Benefit Code Setup within FM2000

The Setup of Benefit Codes within FM2000 and the interface to the Payroll System Deduction screen is coordinated between the Human Resource and Payroll Offices.

The interface to the Payroll Deduction screen is controlled by having a Payroll Deduction Code associated with a Benefit Code within the Human Resources – Maintenance – Benefit Code Table.

In order to facilitate the reconciliation of Benefit Processing to the Payroll Deductions, it is recommended that Payroll Deductions be created with a correspondence to each Benefit Code category.

For Example, if you have a Benefit for Dental Insurance – Family and a Benefit Deduction for Dental Insurance – Single, create 2 Payroll Deductions that you can associate with the appropriate Benefit Code as follows:

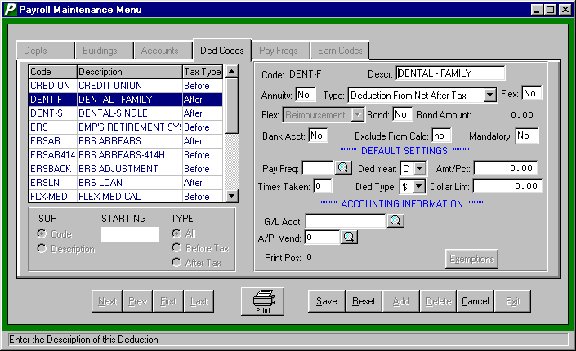

Step 1: Create a Payroll Deduction Code for each Benefit as needed.

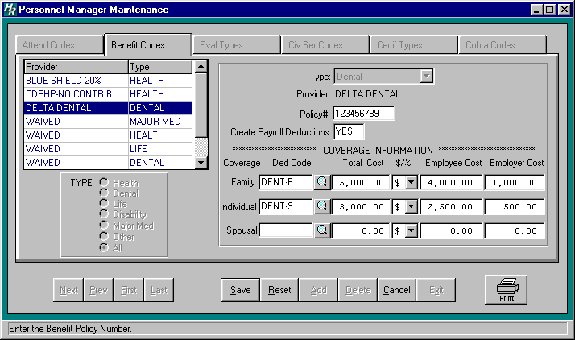

Step 2 - Create a Benefit that is related to the Deduction Codes.

Note that the Ded Code fields have now been associated with the 2 payroll deduction created in the previous step.

*** If you do not want a Payroll Deduction automatically created when a Benefit Code is Added to Each Employee’s Benefit Screen, simply leave the Ded Code fields blank on the Benefit Code Table setup!

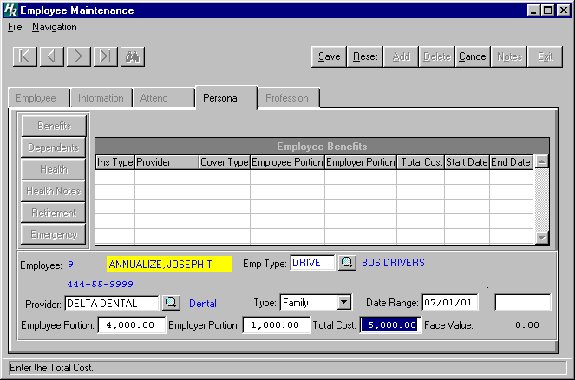

Step 3 - Add the Benefits to each Employee’s individual Benefit Screen.

Note that you can associate Benefits by the appropriate Employee Type!

The Date Range should reflect the Start and End dates of this particular Benefit.

As you select the Provider and the Type, the bottom line Employee, Employer, and Total Cost dollars will fill in. A Waived Benefit should also be recorded!

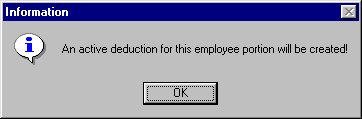

When you save the screen, if this Benefit has a Payroll Deduction associated with it, a message will display as follows:

Click OK to Create a Payroll Deduction for the Employee’s Share of this Benefit.

Click OK to Create a Payroll Deduction for the Employee’s Share of this Benefit.

Please Note that you will need to Update the Payroll Deduction Screen $ Amount.

