function is not for recording total budgetary increases or decreases, which should be made by budgetary journal entries (please refer to Data Entry – Journal Entries). To enter the Budget Transfer function, select Budget Transfer from the Data Entry menu.

Selecting a Schedule

Select an open schedule in which to record the budget transfers. Use the cursor keys or the scroll bar to select the desired schedule. If no schedules are open, ACCOUNTING MANAGER will direct you to open a new schedule.

Parts of the Budget Transfer

Each budget transfer has two parts. The first is the information part of the budget transfer, which records the budget transfer reference number, the date, and a brief explanation. The second part is the account code distribution of the budget transfer.

Entering a Budget Transfer

After selecting a schedule, ACCOUNTING MANAGER will display a listing of all budget transfers in that schedule.

·

Select ADD from the update panel.

·

Enter the budget transfer date and press TAB.

Accounting Tips:

0

As with all data in ACCOUNTING MANAGER, the date of the budget transfer is the basis for all reporting purposes. All transfers should be dated for and correspond with the schedule it is being enter on.

·

Enter an explanation of the budget transfer and click SAVE.

This completes the information part of the budget transfer. Click the Detail tab and ACCOUNTING MANAGER will advance to the second part of the budget transfer to make the appropriate account distributions.

·

Select ADD from the update panel.

·

Enter the first account that funds will be transferred out of and press TAB (press F6 or double click the textbox to view a listing of all available appropriation accounts).

·

Enter the first dollar amount of funds to be transferred out and press TAB.

·

Enter additional transfer out in the same manner.

·

Enter the first account that funds will be transferred into and press TAB twice.

·

Enter the first dollar amount to be transferred in and press TAB.

·

Enter additional transfer in by repeating the procedure.

·

If the description setting is turned on then enter the desired description and click SAVE (for more information, please refer to SYSTEM MANAGER, System Parameters).

When the transfer is in balance and complete, ACCOUNTING MANAGER will allow you to save the new entries.

Accounting Tips:

0

ACCOUNTING MANAGER will indicate if the entry is out-of-balance by the transfer total at the bottom of the screen. If the entry is in balance, the total will equal $0.00. If the entry is out-of-balance, the total will indicate the dollar amount. A positive amount indicates excessive "transfers out" while a negative amount indicates excessive "transfers in".

Fining an Existing Budget Transfer

In order to edit/change or delete a budget transfer, it is necessary to locate it. The scroll bar assists the user in locating transfers on open schedules.

Editing/Changing a Budget Transfer

ACCOUNTING MANAGER provides the user with the ability to edit and change the information provided on the individual budget transfer already entered into the current schedule.

·

Select the individual budget transfer from the schedule listing.

To Edit/Change the description part of a budget transfer

·

Click UPDATE from the update panel.

·

Press TAB until the information to be changed is highlighted.

·

Enter the correct data and click SAVE. ACCOUNTING MANAGER will automatically replace the old data.

To Edit/Change the detail item descriptions of a budget transfer

·

Click DETAIL tab.

·

Select the item line to be changed.

·

Press TAB until the desired field to be changed is highlighted.

·

Enter the correct data and click SAVE. ACCOUNTING MANAGER will automatically replace the old data and return to the item listing.

Removing a Budget Transfer

Users can remove a budget transfer from any open schedule, essentially eliminating the budget transfer entirely.

Detail Line

·

Select the individual budget transfer from the schedule listing.

·

Select the DETAIL tab.

·

Select the detail line to be deleted.

·

Click DELETE from the update panel.

·

ACCOUNITING MANAGER will ask you "Ok to delete the selected detail record?’

·

Click "YES" to remove the line.

·

Click "NO" to keep it.

Budget Transfer

·

Click the DESCRIPTION tab.

·

Select the individual budget transfer from the schedule listing.

·

Select DELETE from the update panel.

·

ACCOUNTING MANAGER will ask you "Delete the transfer?"

·

Click "YES" to remove the budget transfer.

·

Click "NO" to keep the budget transfer.

Accounting Tips:

0

Removing a budget transfer in ACCOUNTING MANAGER must be accomplished in these two series of steps. This safeguards against accidental erasure of the entire budget transfer.

Exiting the Budget Transfer Function

Selecting EXIT from hr Update Panel will return the user to the ACCOUNTNG MANAGER main screen.

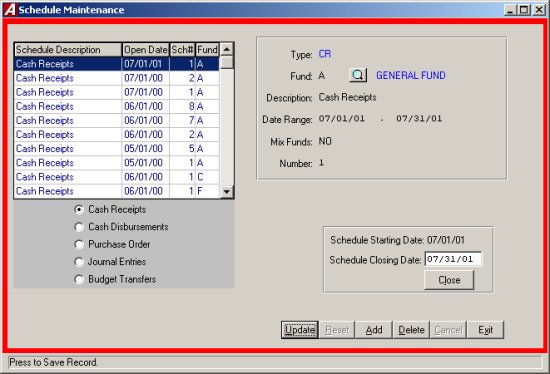

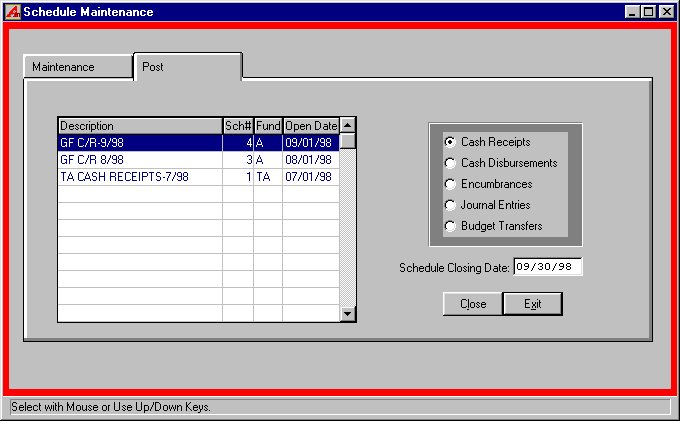

Schedule Maintenance

The schedule maintenance function enables the user to open and edit schedules for the recording and organizing of accounting information.

To enter the schedule maintenance functione, select Schedule Maintenance from the Data Entry main menu.

Types of Schedules

There are five types of schedules one for each type of accounting data. They are:

·

Cash Receipts

·

Cash Disbursements

·

Encumbrances

·

Journal Entries

·

Budget Transfers

Adding a Schedule

·

Select ADD from the update panel.

·

Type in the schedule type, JE for journal entry, BT for budget transfer, CR for cash receipts, CD for cash disbursement, EN for encumbrance, or click the on the drop down list.

Accounting Tips:

0

There are only five valid types of schedules. Each schedule has its own type code and indicated above.

·

Enter the fund letter or click on the magnifying glass to view a list of available funds and press TAB.

Accounting Tips:

0

Although separate schedules are recommended for different funds, municipal entities with minimal transactions may record entries of the particular type (i.e. Cash Receipts) on a single schedule for all funds. Such multi-fund schedules should be labeled as fund A for General Fund.

·

Enter a description for the schedule (i.e. July Cash receipts).

·

Enter the opening date for the schedule and proposed closing date.

·

Enter "YES" or "NO" to indicate if data entry items from multiple funds may be placed on this schedule.

·

Enter the schedule number.

Accounting Tips:

0

As with all data in ACCOUNTING MANAGER, the opening date of a schedule becomes a basis for all reporting purposes. All schedules should be opened as of the first date of the reporting period (see also Appendix A – Sample Monthly Procedures).

After entering the new schedule, click SAVE to save the new entry and return to the Open Schedule listing screen.

Editing/Changing a Schedule

ACCOUNTING MANAGER provides the user with the ability to edit and change schedule descriptions and dates for any open schedules.

·

Select the individual schedule from the listing.

·

Click UPDATE from the update panel.

·

Press TAB until desired information to be changed is highlighted.

·

Enter in the correct data and click SAVE. ACCOUNTING MANAGER will automatically replace the old data and return to the listing.

Exiting the Schedule Function

Selecting EXIT from the update panel will return the user to the ACCOUNTING MANAGER main screen.

Close and Post Schedules

The close & post procedures module enables the user to close and post schedules to the appropriate ledger accounts. This closing and posting procedure is similar in nature to the footing, cross-footing, and posting of a manual set of ledgers.

To enter the close & post procedures module, select the Post tab from the Schedule Maintenance menu.

Selecting an Schedule

·

Select the schedule type to be closed.

·

Select the open schedule to be closed from the listing.

·

Enter date of the closing for the schedule. The default date will be the ending day of the month.

Accounting Tips:

0

As with all data in ACCOUNTING MANAGER, the closing date of the schedule becomes the basis for all reporting purposes. All schedules should be closed as of the last date of the reporting period (see Appendix A – Suggested Monthly Procedures). If the schedule is not closed, as of the ending date of the period, general ledger detail accounts will not correspond to closed & posted balances.

Closing a Schedule

·

After selecting and dating the schedule, click CLOSE. ACCOUNTING MANAGER will ask you, "Are You Sure You Want To Close This Schedule?"

·

Click "YES" to close the schedule.

·

Click "NO" to leave the Schedule Open.

·

Repeat the closing routine for each schedule to be closed.

Accounting Tips:

0

Once a schedule is closed it cannot be edited or changed. Only open schedules may be edited or changed.

Accounting Tips:

0

ACCOUNTING MANAGER will allow the user to only close one schedule at a time. This safeguard prevents the user from erroneously closing an open schedule.

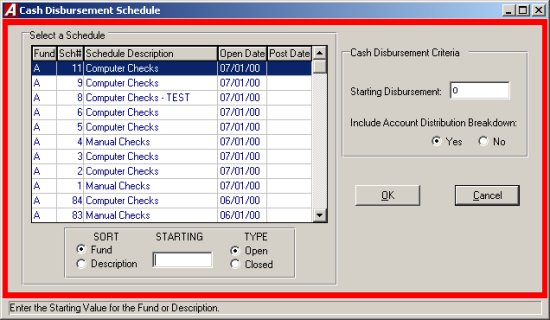

Cash Disbursement

The cash disbursement function is the second segment of the data entry menu. This segment should be used for entering data, recording of manual checks, the preparation and printing of computer-generated checks, the distribution of payroll expenses and the creation of expense warrants. To enter the cash disbursement function, select Data Entry then Cash Disbursements from the ACCOUNTING MANAGER main screen.

The cash disbursement function contains its own menu for data entry of different cash disbursement activities. It is separated into check routines, which handle the information recording of the individual cash disbursements, and reports, which allow the user to control the physical output of cash disbursements.

The menu items are:

·

Manual Checks

·

Computer Checks

·

Void Checks

·

Validate Checks

·

Print Disbursement Checks

·

Payroll to General Ledger Distribution

·

Trust and Agency Payment Processing

·

Reimbursement Payments Menu

Manual Checks

Parts of a Manual Cash Disbursement

Each cash disbursement, just like the cash receipt, has two parts. The first part is the information part of the cash disbursement, which records the check number, disbursement date, complete vendor information, disbursement amount, and a brief description of the payment. The second part is the account code distribution of the cash disbursement.

Selecting a Schedule

Select an open schedule to record the manual/hand drawn cash disbursements in. Use the cursor keys or mouse to select the desired schedule and click the Manual Checks tab.

Entering the Manual Check

After selecting a schedule, click the Manual Check tab.

·

Select ADD from the Update Panel.

·

Enter the manual check number and press TAB (For entering a batch of manual cash disbursements, simply enter the first check number, ACCOUNTING MANAGER will automatically enter the subsequent check numbers).

·

Enter the check date and press TAB.

Accounting Tips:

0

The date of the cash disbursement, just as with a cash receipt, is the basis ACCOUNTING MANAGER uses in preparing all disbursement warrants and reports. All checks should be dated for the date of the actual cash disbursement and should correspond with the current schedule.

·

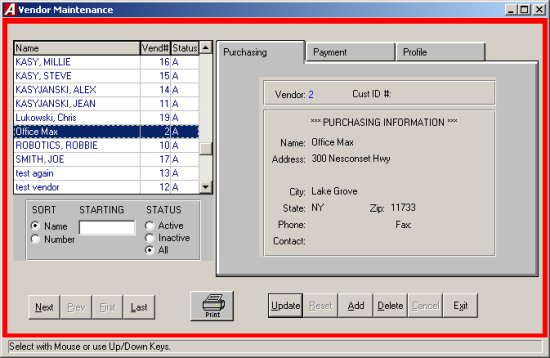

Enter the vendor number or press the magnifying glass to display a listing of all vendors. If the vendor is not in the list you can add a new vendor by pressing the ADD button.

Accounting Tips:

0

ACCOUNTING MANAGER requires a vendor be assigned to each cash disbursement. This assignment aids in maintaining accurate vendor files for both internal and external reporting. (Please refer to Vendor History)

·

Enter the total amount of the check and press TAB.

·

Enter the description for the disbursement and click SAVE and you will automatically be brought to the Detail tab.

This completes the information part of the manual cash disbursement.

Entering the Detail Information

·

Select ADD from the Update Panel.

If it is a direct pay

·

Enter the first account to be debited or expensed and press TAB (Press F6 or double click the text box to view a listing of all available accounts).

·

Enter the dollar amount to be paid

If a purchase order is being paid

·

Enter the first purchase order number being paid.

·

Enter the first account to be debited or expensed and press TAB (Press F6 or double click the text box to view a listing of all available accounts. If a purchase order number was entered you can press F8 to display all accounts listed on that purchase order).

·

Enter the dollar amount to be paid

If a purchase order is being liquidated

·

Enter the dollar amount to be liquidated and press TAB.

·

If the selected account code was not encumbered on the original purchase order, ACCOUNTING MANAGER will indicate that no liquidation may take place.

·

Enter the dollar amount being paid and press TAB. ACCOUNTING MANAGER will make the respective debit or expense entry for the select account.

·

Enter the invoice/reference number and press TAB. A warning will be displayed if this is a duplicate invoice number for this vendor.

Accounting Tips:

0

ACCOUNTING MANAGER automatically credits the default cash account for the respective fund (i.e. A200 – General Fund Cash is credited for the total of General Fund expenditures/debits). No credit entry is necessary. (Please refer to File Maintenance-Funds)

·

After entering the final cash disbursement click SAVE to lock in the new entries and to return to the Manual Check listing.

Finding an existing Cash Disbursement

In order to edit/change or delete a cash disbursement, it is necessary to locate it.

·

Select the open cash disbursement schedule from the Open Disbursement Schedules list

·

Select the appropriate Cash Disbursement.

Editing/Changing a Cash Disbursement

ACCOUTING MANAGER provides the user with the ability to edit and change the information provided on individual manual checks already entered into the current schedule.

·

Select the individual check from the schedule listing.

To Edit/Change the information part of a manual check

·

Click Update from the Update Panel

·

Press TAB until the desired information to be changed is highlighted.

·

Enter in the correct data and click SAVE. ACCOUNTING MANAGER will automatically replace the old data. If the amount was changed you will automatically be bought to the Detail screen.

To Edit/Change the account distribution of a manual check

·

Select the DETAIL tab.

·

Select the account code line to be changed.

·

Click UPDATE from the update panel.

·

Click the text box of the data to be changed.

·

Enter the correct data and click SAVE. ACCOUNTING MANAGER will automatically replace the old data and return to the Manual Check tab.

Removing a Cash Disbursement

Users can remove a manual check or detail line from any open schedule, essentially voiding the transaction out entirely. In order to remove a manual check you must remove all detail lines first.

Detail

·

Select the individual check from the schedule listing.

·

Select the DETAIL tab.

·

Select the detail line to delete.

·

Click the DELETE button from the Update panel.

·

ACCOUNTING MANAGER will ask you "Delete this check Detail?"

·

Click "YES" to remove the line.

·

Click "NO" to keep the line.

·

Repeat until all detail lines are removed.

·

Select the Manual Check tab to continue deleting the manual check.

Check

·

Select the individual check from the schedule listing.

·

Click the DELETE button from the Update panel.

·

ACCOUNTING MANAGER will ask you "Delete this Manual Check?"

·

Click "YES" to remove the disbursement.

·

Click "NO" to keep the disbursement.

Accounting Tips:

0

What is the difference between removing a check and voiding a check?

0

Only checks in the current, open schedule that have not been physically disbursed may be removed from the accounting system. Checks that are from prior accounting periods or that have been physically disbursed should be voided out. (Please refer to Cash Disbursements- Voiding a Check)

Exiting the Manual Cash Disbursements Function

Selecting EXIT from the Update panel will return the user to the ACCOUNTING MANAGER main screen.

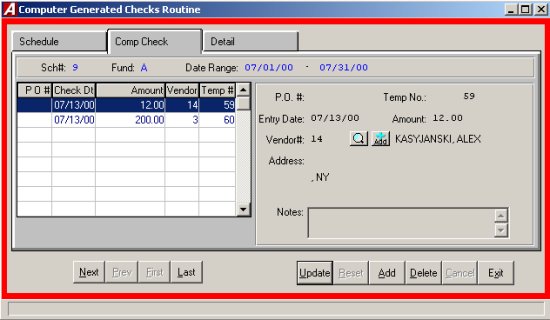

Computer Generated Checks

To produce and record a computer generated check; select Computer Checks from the Cash Disbursement Menu.

Parts of the Computer Generated Cash Disbursement

Each computer generated cash disbursement has two parts. The first part is the information part of the computer generated cash disbursement which records the purchase order number, disbursement date, payment amount, and complete vendor information. A temporary check number is assigned to each disbursement. When the checks are printed the temporary check numbers are replaced with the actual check numbers. The second part is the account code distribution of the cash disbursement. For a screen image please click Computer Generated Checks.

Entering a Computer Generated Cash Disbursement

After selecting a schedule, ACCOUNTING MANAGER will display a listing of all cash disbursements in that schedule.

·

Select ADD from the Update Panel.

·

Enter the purchase order number, if applicable, or leave blank for a direct payment and press TAB.

·

Enter the Check date and press TAB.

Accounting Tips:

0

The date of the cash disbursement, just as with cash receipt, is the basis ACCOUNTING MANAGER uses in preparing all disbursement warrants and reports. All checks should be dated for the date of the actual cash disbursement/warrant and should appropriately correspond with the current cash disbursement schedule.

·

Enter the net payment amount and press TAB.

·

Enter the vendor number. Click the magnifying glass to see and alphabetical listing of all vendors. Click ADD from with in the vendor listing to add a new vendor to the vendor list. (If a purchase order is being liquidated, the vendor information will be automatically listed)

Accounting Tips:

0

ACCOUNTING MANAGER requires a vendor be assigned to each cash disbursement. This assignment aids in maintaining accurate vendor files for both internal and external reporting. (Please refer to Vendor History)

·

Click the Detail tab.

·

Click ADD from the Update panel.

·

Enter the first account to be debited or expensed and press TAB (press F6 or double click in the textbox to view all available accounts, ACCOUNTING MANAGER will ask for the type of account and fund letter).

·

Enter the invoice/reference number and press TAB. A warning will be displayed if this is a duplicate invoice number for this vendor.

For general ledger/revenue accounts to be debited

·

Enter the dollar amount to be debited and click SAVE.

For appropriation accounts to be expensed

·

Enter the amount to be expensed and click SAVE.

·

If insufficient funds are available, the system will prompt if OK to overspend.

·

If a purchase order is to be liquidated, enter the dollar amount to liquidated and click SAVE.

·

Enter additional debits/expenses in the same manner.

For All Entries

·

If the description setting is turned on then enter the desired description (for more information, please refer to SYSTEM MANAGER, System Parameters).

Accounting Tips:

0

ACCOUNTING MANAGER automatically credits the default cash account for the respective fund (i.e. A200 – General Fund Cash is credited for the total of General Fund expenditures/debits). No separate credit entry to the cash account is necessary. (Please refer to File Maintenance – Funds)

After entering the final cash disbursement of the batch, click SAVE to save the entries and return to the cash disbursements listing.

Finding an Existing Computer Generated Disbursement

In order to edit/change or delete a cash disbursement, it is necessary to locate it. To find the appropriate cash disbursement select it from the list by using the scroll bar.

Editing/Changing a Computer Generated Disbursement

ACCOUNTING MANAGER provides the user with the ability to edit and change the information provided on computer generated checks on the current schedule provided that have not yet been printed.

·

Select the individual check from the schedule listing.

To Edit/Change the information part of a computer check

·

Select UPDATE from the Update panel.

·

Press TAB until the desired information to be changed is highlighted.

·

Enter in the correct data and click SAVE. ACCOUNTING MANAGER will automatically replace the old data.

To Edit/Change the account distribution of a computer check

·

Click the DETAIL tab.

·

Select the account code line to be changed.

·

Click UPDATE from the Update panel.

·

Press TAB until the desired information to be changed is selected.

·

Enter in the correct data and click SAVE. ACCOUNTING MANAGER will automatically replace the old data and return to the listing.

Removing a Computer Generated Cash Disbursement

Users can remove a computer generated check or detail line from any open schedule, provided the checks have not yet been printed.

·

Select the individual check from the schedule listing.

·

Click the DETAIL tab. Select the Detail line.

·

Click DELETE from the Update panel.

·

ACCOUNTING MANAGER will ask you "Ok to delete the selected detail record?"

·

Click "YES" to remove the first line.

·

Click "NO" to keep the disbursement.

·

Repeat until all detail lines are removed.

Exiting the Computer Generated Disbursements Function

Selecting EXIT from the Update Panel will return the user to the ACCOUNTING MANAGER main screen.

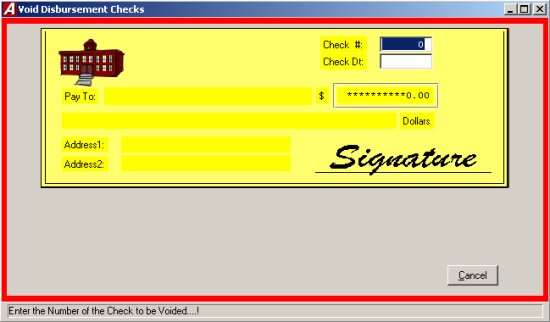

Voiding Computer Generated Cash Disbursements

To void any checks, either computer or manually prepared, that have already been entered into ACCOUNTING MANAGER and are not on a current schedule, select Void Checks from the Cash Disbursement Menu.

The Void Check Routine screen will appear.

·

Enter the check number and the check’s original issue date and press TAB.

·

ACCOUNTING MANAGER will display the check information and ask if this is the check to be voided.

·

Select an open warrant to place the void check record.

·

Enter the date (this is the date that you are voiding the check NOT the date the check was written).

·

Click "OK" to void the check.

·

ACCOUNTING MANAGER will ask "ARE YOU SURE?"

·

Click "YES" to void the check.

·

Click EXIT to return to the ACCOUNTING MANAGER main screen.

Validate Computer Generated Checks

Before printing a warrant of computer generated checks, the user may want to validate the checks to ensure all selected checks have been properly distributed to account codes. To validate check prior to printing, select Validate Checks from the Cash Disbursement menu.

·

Select the cash disbursement schedule to validate.

·

Click the VALIDATE button.

·

ACCOUNTING MANAGER will validate all of the checks on the selected schedule/warrant. If there are any errors, ACCOUNTING MANAGER will display errors on screen for review and correction.

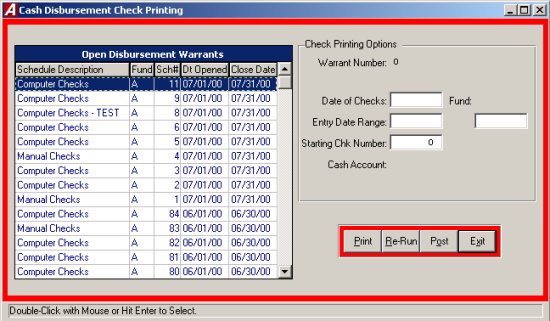

Printing Computer Generated Checks

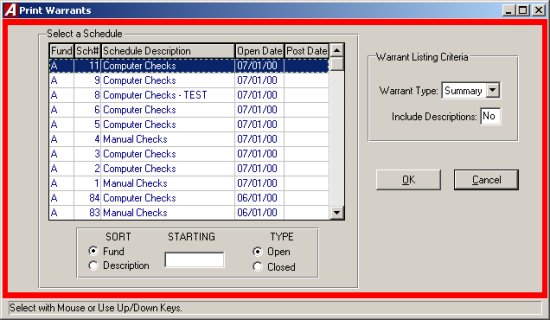

To print computer-generated checks that have already been entered into the current disbursement warrant, select Print Disbursement Checks from the Cash Disbursement Menu. ACCOUNTING MANAGER will display the Check Print Parameters screen.

All of the account distribution information was entered on the schedule through the Computer Generated Cash Disbursements module (Please refer to Computer Generated Cash Disbursements – Schedules). Through the check printing routine of ACCOUNTING MANAGER, the user can enter the date of the warrant, the actual check numbers, and the range of temporary check to print.

Updating the Check Printing Options

·

Select a schedule or warrant to print and press TAB.

Accounting Tips:

0

The difference between a Warrant and a Cash Disbursement Schedule: A warrant is comprised solely of computer generated checks while a cash disbursement schedule consists of all cash disbursements, including manual checks, computer generated, and payroll expense distributions, for a particular period. A Cash Disbursement Schedule may include more that one Warrant.

·

Enter the date to be printed on the checks and press TAB.

·

Enter the check entry date range to be printed and press TAB.

Accounting Tips:

0

The ability to select a date entry range provides the user the ability to print a smaller subset of the selected schedule/warrant. This will allow users to maintain multiple warrants, based upon the date the checks were printed, within each schedule.

·

Enter the check number of the first check in the printer. The actual check number will replace the temporary check numbers that were originally assigned by ACCOUNTING MANAGER when the cash disbursement information was entered onto the current schedule.

·

If you are using a third-party laser printing option, enter the output destination.

Printing Accounts Payable Checks

Accounting Tips:

0

The user should load the blank computer checks into the desired printer prior to selecting the Print Checks routine.

After updating the Cash Disbursement Check Printing Options, the user can proceed to print the checks by selecting the PRINT button from the Cash Disbursement Check Printing Options screen.

·

ACCOUNTING MANAGER will validate the current check run to ensure they have been properly prepared. If any errors exist, the user will be prompted to correct the error before printing.

·

If printing checks, the system will prompt the user to align the checks in the printer

·

After the checks are aligned, click "YES": to confirm and begin printing checks.

Re-Running Checks

After printing the checks, the user has the option of voiding and re-running the checks in case of errors during the printing process. To re-run the checks, click RE-RUN from the Cash Disbursement Check Printing Options screen.

ACCOUNTING MANAGER will review the checks that have been sent to the printer to determine if all checks or if only a portion is printed. The range of check numbers assigned to checks will be displayed on screen. The user may select to re-run all checks or only a selected range of check numbers.

·

Selected to re-run All or a Range and press TAB.

·

If a range, enter the number range to re-run and press TAB.

·

Click "YES" to re-run the selected range.

Posting Checks

Once the checks have been printed and determined to be accurate, the checks must be posted. Posting the checks records the payment permanently in the accounts payable file. To post the checks click POST from the Cash Disbursement Check Printing Options screen.

·

Read the check posting message that appears on screen.

·

Click "YES" to post the payroll checks.

·

Click "NO" to leave the routine and not post the payroll checks.

To record a period’s payroll expenses from an outside program, select the General Ledger Distribution or Trust & Agency Processing from the Cash Disbursement Menu.

Payroll to General Ledger Distribution

Entering the Payroll Check Information

·

Select Payroll to general Ledger Distribution from the Cash Disbursement menu to record the payroll accounting data.

Selecting a Schedule

Select an open schedule to record the payroll distribution. Use the cursor keys or the scroll bar to select the desired schedule and press TAB. If no schedules are open, ACCOUNTING MANAGER will direct you to open a new schedule.

·

Enter in the Reference/Check numbers used for the particular payroll (If checks are not used, enter in appropriate reference numbers, i.e. bank wire reference numbers).

·

Enter the date of the payroll.

·

Enter the reference number of the payroll.

·

Enter in a description of the payroll.

·

Enter the total payroll expense for the payroll.

Accounting Tips:

0

The Total Payroll Expense of any payroll period is equal to the total gross payroll for the period plus the entity’s share of the payroll taxes. Gross payroll is the total net payroll and all employee deductions (i.e. Federal Withholding Taxes, New York State Withholding Taxes, FICA Withholding, etc.). Payroll taxes are those taxes (i.e. FICA tax, Unemployment tax, etc.) that the entity, as an employer, must pay to the respective federal and state governments.

Importing the Payroll to General Ledger

Click IMPORT from the Payroll Distribution Screen to import the payroll data from PAYROLL MANAGER. The date Criteria screen will appear and allow the user to select the appropriate payroll dates to import.

·

Enter in the starting and ending payroll check dates and click "OK". ACCOUNTING MANAGER will import in the appropriate payroll budget information.

Distributing the Payroll to Budget Accounts

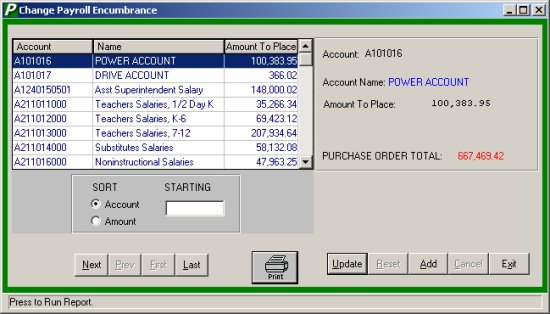

Click DISTRIBUTE from the Update panel to distribute the payroll expenses to the appropriate budget accounts. The payroll Distribution screen will appear and allow the user to distribute the payroll to predefined general ledger accounts (for more information, please refer to SYSTEM MANAGER: Payroll Parameters).

·

Enter in the appropriate debits and credits to the predetermined accounts. The accounts will be listed in numeric order.

After all accounts have been entered, ACCOUNTING MANAGER will display the Expense Distribution screen.

·

Select the first expense account to be distributed to (Please see below on Using the SORT feature to select an Account).

·

Select UPDATE from the Update panel.

·

Enter the appropriate debit or credit to the expense account.

·

ACCOUNT MANAGER will keep a running total of distributed expenses at the bottom of the screen.

·

Repeat until all payroll expenses are distributed.

·

Select EXIT to return to the ACCOUNTING MANAGER main screen.

ACCOUNTING MANAGER will proceed to each fund, in alphabetical order, to distribute multiple fund payrolls.

To Use the SORT Feature to Select an Account

The SORT feature assists the user in locating expense accounts with five search options.

KEY Allows the user to type in the expense account number being searched

FIRST/LAST Selects the first or last expense account in the system

NXTPAGE Proceeds to the next screen of expense accounts

PRVPAGE Proceeds to the previous screen of expense accounts.

Posting the Payroll Information

Click Post from the Payroll Distribution screen to post the payroll accounting data. ACCOUNTING MANAGER will display each account as it is posted and will respond "PAYROLL POSTING COMPLETED" when the routine is finished.

Trust and Agency Payment Processing

The Trust & Agency Payment Processing routine will automatically summarize the information for a payroll process for each vendor to be paid. The summarized data may be reviewed and modified before processing for payment. In addition, selected payments may be held for future processing, delaying until the appropriate time.

Each payroll deduction code must be maintained to identify the vendor to be paid and the appropriate account codes to use for making each entry. Once entered, the desired settings will remain for each code.

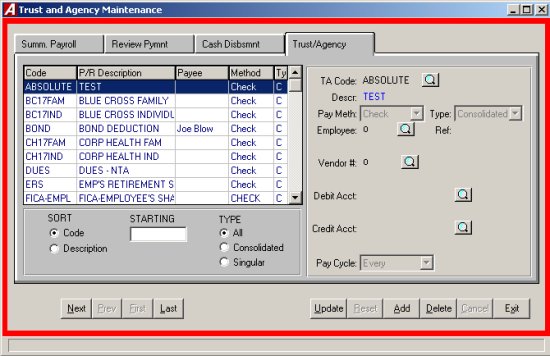

Maintain Trust & Agency Codes

Select Trust & Agency Codes and Payment Warrants from the Cash Disbursements menu to maintain and add trust & agency codes.

Adding a Code

·

Select ADD from the Update Panel.

·

Enter the T&A code or click the magnifying glass to see a list of payroll deductions and press TAB.

·

Choose the pay method from the drop down list and press TAB.

·

Select the type (C) Consolidated-1 check or (S) Singular – Individual checks.

·

Enter the individual employee’s number, or press the magnifying glass to select from the listing of employees.

·

Enter the Vendor number, or press the magnifying glass to see an alphabetical listing of all vendors with city and state.

·

Enter the account to be debited or click the magnifying glass to see a list of accounts.

·

Enter the account to be credited or click the magnifying glass to see a list of accounts.

·

Click SAVE to save the new information.

Finding a Code

In order to edit/change or delete a code, it is necessary to locate it. The SORT feature assists the user in locating codes on open schedules by three search options.

CODE Allows the user to have the listing arranged by code number

DESCRIPTION Allows the user to have the list arranged by description

TYPE Allows the user to search by code type

Editing/Changing a Code

ACCOUNTING MANAGER provides the user the ability to edit and change the information provided on individual codes already entered.

·

Select the code from the listing.

·

Select UPDATE from the Update pane.

·

Press TAB until the information to be changed is highlighted.

·

Enter in the corrected data. Click SAVE and ACCOUNTING MANAGER will automatically replace the old data.

Removing a Code

User can remove a code from any open listing.

·

Select the individual code from the schedule listing.

·

Select DELETE from the Update panel.

·

ACCOUNTING MANAGER will ask you "Delete this trust?"

·

Click "YES" to remove.

·

Click "NO" to keep the code.

Review Payment

Users can update the payment amount or the hold status.

·

Click the Review Payment tab.

·

Select the payment from the listing.

·

Click the UPDATE from the Update panel.

·

Enter the new amount.

·

Select the holding status. Click the check to place the payment on hold or leave blank to allow the payment.

·

Click SAVE to save the new information.

Exit the Code Function

Selecting EXIT from the Update panel will return the user to the ACCOUNTING MANAGER main screen.

Summarize Payroll Information

Selecting Summarize Payroll Information from the Cash Disbursements then Trust and Agency Payment processing menu to generate a summary of trust and agency information.

·

Enter the starting payroll check date and press TAB.

·

Enter the ending payroll check date and press "OK" to run the Summarize Payroll Information Report.

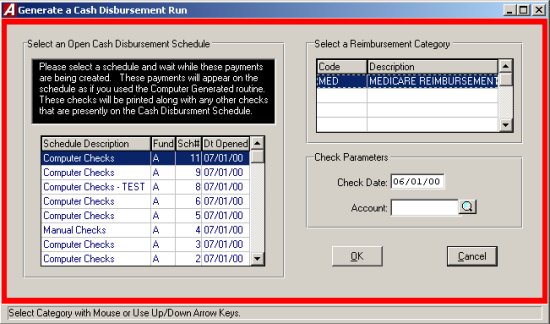

Generate a Cash Disbursement Run

When the Trust & Agency data is summarized and reviewed, the data can be used to make computer generated checks. These checks are placed on an open cash disbursement schedule and may be printed as normal computer generated checks. The routine will validate that records are complete (i.e. Vendor still exits and is active and/or account is still open).

Select Generate a Cash Disbursement Run from the Trust and Agency Payment Processing Menu to generate a check run.

·

Select an open schedule in which to record the Trust and Agency cash disbursements. Use the cursor or scroll bar to select the desired schedule and press TAB. If no schedules are open ACCOUNTING MANAGER will direct you to open a new schedule.

·

Enter the payment date for these checks

·

Click "OK".

·

If any errors are found the Progress editor will display the error report on screen. These errors must be corrected and then run the routine again.

·

The checks may now be printed as normal (for more information please refer to Printing Computer Generated Checks).

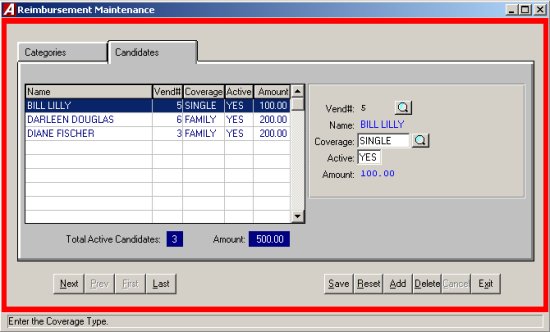

Reimbursement Payments Menu

The Reimbursement Payments function is used to process recurring, repetitive payments to numerous vendors. Each vendor is created in the system and the type of payment they receive is maintained. When the time for payment occurs, each vendor in the reimbursement payments file is given a payment for a fixed amount.

To enter reimbursement payments, select Data Entry

ŕ

Cash Disbursement

ŕ

Reimbursement Payments menu.

Selecting a Reimbursement Category

In order to make a payment, you must select an active category. This category will remain selected until the user leaves the Reimbursement Payments Menu.

·

To select an active category, choose the desired category by scrolling through the listing.

Maintaining Reimbursement Categories

In addition to selecting a category, you may also maintain categories, define new ones, and assign coverage rates.

·

To add a category, click ADD from the update panel. Enter the category code and description.

·

To modify a category code and description, select UPDATE from the update panel.

·

To define coverage and set rates, TAB to the Coverage information. Enter the coverage type and the current rate. Each category may have up to 6 coverage types and rates.

·

Select DELETE from the update panel.

Adding/ Maintaining Reimbursement Candidates

Vendors may be maintained as reimbursement candidates in the selected category for any of the six coverage types. Candidates may be made active or inactive at any time. Only active candidates will be processed for payments.

To work with candidates, select the Candidates tab from the Reimbursement Maintenance screen.

Adding a Candidate

·

To add a candidate, select ADD from the Update panel.

·

Select the desired vendor or click the magnifying glass to view a list of available vendors.

·

Select the desired coverage or click the magnifying glass to view a list of available coverage types for the selected category.

Modifying a Candidate

·

To modify a candidate, Select UPDATE from the update panel.

·

Press Tab until the information to be changed is highlighted.

·

Enter the new information and click SAVE. ACCOUNTING MANAGER will automatically replace the old data.

Removing a Candidate

·

To delete a candidate, select the candidate, click DELETE from the update panel.

·

ACCOUNTING MANAGER will ask, "Delete this reimbursement candidate?"

·

Click "YES" to remove the candidate or click "NO" to keep the candidate.

Generating a Cash Disbursement Run

To create a Cash Disbursement Run, Select Generate a Cash Disbursement Run from the Reimbursement Payments Menu.

·

Select the active cash disbursement schedule in which to place the checks.

·

Enter the date the checks will be printed.

·

Enter the account number to change for the expense or click the magnifying glass to see a list of available account codes.

·

ACCOUNTING MANAGER will create a disbursement check for each active candidate based on the rate of his or her coverage. Checks may be printed as part of the remaining cash disbursement process.

Produce Candidate Mail Labels

To produce candidate mail labels select Produce Candidate Mail Labels from the Reimbursement Payments Menu.

·

Select the Reimbursement Categories and press TAB.

·

Select the coverage type.

·

Select the Status (A) Active, (I) Inactive, or (B) Both.

·

Select the Printer type (L) Laser or (D) Dot Matrix and click "OK".

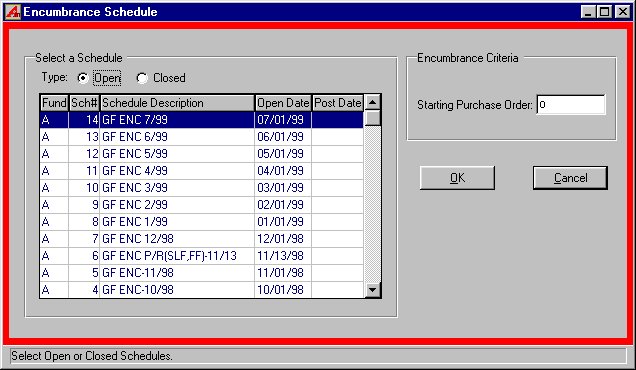

Encumbrance

The Encumbrances function ids the fourth segment of the data entry menu. This segment should be used for entering data for the recording of manual purchase orders, the preparation and printing of computer-generated purchase orders, the liquidation and cancellation of purchase orders, the increase of purchase orders and the creation of vendor histories and encumbrance listings.

To enter the encumbrance function, select Encumbrance form the Data Entry Menu.

Accounting Tips:

0

What is an Encumbrance?

0

An encumbrance is a temporary budgetary entry, which encumbers, or sets aside, a portion of a budget to satisfy an incoming obligation for a specific purpose. The portion of the budget set aside is said to be encumbered. These encumbered funds are used in the purchasing process to maintain appropriations within a budget. They are used to pay an obligation to be received in the future for an order placed by the entity.

The encumbrance function contains its own menu for data entry, which handles the recording of the individual purchase order and budgetary encumbrances, reports, which provide organized information on all encumbrances and queries, which provides rapid inquiry capability into specific encumbrance and vendor related items.

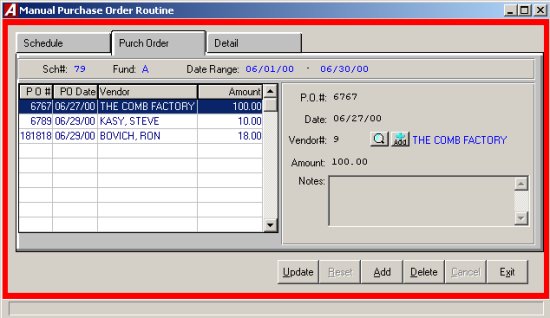

Manual Purchase Orders

Manually prepared purchase orders are where departments and buildings physically type their purchase request on an actual preprinted purchase order form. The typed form is then sent through the approval process, with all noted signatures being made directly on the purchase order. Once signed by the purchasing, agent it becomes a valid purchase order and must now be encumbered in the accounting system.

To record a manually prepared purchase order, select Manual PO from the Encumbrance menu.

Selecting a Schedule

Select an open schedule to record the manual purchase order in. Use the cursor keys or scroll bar to select the desired schedule. If no schedules are open, ACCOUNTING MANAGER will direct you to open a new schedule.

Parts of the Manual Purchase Order

Each purchase order has two parts. The first part is the information part, which records the purchase order number, the purchase order date, complete vendor information and the encumbrance amount. The second part is the account code distribution of the purchase order.

Entering a Purchase Order

After selecting a schedule, ACCOUNTING MANAGER will display a listing of all purchase order in that schedule.

·

Click ADD from the update panel.

·

Enter the purchase order number and press TAB (For entering a batch of manual purchase orders, simply enter the first purchase order number, ACCOUNTING MANAGER will automatically enter the subsequent purchase order numbers in order).

·

Enter the purchase order date and press TAB.

Accounting Tips:

0

Purchase orders should be dated for the date the order or commitment to purchase goods and services is made. Proper dating of purchase orders will result in accurate comparison to budget reports.

·

Enter the vendor number or click the magnifying glass to see an alphabetical listing of all vendors with city and state.

·

Enter the total amount of the manual purchase order.

·

Enter an explanation of the manual purchase order, if any, and press SAVE.

Detail Account Numbers

·

Select the Detail tab.

·

Select ADD from the update panel.

·

Enter the first appropriation account to be encumbered and press TAB (Select F6 or double click the textbox to view all available appropriation accounts).

·

Enter the dollar amount to be encumbered by the purchase order and press SAVE.

·

If there are insufficient funds in the selected appropriation account, ACCOUNTING MANAGER will prompt the user if you want to override the transaction. The ability to override the transaction is based upon a permission level set by the System Administrator and may have been restricted to selected personnel.

·

Enter additional encumbrances in the same manner.

When the entry is in balance and complete, ACCOUNTING MANAGER will allow you to save the new entries.

Finding an existing Purchase Order

In order to edit/change or delete a purchase order, it is necessary to locate it. The scroll bar is used to assist the user in locating purchase orders on open schedules.

Editing/Changing a Purchase Order

ACCOUNTING MANAGER provides the user with the ability to edit and change the information provided in the individual manual purchase orders already entered into the current schedule provided they have not yet been printed.

·

Select the individual purchase order from the schedule listing.

To Edit/Change the description part of a manual Purchase order

·

Click UPDATE from the update panel.

·

Press TAB until the information to be changed is highlighted.

·

Enter in the correct data and click SAVE. ACCOUNTING MANAGER will automatically replace the old data and return to the item listing.

To Edit/Change the detail items of a manual purchase order

·

Select the DETAIL tab from the update panel.

·

Select the item line to be changed.

·

Press TAB until the desired information to be changed is highlighted.

·

Enter in the correct data and click SAVE. ACCOUNTIN MANAGER will automatically replace the old data and return to the item listing.

Remove a Purchase Order

User can remove a manual purchase order from any open schedule, essentially deleting it entirely. If the schedule has been closed, the purchase order can only be canceled (for more information, please refer to Purchase Order Routines: Canceling a Purchase Order).

Detail

·

Select the individual purchase order from the schedule listing.

·

Select the DETAIL tab.

·

Select the line to be deleted.

·

Click DELETE from the update panel.

·

ACCOUNTING MANAGER will ask you, "Ok to delete the selected detail entry?"

·

Click "YES" to remove the line.

·

Click "NO" to keep the line.

Purchase Order

·

Select the individual purchase order from the listing.

·

Click DELETE from the update panel.

·

ACCOUNTING MANAGER will ask you, "Delete this PO?"

·

Click "YES" to remove the purchase order.

·

Click "NO" to keep the purchase order.

Exiting the Manual Purchase Orders Module

Selecting EXIT from the update panel will return the user to the ACCOUNTING MANAGER main screen.

Computer Generated Purchase Orders

Computer generated purchase orders are where all of the information, including items and their associated costs are entered into the system. Once entered, the purchase orders are encumbered against the system. Then at a specified point in time, the entered purchase orders are printed onto preprinted purchase order forms. After printing, the purchase orders are then sent to the respective vendor for processing.

To produce a computer generated purchase order; select Computer PO from the Encumbrance menu.

Selecting a Schedule

Select an open schedule in which to record the purchase order. Use the cursor keys or scroll bar to select the desired schedule. If no schedules are open, ACCOUNTNG MANAGER will direct you to open a new schedule.

Parts of the Computer Generated Purchase Orders

Each computer generated purchase order has two parts. The first part is the information part, which records a temporary purchase order number, the encumbrance, date, complete vendor information and building and contact address. A temporary purchase order number is assigned to each encumbrance.

Enter a Computer Generated Purchase Order

After selecting a schedule, ACCOUNTING MANAGER will display a listing of all computer generated purchase orders in that schedule.

·

Click ADD from the update panel.

·

A temporary number will be assigned to the purchase order and the number of the selected schedule will be displayed.

·

Enter the entry date and press TAB.

Accounting Tips:

0

Computer Generated Purchase Order may be dated for the entry date to simplify the review process. Once printed, the printing date will represent the date the order or commitment to purchase goods and services is made. Proper dating of the purchase orders will result in accurate comparison to budget reports.

·

Enter the vendor number or click the magnifying glass to see an alphabetical listing of all vendors.

·

Enter the Building bode to designate a place of delivery, if necessary. (Please refer to File Maintenance: Buildings)

·

Enter the name of the contact, or "ATTN:" person to appear on the purchase order, in the "Req. By:" box.

·

Enter in the explanation.

·

Click the Detail tab and ACCOUNTING MANAGER will proceed to the Purchase Order Items screen.

·

Select ADD from the Update Panel.

·

Enter the first appropriation account to be encumbered and press TAB, click the magnifying glass to view all available accounts). The account code will be used as the default account code on all subsequent lines, unless changed.

·

Enter the quantity to be ordered and press TAB. For a single item with no unit price, enter a quantity of zero (0).

·

If the quantity was given, enter the per unit price for the goods/services and press TAB.

·

If no quantity was given, enter the extended price for the goods/services and press TAB.

·

If there are insufficient funds in the selected appropriation account, ACCOUNTING MANAGER will prompt the user if you want to override the transaction. The ability to override the transaction is based upon a permission level set by the System Administrator and may have been restricted to selected personnel.

·

Enter the description of the item of good/services to be ordered and press TAB.

·

Click SAVE to save the new entries.

·

Enter additional items in the same manner.

Accounting Tips:

0

ACCOUNTING MANAGER automatically credits the reserve for the encumbrance account in the General Fund. No additional journal entry is necessary to record the encumbrance.

After entering the final item on the purchase order, select EXIT from the update panel to return to the ACCOUNTING MANAGER main screen.

Finding an Existing Computer Generated Purchase Order

In order to edit/change or delete a purchase order, it is necessary to locate it. The scroll bar assists the user in locating purchase orders on open schedule.

Editing/Changing a Computer Generated Purchase Order

ACCOUNTING MANAGER provides the user with the ability to edit and change the information provided on computer generated purchase orders on the current schedule, provided they have not yet been printed.

·

Select the individual purchase order from the schedule listing.

To Edit/Change the description part of a computer generated purchase order

·

Click UPDATE from the update panel.

·

Press TAB until the information to be changed is highlighted.

·

Enter in the correct data and click SAVE. ACCOUNTING MANAGER will automatically replace the old data.

To Edit/Change the detail item descriptions of a computer generated purchase order

·

Select the DETAIL tab.

·

Select the item line to be changed.

·

Select Update from the update panel.

·

Press TAB until the desired information to be changed is highlighted.

·

Enter in the correct data and click SAVE. ACCOUNTING MANAGER will automatically replace the old data and return to the item listing.

Removing a Computer Generated Purchase Order

Users can remove a computer generated purchase order for any open schedule, provided the purchase order has not yet been printed. If the purchase order has been printed, it can only be canceled (please refer to Purchase Order Routines: Canceling a Purchase Order).

Detail

·

Select the individual purchase order from the schedule listing.

·

Select the DETAIL tab.

·

Select the detail line to delete.

·

Click DELETE from the update panel.

·

ACCOUNTING MANAGER will ask you, "Delete this PO item?"

·

Click "YES" to remove the detail line.

·

Click "NO" to keep the item.

Purchase Order

·

Select the Description tab.

·

Select the purchase order to be deleted.

·

Click DELETE from the update panel.

·

ACCOUNTING MANAGER will ask you, "Delete this PO?"

·

Click "YES" to remove the purchase order

·

Click "NO" to keep the purchase order.

Exiting the Computer Generated Purchase Order Module

Selecting EXIT from the update panel will return the user to the ACCOUNTING MANAGER main screen.

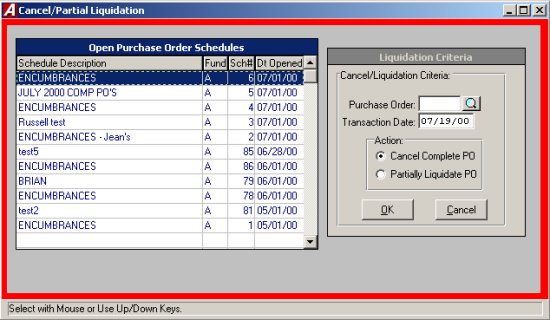

Cancel or Partially Liquidate a Purchase Order

To fully cancel or partially liquidate a purchase order from either and open or a closed schedule, select Liquidate from the Encumbrance menu.

Selecting a Schedule

Select an open schedule in which to record the cancellation/liquidation of the purchase order. Use the cursor keys or mouse to select the desired schedule. If no schedules are open, ACCOUNTNG MANAGER will direct you to open a new schedule.

Selecting a Purchase Order

·

Enter the purchase order number or click the magnifying glass to view a listing of available Purchase Orders.

·

Enter the effective date of the cancellation or liquidation.

·

In the action section select to cancel or partially liquidate the PO, then click "OK".

Canceling a Purchase Order

When the user selects the option of canceling the purchase, ACCOUNTING MANAGER will display a purchase order detail breakdown. ACCOUNTING MANAGER will ask the user if they want to cancel the entire remaining amount. Selecting "YES" will cancel the entire purchase order. Selecting "NO" will escape from the routine and return the user to the initial prompt.

Partially Liquidating a Purchase Order

When the user selects a purchase order, ACCOUNTING MANAGER will display the reference number and the vendor name of the purchase order on screen.

·

Enter the PO description.

·

Enter the amount to be liquidated and click "OK".

·

ACCOUNTING MANAGER will display each account code on the purchase order. The user must distribute the total amount to be liquidated to the account codes.

·

Enter the amount to be liquidated and click "OK".

·

Repeat for each desired account code.

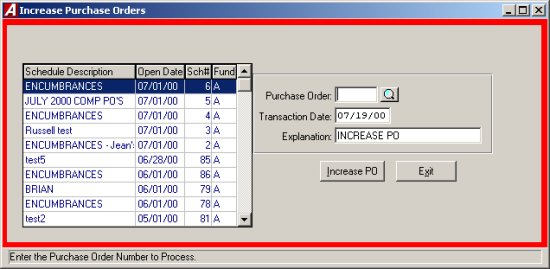

Increase Purchase Orders

In addition to issuing, canceling, and partially liquidating purchase orders, ACCOUNTING MANAGER also increases purchase orders, either in one of the existing account codes on the purchase order or on an entirely new account. To increase an existing purchase order, select Increase PO from the Encumbrance menu.

Selecting a Schedule

Select an open schedule in which to record the increase of the purchase order. Use the cursor keys or scroll bar to select the desired schedule. If no schedules are open ACCOUNTING MANAGER will direct you to open a new schedule.