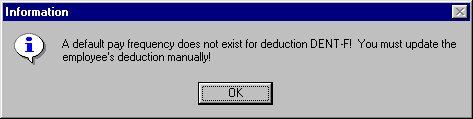

If you have not included a Default Pay Frequency on the Payroll Maintenance – Deduction Code screen or a Default Number of Checks, the System will remind you that you will need to add that to the Employee’s Payroll Deduction Screen.

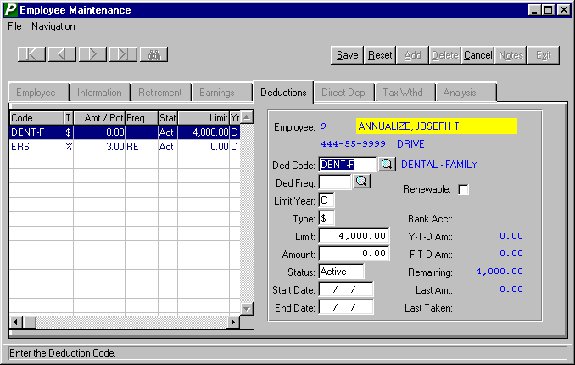

Step 4 - The Payroll Deduction Screen for the Employee is now ready to be finalized by the Payroll Department for processing on an upcoming payroll. Notice that the Limit field is the Employee Portion of the Benefit!

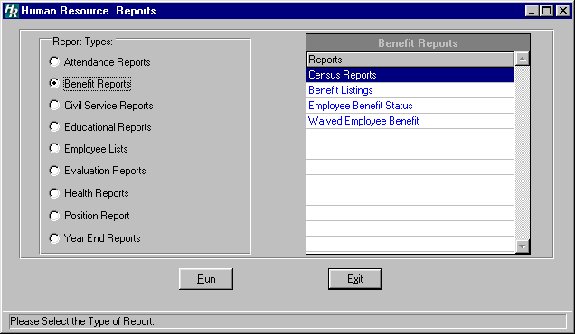

Human Resources – Reports provides for a number of listings related to Benefits:

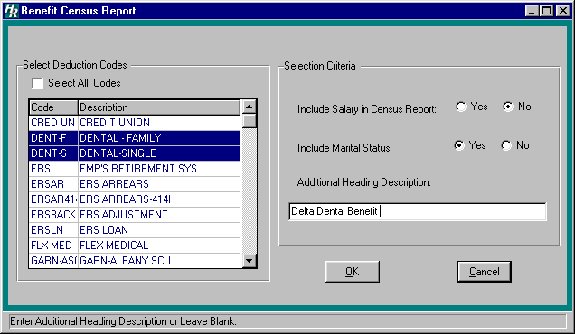

Selection Screen for the Benefit Census Report:

Selection Screen for the Benefit Census Report:

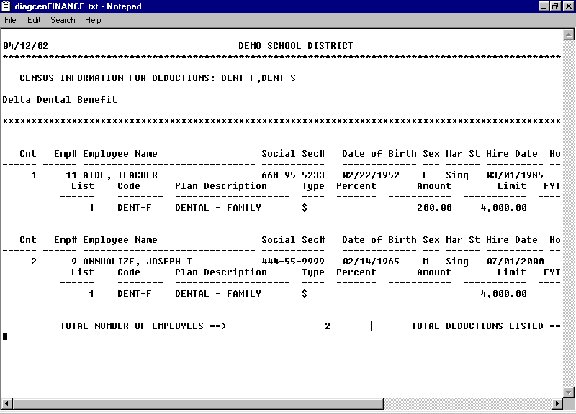

Sample Benefit Census Report – Note the individual whose Payroll Deduction has not yet been updated to include the Per Pay Amount!

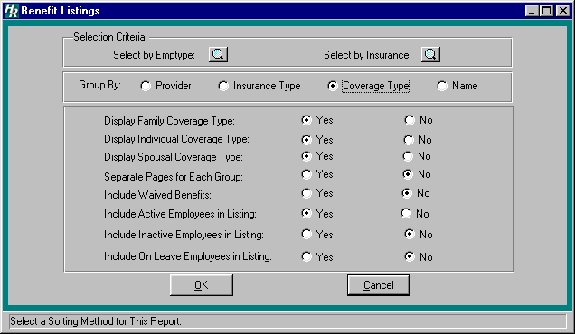

Selection Screen for Benefit Listing Report.

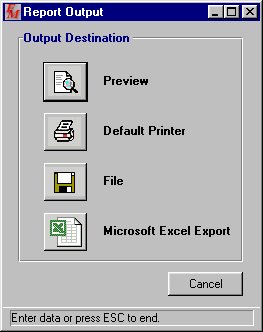

Select the desired Output Destination:

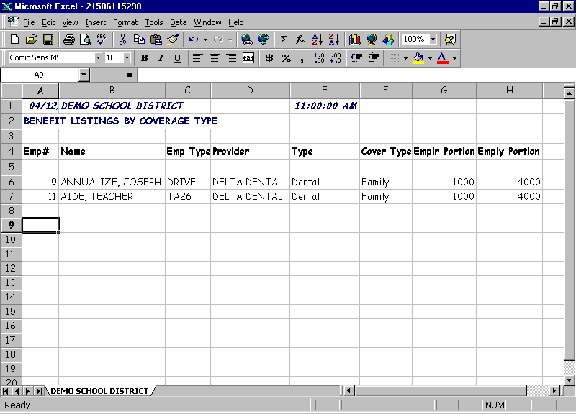

Sample Benefit Listing Report Output to Excel!

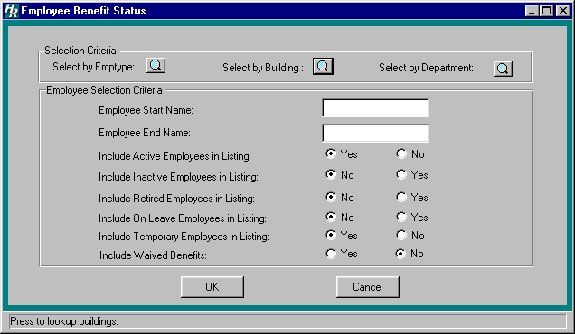

Selection Screen for Employee Benefit Status Report

Selection Screen for Employee Benefit Status Report

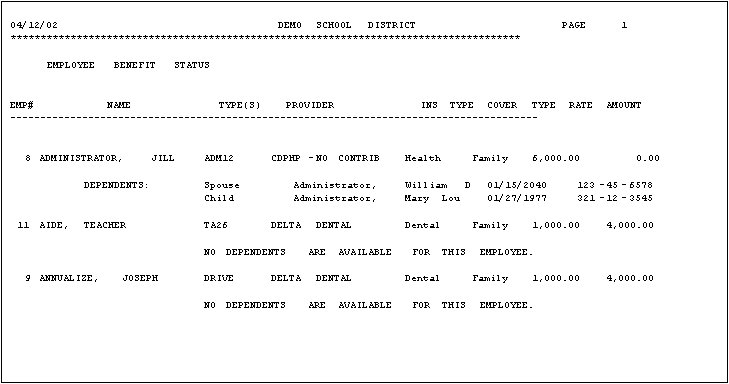

Sample Employee Benefit Status Report:

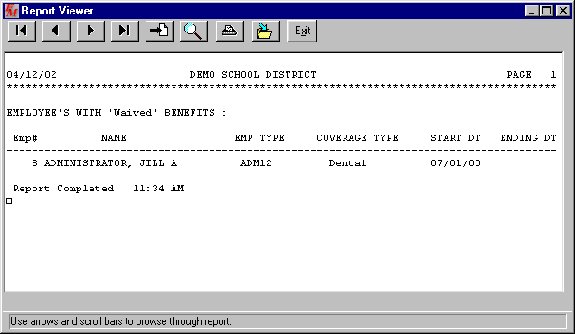

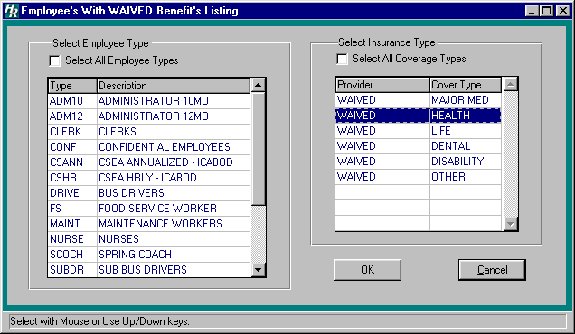

Setup Screen for Waived Benefit Listing Report:

Sample Waived Benefit Listing Report: