PAYROLL MANAGER uses a five-step procedure to process each payroll. Users can follow the payroll process from generating the initial payroll and processing unique payroll situations, to calculating the entire payroll and printing the payroll checks. In addition, PAYROLL MANGER allows the user to view a single payroll check on screen, either before or after it has been printed.

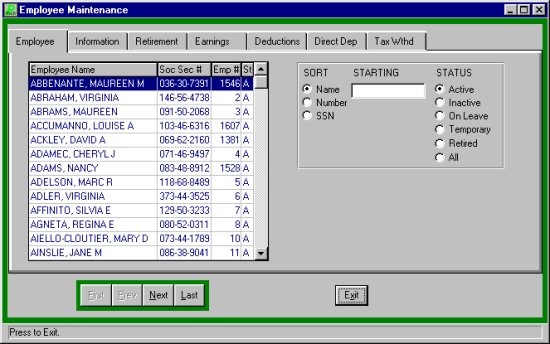

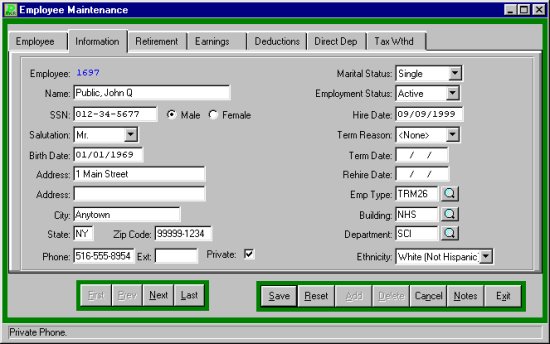

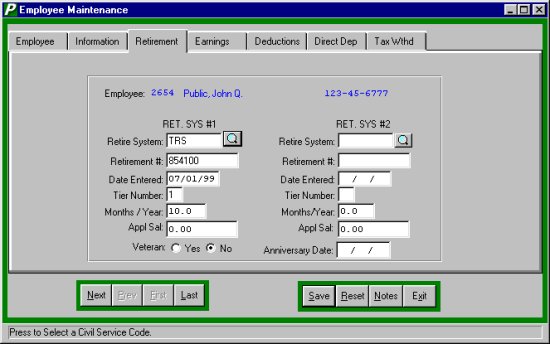

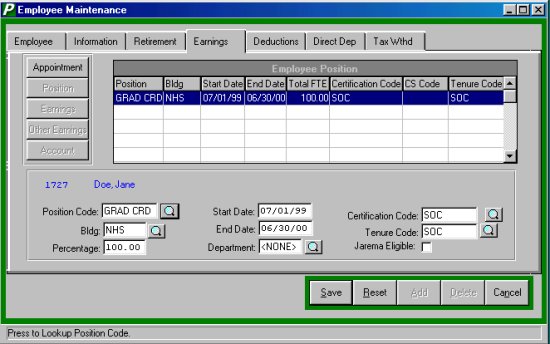

PAYROLL MANAGER features a computerized employee database, which catalogs all relevant employee data. The database allows users to maintain the data on-hand electronically, eliminating the need to manually research employee data.

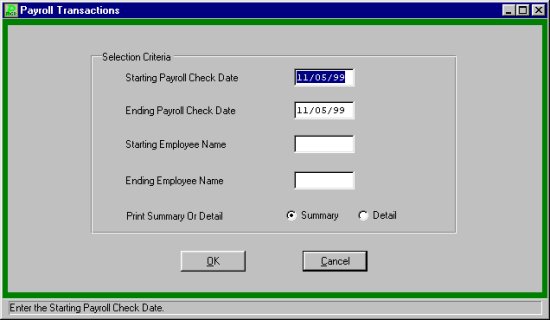

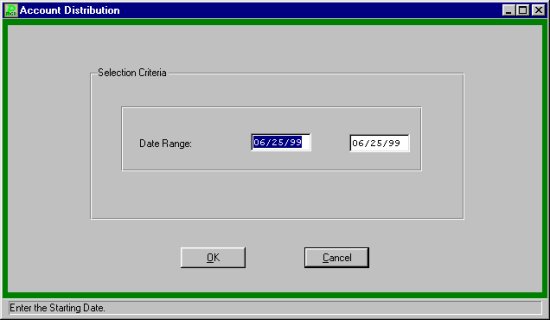

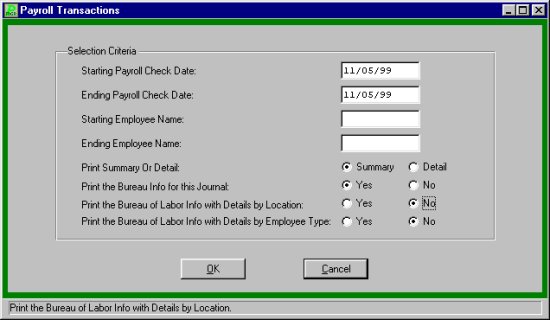

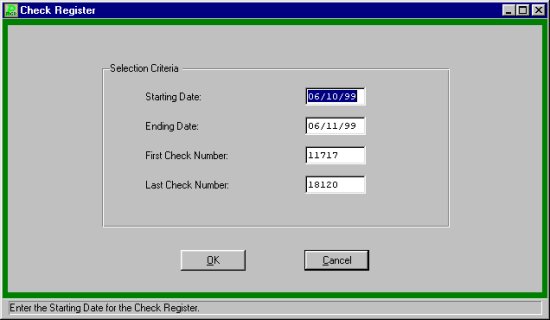

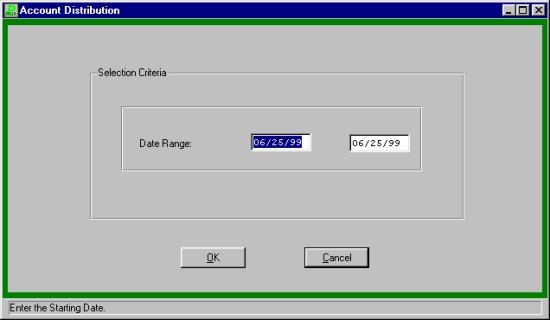

In addition to its processing function, PAYROLL MANAGER can generate a full set of payroll reports, including contract and earnings listings, edit listings, check registers, account code distributions, as well as all state retirement system reports.

Before becoming involved in the details of PAYROLL MANAGER, the user must grasp the most important concept of the program:

· Understanding how the payroll process works

PAYROLL MANAGER utilizes a five-step procedure to process each payroll. The processing steps include:

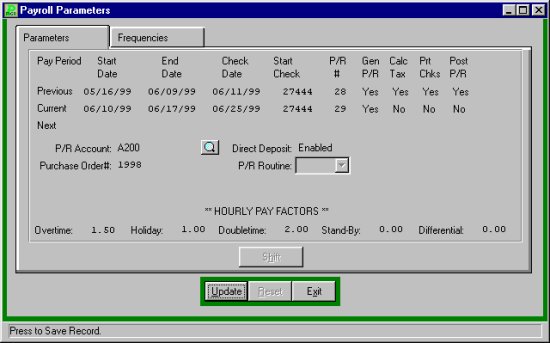

Setting the Payroll Parameters The first part of the payroll process is to set the parameters for the current payroll. The parameters include the dates covered by the payroll period, the payroll check date, and the pay frequencies to be used on the current payroll. Each item must be defined for the current payroll period.

Generating the Payroll

The next part of the payroll process is to generate the payroll for all full-time contractual employees. The generation of payroll is based upon the employees contracted salary and the time period for which the payroll is intended. All adjustments made to the employeeās base contractual salary will be reflected in the current payroll generation.

The generated payroll is essentially the base payroll of the individual contractual employees and remains constant until the employeeās contract salary changes.

PAYROLL MANAGER generates the payroll by accessing each employee data file and computing the standard, full-time salary to be paid during the current payroll period.

Entering Additional Earnings

The third part of the payroll process is to enter the additional earnings for the payroll period. The additional earnings are entered from timesheets or payroll vouchers for both full-time and part-time employees. Entered data is unique for the payroll period and will include hours worked for hourly employees, overtime hours for salaried employees, and additional payments for other employee earnings (e.g. ā night differential pay, longevity stipends). Entered data will automatically reset for each payroll period. Utilities are available to speed the data input process of additional earnings.

Calculating the Payroll

The fourth part of the payroll process is to calculate the payroll for all employees by merging together the generated contractual earnings and the entered additional earnings. The combination is the employeeās gross wages for the payroll period.

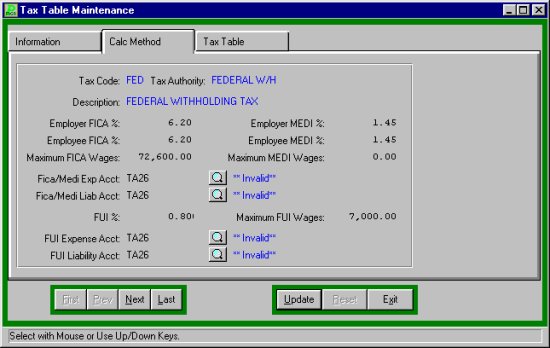

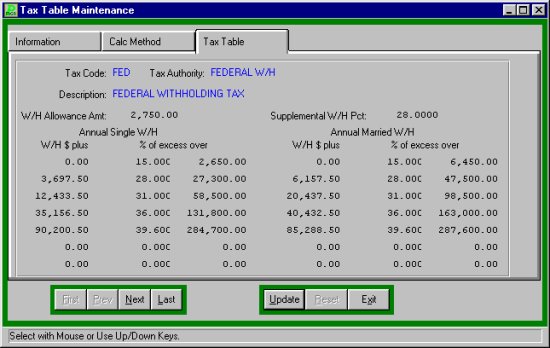

Once the gross wages have been totaled, Once the gross wages have been totaled, PAYROLL MANAGER completes the calculation as based upon the employeeās specific voluntary deductions and the current yearās tax tables. The calculation will result in the employeeās net wages for the period.

After the calculation of the payroll, the user can then work with and review the payroll periodās data in a variety of formats. The user can generate reports to compare to batch totals of timesheets, correct any discovered errors or discrepancies re-generate and re-calculate select employees to account for changes, and view individual payroll checks on screen.

Printing the Checks

After any errors have been corrected and all of the checks are determined to be correct, the user can print the periodās payroll checks. After the checks have been printed and reviewed, the payroll data can be posted to the individual employeeās file.

For additional information, please refer to the Sample Payroll Procedure.

Payroll Modules

The PAYROLL MANAGER program can be broken up into three different sections or modules. Each module has its own specific purpose in the program. Similar operations have been grouped together to simplify PAYROLL MANAGER'S operation

The three modules consist of routines for:

Processing

Requests

Setting the Payroll Parameters

The payroll process for each payroll period begins in the Payroll Processing section by setting the payroll parameters for the current payroll period. To enter the set payroll parameters module, select Processing

ą

Set Payroll Parameters from the PAYROLL MANAGER Main Menu.

Before data for a new payroll period can be entered, the payroll period must be defined. To define a new payroll period:

·

Click UPDATE from the update panel.

·

Enter the Start Date of the current payroll period to be defined and press TAB.

·

Enter the End Date of the current payroll period and press TAB.

·

Enter the Check Date of the current payroll period and press TAB. This date should be the date of the payroll, not necessarily the date they will be printed.

Payroll Tips:

0

The date of the checks should be the date of the payroll. Normally, payroll checks are prepared prior to the payroll date. Checks dated for the date of the payroll and not for the date they are prepared will reduce any potential irregularities in the payroll process.

·

Enter the Starting Check number of the next payroll check and press TAB.

·

Enter the Payroll Number and press TAB. This is a number unique to a district.

Payroll Tips:

0

The YES or NO options for the payroll generated, taxes calculated, P/R Checks printed and Payroll posted will change automatically as the procedures are completed by the user. You do not need to enter these values.

Repeat the same process for the next payroll.

·

Enter the Payroll Cash account code as used in ACCOUNTING MANAGER to record transactions in the payroll checking account and press TAB. FINANCE MANAGER will automatically default to the A200 account number. To select another account the user can click the magnifying glass to display a list of available General Ledger accounts.

·

If the payroll includes Direct Deposit of employeeās wages, enter āEā for āEnabledā and press TAB. If Direct Deposit is not used, enter āDā for āDisabledā and press TAB

·

If the payroll has been encumbered and is to be liquidated by a purchase order, enter the purchase order number and press TAB.

Select the type of Payroll Routine. The different Payroll Routines are:

Regular This routine is for a normal regular biweekly payroll.

Year-End This routine will prepare the year end āmulti-payā payroll to satisfy fiscal contracts.

Split Period This routine is intended for any payroll period that is less than the full payroll cycle. It will allow the earnings to be split into a smaller period, i.e. to pay for only 6 out of 10 days in the payroll period. This routine is commonly used for the first biweekly payroll in the fiscal year where only a partial period is being paid.

·

Enter the default hourly multipliers to be used for the payroll, if applicable.

·

Click SAVE to lock in the information.

Shifting the Periods

As each payroll period passes, the user must shift the payroll into the proper time frame. PAYROLL MANAGER uses three different definitions to refer to payroll periods. The three definitions are:

Previous - the most recent payroll period

Current - the current payroll period

Next - the next payroll period

To shift the payroll to the next payroll period:

·

Click the SHIFT Button.

·

PAYROLL MANAGER will automatically shift the current payroll to the previous period.

·

The user may then fill in the current dates to begin the new periodās payroll.

Payroll Tips:

0

The user cannot shift to the next payroll period unless the most recent payroll period has been completed, printed, and posted and the YES or NO fields on the P/R Parameters screen must all read YES.

0

āPostā on the P/R Parameters screen may not change to YES if checks with errors remain in the Display/Modify Checks screen.

Setting the Payroll Frequencies

Because not all employees are paid in the same way, PAYROLL MANAGER allows the user to create and use payroll frequency codes to pay and deduct selected items at different times.

To set the payroll frequency codes:

·

Select the FREQUENCY tab.

·

Select the desired frequency.

·

To turn the frequency code on or off for this payroll, you can either double click the deduction or earning column, or type āYā for āYESā or āNā for āNOā and click SAVE to include the earning and/or deduction codes in the current payroll period. The ability to change the āYESā or āNOā in the columns is based on the type column. If the type column displays deductions you can only change the deduction column, like wise if the type column displays earnings you can only change the earnings column, and if the type column displays both you can change both the earnings and deductions columns. Another indication of the ability to change the āYESā or āNOā in the columns is that the appropriate āYESā or āNOā will be highlighted in green.

Payroll Tips:

0

The ability to update or change the YES or NO option for the earning or deduction fields will be based on the frequency chosen.

For more information about the use of pay frequencies, please refer to Maintenance Menu - Pay Frequencies.

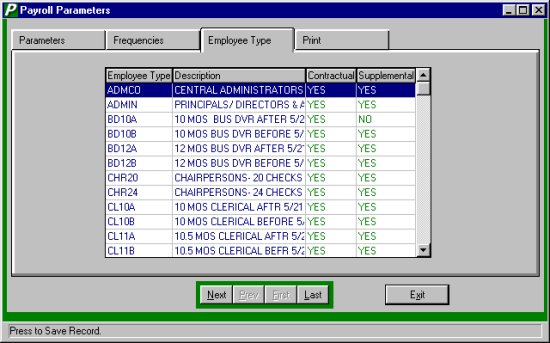

Employee Type

The Employee Type Tab is used to update the type of payments that will be made to each employee type.

·

Select the employee type from the listing by using the scroll bar.

·

To change the type of payment that will be made to the employee type you must double click the correct column either contractual or supplemental to turn the payment on or off for that employee type. YES will have the payment be made, NO will stop the payment. These changes need to be made for each payroll they will not be saved in the database.

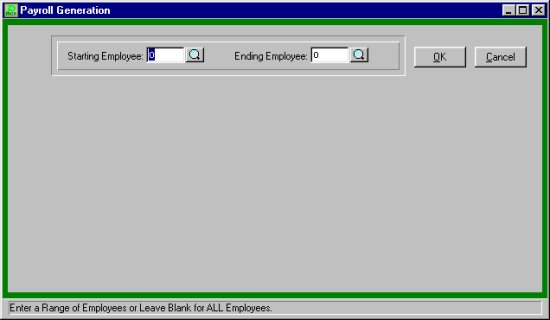

Generating Payroll

Once the payroll parameters for the current payroll period have been set, the payroll should be generated. To generate the payroll, select Processing

ą

Generate Payroll from the PAYROLL MANAGER Main Menu.

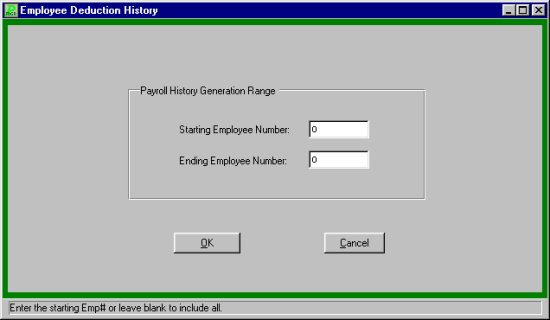

PAYROLL MANAGER will ask the user to define the range of employees for the payroll being generated. To enter the range:

·

To generate all employees, leave the selection criteria blank.

·

To generate a range of employees enter the first employee number of the range and press TAB twice.

·

Enter the last employee number of the range and press TAB. To select an employee click the magnifying glass to display a list of available employees from which to select.

·

Click "OK" to generate the payroll information. The generation will display across the bottom of the screen as it occurs.

PAYROLL MANAGER will automatically generate the payroll for all active, contractual employees within the selected range.

Payroll Tips:

0

To re-generate a single employee, simply enter the desired employee number as both the beginning and ending number of the range. An employee or group of employees may be regenerated an infinite number of times prior to printing payroll checks. Once regenerated, the employeeās deduction information will be reset to zero and the applicable taxes and deductions MUST be calculated again.

0

Once a check has been generated, inactivating an employee will NOT remove it from the generated list. The user must manually delete the check form the Display/Modify Check screen.

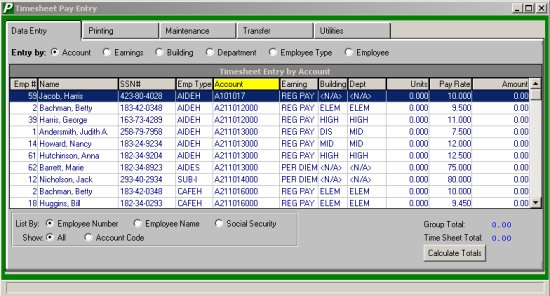

Timesheets

Timesheet Input Utility

To access the Timesheet Input Utility function, select the Timesheet Input Utility option from the Processing drop-down menu or simply select the Timesheet button.

The Timesheet Input Utility function allows you to group and enter payroll period data by account, earnings, building, department, employee type, or employee name. These various methods of data input help to expedite the payroll process. Blank timesheet input worksheets can be printed and distributed to various departments. Once the worksheets are completed and returned to the Payroll Department, the data can be easily entered. Once entered into the system, the data is transferred to the current payroll checks.

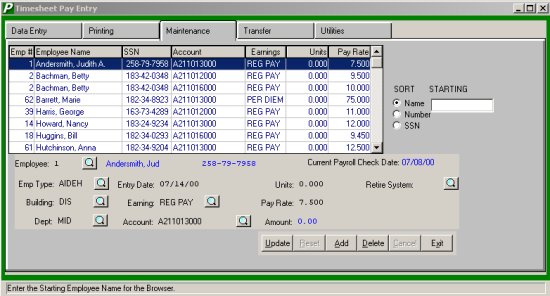

Data Entry

The Data Entry folder contains a listing of those timesheet records that were created either through the Maintenance folder or set up through the Utilities folder. This folder facilitates the Payroll Timesheet process in that the user can simply go down the list of timesheet entries and enter the proper number of units to be paid.

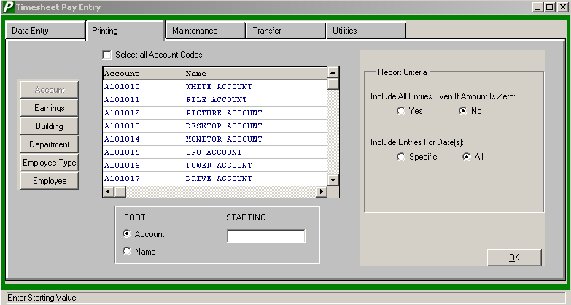

Printing

The Printing folder is used to print completed timesheet data so that you may verify your entries before transferring the data to the current payroll.

Maintenance

The Maintenance folder is used to add, update, or delete a timesheet record for an employee.

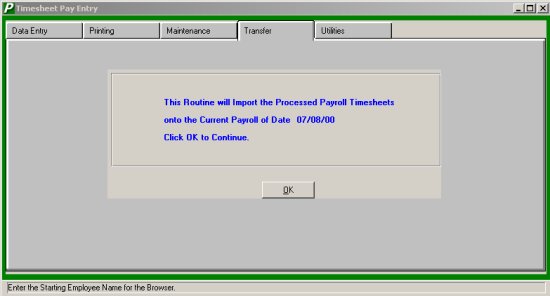

Transfer

The Transfer folder is used to transfer timesheet data to the current payroll checks.

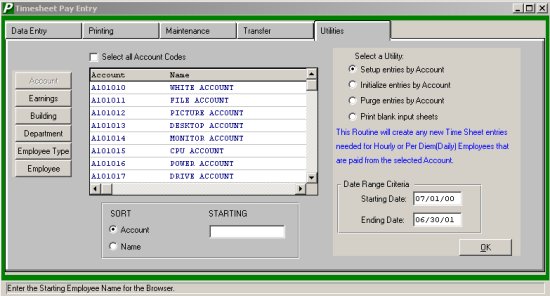

Utilities

The Utilities folder is used to create, initialize, or purge timesheet entries for all employees associated with a specific group (Account, Earnings, Building, Department, Employee Type, Employee). You may also generate blank timesheet input worksheets.

Timesheet Data

The Data Entry folder contains a listing of those timesheet records that were manually created either through the Maintenance folder or automatically set up through the Utilities folder. This folder facilitates the Payroll Timesheet process in that the user can simply go down the list of timesheet entries and enter the proper number of units to be paid.

The Timesheet Entry browser displays the following information: Employee Number, Employee Name, Social Security Number, Employee Type, Account Code, Earnings Code, Building Code, Department Code, Units, Pay Rate, and Extended Amount. The Timesheet Pay Entry function allows you to group and enter payroll period data by account, earnings, building, department, employee type, or employee name. These various methods of data input help to facilitate and expedite the payroll process.

To Use the Timesheet Pay Entry Window:

1. Use the radio buttons in the Entry By field located above the browser to indicate how the timesheet data is being grouped and inputted. Employee timesheet records can be sorted in any one of the following methods: by Account Code, Earnings Code, Building, Department, Employee Type, or Employee Number. Once the timesheet entry method has been specified, the column heading in the browser is highlighted to reflect the selected entry method.

2. Optionally select a secondary sort for timesheet entry by flagging the appropriate radio button in the List By field located below the browser. Within each primary sort method, a secondary sort by employee number, employee name, or social security number may be specified. For example, if timesheets are entered alphabetically by employee name within each building, set the Entry By radio button to Building and the List By radio button to Employee Name.

3. The Show radio buttons can be used to restrict the browser to specific timesheet entries. All Timesheet Reports contain the following information: employee number, employee name, account number, earnings code, building, department, employee type, pay rate, units, extended pay amount, transfer flag (indicating whether the timesheet information has been transferred to the current payroll), timesheet entry date, and initials of the individual who entered the timesheet information. Subtotals are provided for each group and for the entire timesheet.

Timesheet Data Maintenance

The Maintenance folder is used to add, update, or delete a timesheet record for an employee. If you already have used the Setup Entries by Account option under Timesheet Utilities, those timesheet records are displayed on the Maintenance folder.

Each timesheet record in the browser includes the following information: employee number, employee name, social security number, account number, earnings code, pay rate, and number of units. Use the Sort radio buttons to change the sort order of the information contained in the browser. Records may be displayed in employee name, number, or social security number order. Use the Starting field to change the starting point of timesheet records contained in the browser.

R ā Regular Pay

O ā Overtime Pay

U ā Doubletime Pay

I ā Differential Pay

X ā Extra Pay

D ā Per Diem Pay

To display more earnings codes, use the Earnings Code Lookup browser to select the appropriate code.

·

If the Earnings Code selected is Regular Pay, this field defaults to the Regular Account code defined on the Earnings window in Employee Maintenance.

·

If the Earnings Code selected is Overtime Pay and the employee is an Hourly employee, this field defaults to the Overtime Account code defined on the Earnings window in Employee Maintenance.

·

This field defaults to the pay rate associated with the earnings code as defined on the Earnings window in Employee Maintenance. If the Earnings code is for Overtime or Doubletime Pay, the system calculates the appropriate pay rate based on the hourly pay factors defined in the Set Payroll Parameters function.

Adding a Timesheet Record

·

Select the Add button.

·

Enter all appropriate timesheet information.

·

Select the Save button to lock in the new information.

Finding a Timesheet Record

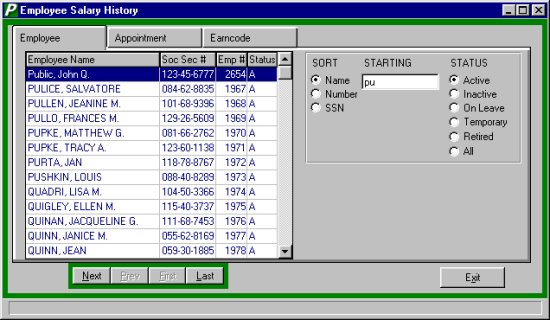

In order to edit/change or remove a timesheet record, you must first identify the appropriate record. PAYROLL MANAGER allows you to locate records using the SORT method with three search options.

Name Select the Name radio button in the Sort box to sort timesheet records by employee last name. In the Starting field, type in all or part of the employeeās last name. The starting point of the records in the listing is based on the sort criteria you enter.

Number Select the Number radio button in the Sort box to sort timesheet records by employee number. In the Starting field, type in all or part of the employee number. The starting point of the records in the listing is based on the sort criteria you enter.

SSN Select the SSN radio button in the Sort box to sort timesheet records by social security number. In the Starting field, type in all or part of the social security number. The starting point of the records in the listing is based on the sort criteria you enter.

Editing a Timesheet Record

·

Highlight the appropriate timesheet record from the list.

·

Select the Update button.

·

Make changes by typing over the existing data.

·

Select the Save button to lock in the new information.

Deleting a Timesheet Record

·

Highlight the appropriate timesheet record from the list.

·

Select the Delete button.

·

Confirm that this is the correct record that you wish to delete. Click Yes to delete the record. Click No if you do not wish to delete the record.

Exiting from Timesheet Maintenance

·

Select the Exit button to return to the PAYROLL MANAGER Main Menu.

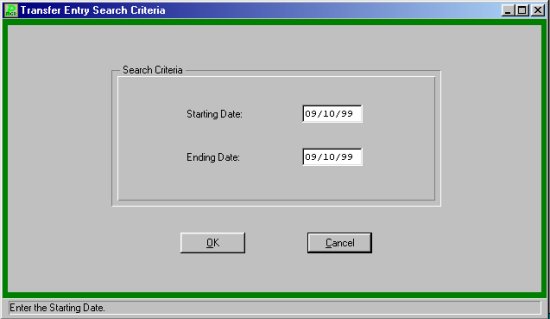

Transfer Timesheet Data

The Transfer folder is used to transfer timesheet data to the current payroll checks.

NOTE: This function should only be used after the timesheet data has been entered and verified. Use the Printing folder tab to print a timesheet report to ensure that all data is correct before generating the timesheet transfer process.

To Transfer Timesheet Data:

1. Select the OK button.

2. A message box displays asking you to confirm that you wish to proceed with the timesheet transfer process at this time. Select YES if you wish to transfer timesheet data. Otherwise, select NO.

3. Once data has been transferred, the system displays an Information box stating that the transfer is complete.

The timesheet entries on the Data Entry window are displayed in red, indicating that the data has been transferred to the current payroll. The transferred payroll records can be viewed using the Display/Modify Current Payroll Checks function or Enter Additional Earnings. At this point, updates to the units and amount values are not permitted. Use the Enter Additional Earnings function to make any necessary changes.

Timesheet Utilities

The Utilities folder is used to create, initialize, or purge timesheet entries for selected or all employees associated with a specific group (Account, Earnings, Building, Department, Employee Type, Employee). You may also generate blank timesheet input worksheets.

Setup Entries Utility

This utility creates a new timesheet entry for all employees with Hourly or Per Diem appointments based on a specified date range. If any new employees were hired since the last payroll was run, this utility will create a timesheet entry for those employees. This utility can also be used to create a new timesheet entry for hourly or per diem employees at the start of the fiscal year.

1. Use the buttons on the left-hand side of the window to indicate how the timesheet entries are to be set up. Employee timesheet records can be set up in any one of the following methods: by Account Code, Earnings Code, Building, Department, Employee Type, or Employee.

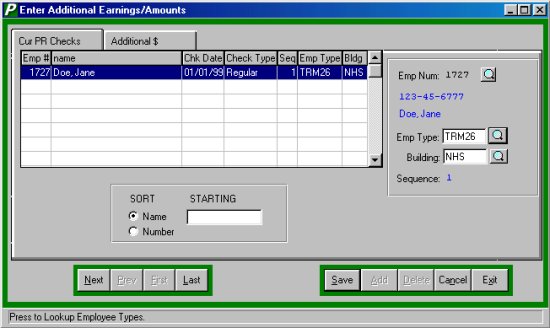

2. Once the setup method or group has been specified, use the browser to select specific criteria for the setup process. If the employee is contractual and has been generated, a check already exists and the employee simply needs to be selected to add additional earnings information. To select an existing employee:

·

Select the employee from the list, either through the SORT method or by using the scroll bars.

·

Select the Additional $ tab.

Once created or selected to be processed, additional earnings can be entered. Select the type of earning to enter. When a selection is chosen, the Additional Earning Screen will appear.

Finding an Employeeās Current Payroll Data

In order to edit/change or delete an employeeās payroll data for the current period, it is necessary to locate it. The SORT method assists the user in locating the data by four search options.

NAME Allows the user to type in the employee name being searched EMP NUM Allows the user to type in the employee number being searched

Removing an Employeeās Current Payroll Data

Users can remove an employeeās current payroll period data from any open listing, essentially removing the employeeās check.

·

Select the individual employee from the Current Payroll Checks listing

·

Click DELETE from the Update Panel

·

PAYROLL MANAGER will ask, "Delete this payroll check?"

·

Click āYESā to delete the employeeās check or click "No" to keep the information.

Exiting the Payroll Processing

Selecting EXIT from the Update Panel will return the user to the PAYROLL MANAGER Main Menu.

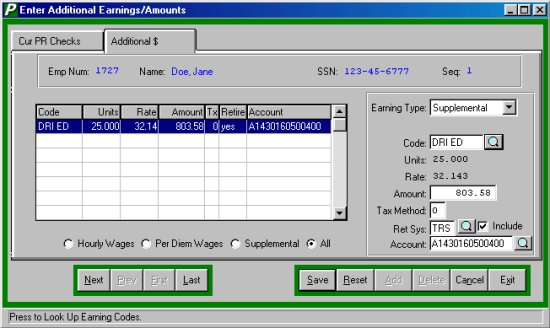

Entering Additional Wages

·

Select ADD from the Update Panel

·

Enter the Earning type "H" for hourly, "P" for per diem wages, or "S" for supplemental and press TAB.

For Hourly Wagesā¦

·

Enter the type of pay, āRā for regular, āXā for extra, āOā for overtime, āUā for double-time, āHā for holiday, āVā for vacation, āIā for differential pay or āSā for stand-by time and press TAB.

·

Continue to follow the directions for All Entries

For Per Diem Wagesā¦

·

PAYROLL MANAGER automatically provides the user with the correct type and code

·

Continue to follow the directions for All Entries.

For Supplemental Wagesā¦

·

Enter the supplemental earning code and press TAB (Click the magnifying glass to view all available earning codes, select the code from the list and click exit to return to the Additional $ screen).

·

Continue to follow the directions for All Entries.

All Entries...

·

Enter the number of hours, if necessary, and press TAB.

·

Enter the hourly rate. The default rate displayed by PAYROLL MANAGER is the employeeās hourly rate from their earnings information screen (Screen 4) multiplied by the respective hourly multiplier as indicated in the Set Payroll Parameters (Please refer to Employee Information - Earnings Information - Screen 4)

·

The default amount displayed by PAYROLL MANAGER is the number of hours multiplied by the hourly rate

·

Enter the desired tax method, ā0ā for taxation at the employeeās normal tax rate or ā9ā for the taxation at the reduced supplemental flat tax rate, and press TAB. These are the only two allowable taxation methods for earnings as detailed by the Internal Revenue Service in its Publication 15, Circular E, Employerās Tax Guide

·

Enter the retirement System Code, or click the magnifying glass for an available listing and press TAB. If the specific earning is to be excluded from the retirement system calculations for the employee, select āXā to exclude.

·

Enter the budgetary account to be expensed and click SAVE to lock in the new information (click the magnifying glass to view all available payroll accounts).

Payroll Tips:

0

Payroll Manager displays the default account. The default code is the budgetary account code with the highest Fiscal Year-to-Date earnings for the employee for the Earning Code entered.

·

Enter additional items in the same manner

Modifying Additional Wages

·

Select the earning line to change.

·

Select UPDATE from the Update Panel.

·

Press TAB until the desired information to be changed is selected.

·

Enter in the correct data and click SAVE. PAYROLL MANAGER will automatically replace the old data and return to the item listing.

Payroll Tips:

0

Payroll Manager allows the user to change all information except the employee type. If the employee type needs to be changed then the user must enter a new additional wages earning line.

Removing Additional Wages

·

Select the earning line to remove.

·

Click DELETE from Update Panel.

·

PAYROLL MANAGER will ask āDelete this earning?ā click "YESā to remove the earning line or click "No" to keep it.

Exiting the Payroll Processing

Selecting EXIT from the Update Panel will return the user to the PAYROLL MANAGER Main Menu.

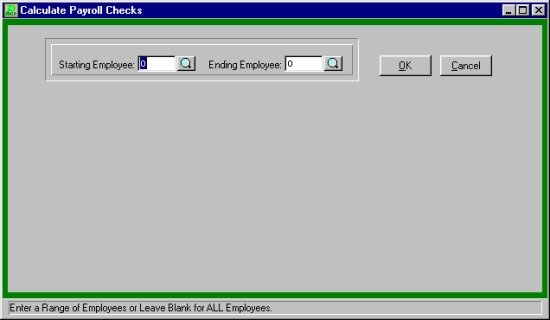

Calculating Payroll

After the base salary has been generated, and the additional earnings data has been processed, the gross and net wages are ready to be calculated. PAYROLL MANAGER completes the payroll calculation based upon the employeeās specific deductions and the current yearās tax tables. The calculation will result in the employeeās net earnings for the period.

To calculate the payroll, select Processing

ą

Calculate Payroll from the PAYROLL MANAGER Main Menu.

PAYROLL MANAGER will ask the user to define the range of employees that should be calculated for the payroll. To enter in the range:

·

Enter the first employee number of the range and press TAB or click the magnifying glass to select from the employee list.

·

Enter the last employee number of the range and press TAB or click the magnifying glass to select from the employee list.

·

To select all employees, leave the selection criteria blank.

·

Click "OK" to generate the payroll. PAYROLL MANAGER will automatically calculate the payroll for the selected employees.

Payroll Tips:

0

To re-calculate a single employee, simply enter the desired employee number as both the beginning and ending number of the range. An employee or group of employees may be recalculated an infinite number of times prior to printing payroll checks. Once recalculated, the employeeās tax and deduction information will be reset to the recalculated amounts, overwriting any amounts modified through Display/Modify checks.

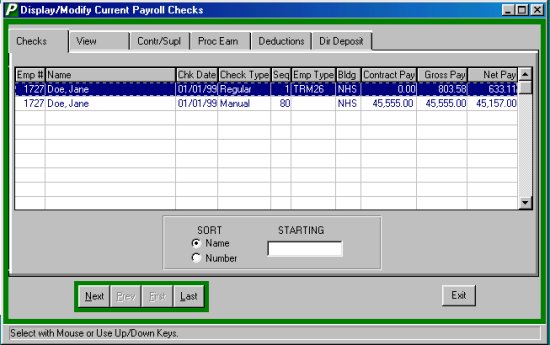

Display/Modify Payroll Checks

After the payroll has been generated, processed, and calculated, the checks may be displayed on screen to verify the calculation process and modified, if necessary. To display or modify checks in the current payroll, select Processing

ą

Display/Modify Checks from the PAYROLL MANAGER Main Menu.

PAYROLL MANAGER will display a listing of all non-posted checks. You may not modify information for manual checks or checks that have already been printed.

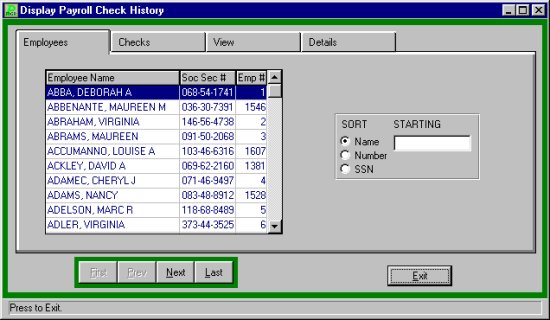

Finding an Employeeās Current Payroll Check

In order to edit/change or delete an employeeās payroll check for the current period, it is necessary to locate it. The SORT method assists the user in locating the data.

NAME Allows the user to type in the employee name being searched

NUMBER Allows the user to type in the employeeās employee number being searched

Modifying an Employeeās Check

At times, modifications that apply for only one payroll period must be entered. To make these modifications:

·

Select the employeeās check (as detailed above).

·

Select the View Tab.

·

Select UPDATE from the Update Panel.

·

Press TAB until the desired field is reached. Enter the new data and click SAVE. The new data will replace the old data.

·

After the last item is entered the gross wage amounts and net amount of the check will be recalculated.

Payroll Tips:

0

When a check is modified in PAYROLL MANAGER, all applicable wages and FICA and Medicare withholding will be recalculated for the check. The related federal, state, and city tax withholdings will not be recalculated. To enable the system to recalculate the withholdings, modifications should be made to the employeeās master records and the payroll check should be regenerated and recalculated.

Override an Employeeās Wages

PAYROLL MANAGER provides user the ability to override the calculated wages. Any modifications to an employeeās wages should be documented and reported on the necessary federal, state, and local wages reports.

·

Click the OVERRIDE WAGES button.

·

PAYROLL MANAGER will prompt the user for a password. Enter in the System Supervisor Password to continue.

·

Enter the desired gross, FICA, Medicare, Federal or State wages.

·

When a user has selected to override a payroll checks wages, PAYROLL MANAGER will internally mark the check with the time, date, and user identification for audit control purposes.

For Earnings and Deductions, a separate tab will display their respective windows.

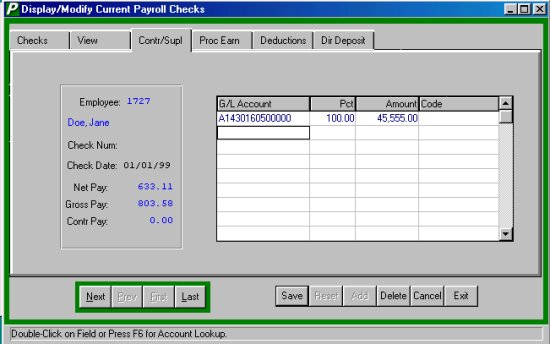

Contractual Earnings

If the employee is a Contractual Employee the user will be able to enter the account for the earnings and either the percentage or amount.

Adding a Contractual Earning

·

Click ADD from the Update Panel.

·

Enter the account number or Double Click the text box to display the Employee Account Code look-up screen.

·

After selecting the Code enter the percentage for that code or press tab and enter the amount for that code (If you use the percentage method it must total 100% before you can leave the screen).

·

Enter addition information in the same manner. When all information has been entered click SAVE to lock in the new information.

Modify Contractual Earnings

·

Click UPDATE on the Update Panel.

·

Click the earnings line that needs to be changed.

·

Enter in the new information and click SAVE. PAYROLL MANAGER will automatically replace the old data with the new data.

Remove a Contractual Earning

·

Click the earnings line that you would like to delete.

·

Click DELETE from the Update Panel.

·

PAYROLL MANAGER will ask, "Ok to delete the selected earning record?" click "Yes" to delete the record, or click "No" to keep the record.

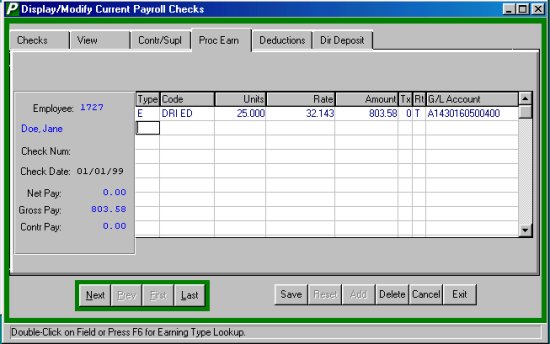

Processed Earnings

If the employee is not contractual the user will enter the information in the processed earnings screen.

Adding Processed Earnings

·

Click ADD from the Update Panel.

·

Enter the employee type, double click the text box or press F6 to display the employee type look-up screen.

·

Enter the earning code, double click the text box or press F6 to display the earnings code look-up screen.

·

Enter the number of hours for the employee and press TAB.

·

Enter the rate of pay for the employee and press TAB twice. The amount will automatically be calculated for you.

·

Enter the tax method "0" for normal or "9" for 28% Federal, 7.35% NY State and 4.080 NY City.

·

Enter the Retirement System Code āXā to exclude, "E" for NYS ERS, "P" for NYS Police, "T" for NYS.

·

Enter the account number, double click the text box or press F6 to display the employee type look-up screen.

·

Enter additional processed earnings in the same manner.

·

After all entries have been made click SAVE to lock in the new information.

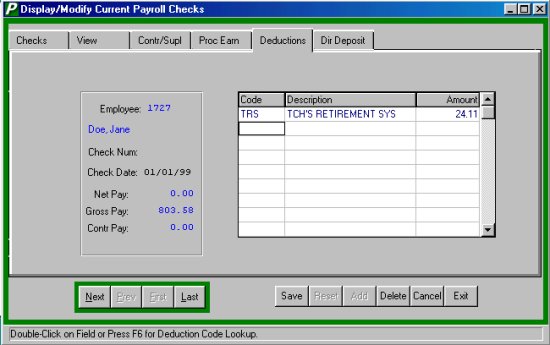

Deductions

·

Click ADD from the Update Panel.

·

Enter the deduction code, double click the text box or press F6 to display the deduction code look-up screen.

·

Enter the amount to be deducted.

·

Click SAVE to lock in the new information.

·

Enter additional entries in the same manner.

Remove Deductions

·

Select the deduction line to be removed.

·

Click DELETE from the Update Panel.

·

PAYROLL MANAGER will ask, "Ok to delete the selected deduction record?" click "Yes" to remove the record or click "No" to keep the record.

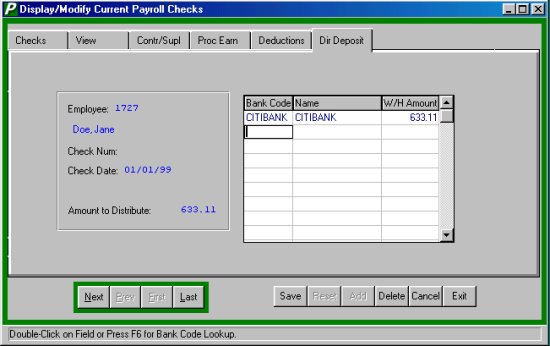

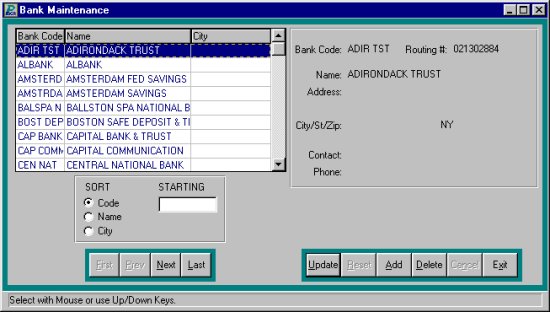

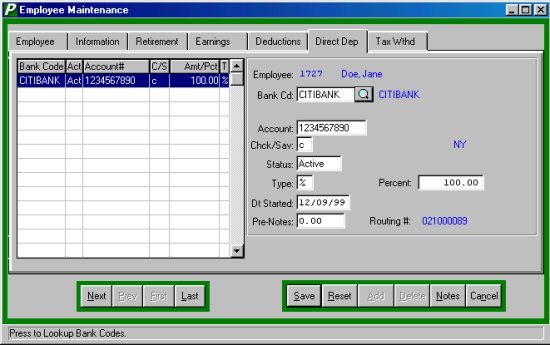

Direct Deposit

·

Click ADD from the Update Panel

·

Enter the bank code, double click the text box or press F6 to display the Employee Direct Deposit Bank look-up screen.

·

Enter the amount of the deposit.

·

Enter additional entries in the same manner.

·

After all entries have been made click SAVE to lock in the new information.

Modify a Direct Deposit

·

Select the Direct Deposit line to be changed.

·

Click the amount text box to change the amount of deposit. (If the Bank Code needs to be changed the user can both delete the old code and add a new one or keep the old code and add a new code.)

Removing a Direct Deposit

·

Select the direct deposit to be deleted.

·

Click DELETE from the Update Panel. ·

PAYROLL MANAGER will ask, "Ok to delete the selected direct deposit record?" click "Yes" to remove the record or click "No" to keep the record.

Removing an Employeeās Check

Users can remove an employeeās current payroll period data from any open listing, essentially removing the employeeās check.

·

Select the Check tab.

·

Select the individual employee from the Current Payroll Checks listing

·

Select the Maintenance tab.

·

Click DELETE from the Update Panel

·

PAYROLL MANAGER will ask, "Delete this manual check?" click āYESā to delete the employeeās check or "No" to keep the check.

Exiting Display/Modify

·

Selecting EXIT from the Update Panel will return the user to the PAYROLL MANAGER Main Menu.

Printing the Payroll Checks

After the payroll modifications are completed, the checks may be physically printed. To print the current payroll, select Processing

ą

Print Payroll Checks from the PAYROLL MANAGER Main Menu.

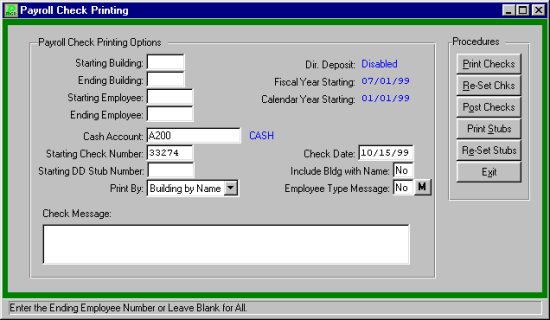

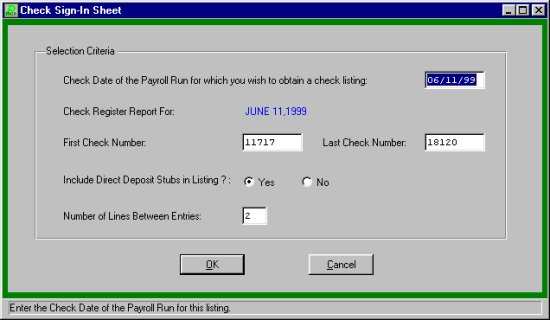

Updating the Check Printing Option

PAYROLL MANAGER will ask the user to define the print options for how employee payroll checks should be printed. To update the options:

·

Enter the starting and ending building of the range and press TAB. Leave blank to select all buildings.

·

Enter the first and last employee number of the range and press TAB. Leave blank to select all employees.

·

Enter the account number of the payroll bank account.

·

Enter the starting check number and press TAB. The starting check number should be the first check ready to print after loading the checks into the printer.

·

Enter the check date and press TAB.

·

If Direct Deposit is enabled and the Direct Deposit Stubs are to be printed in a separate print run, enter the starting Direct Deposit Stub number and press TAB. The starting stub number should be the first check ready to print after loading the forms into the printer (please refer to SYSTEM MANAGER, System Parameters, for more information on configuring PAYROLL MANAGER for a separate Direct Deposit Stub Run).

·

Enter the method of sorting the payroll checks, āBā for Building by Name, āDā for Department by Name, or āNā for Name only.

·

Enter āYesā to print the Building location next to the employeeās name. This will enable the building location to be seen when the check is in an envelope.

·

Enter āYesā to add messages by employee type. If "Yes" is entered click the icon ·

Enter āNoā to add a generic check message.

Update Employee Type Messages

PAYROLL MANAGER will ask the user to update the employee type message to print on the current payroll checks. After the checks are printed, PAYROLL MANAGER will automatically delete old messages to allow new messages to be inserted in the new payroll.

Changing an Message

·

Select UPDATE from the Update Panel.

·

Type in the message to be printed and click SAVE to lock in the new message.

Finding an Employee Type Message

In order to edit/change or delete an employee type message, it is necessary to locate it. The SORT method assists the user in locating the data.

TYPE Allows the user to type in the employee type code being searched

DESCRIPTION Allows the user to search by description.

Viewing an Employee type Message

Users can view an Employee Type Message from the open listing.

·

Select the individual employee type from the current listing

·

The message will appear in the message text box.

Exiting an Employee Type Message

Select EXIT from the Update Panel it will return the user to the Payroll Check Printing screen.

Printing the Checks

Payroll Tips:

0

The user should load the blank computer checks into the desired printer prior to selecting the Print Payroll Checks module.

After updating the Payroll Check Printing Options, the user can proceed to print the checks.

·

Click Print Checks from the Payroll Check Printing Options to print the checks

·

PAYROLL MANAGER will validate the current payroll checks to ensure they have been properly prepared. If any errors exist, the user will be prompted to correct the error before printing.

·

If printing checks, the system will prompt the user to align the checks in the printer.

·

After the checks are aligned, click āYESā to confirm and begin printing checks.

·

The check number on the screen will increase as each check is printed. A total of the number of checks will be displayed at the end of the print routine.

Re-running the Payroll Checks

After printing the checks, the user has the option of voiding and re-running the checks in case of errors during printing. To re-run the checks, click Re-Run Checks from the Payroll Check Printing Options.

PAYROLL MANAGER will review the checks that have been sent to the printer to determine if all checks or if only a portion were printed. The range of check numbers assigned to checks will be displayed on screen. The user may select to re-run all checks or only a selected range of check numbers.

·

Select to re-run All or a Range and press TAB.

·

If a range, enter the number range to re-run and press TAB.

·

Click āYESā to re-run the selected range.

·

The user will be returned to the Print Checks screen. Click the Print Checks button to reprint the checks.

Printing Direct Deposit Stubs

If PAYROLL MANAGER has been configured to print Direct Deposit Stubs on separate forms, options Print Stubs and Re-Run Stubs will be available (please refer to SYSTEM MANAGER, System Parameters, for more information on configuring PAYROLL MANAGER for a separate Direct Deposit Stub Run).

Payroll Tips:

0

The user should load the direct deposit forms into the desired printer prior to selecting the Print Stubs option.

After updating the Payroll Check Printing Options, the user can proceed to print the checks.

·

Select option Print Stubs from the Payroll Check Printing Options to print the stubs.

·

PAYROLL MANAGER will validate the current direct deposit stubs to ensure they have been properly prepared. If any errors exist, the user will be prompted to correct the error before printing.

·

If printing forms, the system will prompt the user to align the checks in the printer.

·

After the forms are aligned, Click OK to confirm and begin printing.

·

The Direct Deposit Stub number on the screen will increase as each check is printed. A total of the number of stubs will be displayed at the end of the print routine.

Re-running Direct Deposit Stubs

After printing the stubs, the user has the option of voiding and re-running the stubs in case of errors during printing. To re-run the checks, select Re-Set Stubs from the Payroll Check Printing Options.

PAYROLL MANAGER will review the stubs that have been sent to the printer to determine if all stubs or if only a portion were printed. The range of stub numbers used will be displayed on screen. The user may select to re-run all direct deposit stubs or only a selected range.

·

Select to re-run All or a Range and press ENTER.

·

If a range, enter the number range to re-run and press ENTER.

·

Click OK to re-run the selected range.

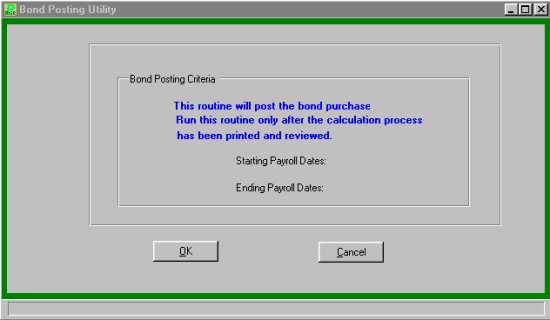

Post the Checks

Once the payroll checks and, if applicable, the direct deposit stubs are printed and are determined to be accurate, the checks must be posted. Posting the checks records the information permanently in the employeeās payroll file.

To Post the Payroll Checks

·

Click Post Checks from the Payroll Check Printing Options screen.

·

Read the check-posting message that appears on screen. Click "OK" or click "Cancel".

·

Click āYesā to post the payroll checks.

·

Click āNoā to leave the routine and not post the payroll checks.

·

If errors are found while trying to post a list of the checks with errors will be displayed on screen.

Payroll Tips:

0

Why should I post my payroll checks immediately?

0

Payroll checks should be posted immediately so that no unwanted changes are made to the checks that have already been printed. Any changes that are made might lead to discrepancies between the printed checks and the posted checks. Also, final payroll journals may not be printed until the checks are posted.

Void and Reissue Payroll Checks

The Void and Reissue Payroll Checks function is accessed by selecting the Supervisor Utilities option from the Utilities drop-down menu, and then selecting Void and Reissue Payroll Checks. For a screen image, please click Void and Reissue Payroll Checks.

The Void and Reissue Checks function allows you to record a printed and posted check as void and, if needed, reissue another replacement check. This function can be utilized to reissue a lost check. This function can also be used in a situation where a deduction pay flag was inadvertently turned off before checks were printed and posted, and it becomes necessary to void an entire check run. You may choose to void one, multiple, or all checks having a specified check date.

The Void Only option may be performed for regular-type checks, including those that are direct deposit. The Void and Reissue option may only be used for regular-type checks that are not direct deposit. During the void check process, the system reverses the earnings, deductions, and taxes.

To Perform the Void/Reissue Payroll Check Process:

1. Enter the date of the check(s) to be voided or voided and reissued.

2. The Effective Date of Void field defaults to the same date as that entered for the Date of Check. Accept the default value or enter the effective date of the void.

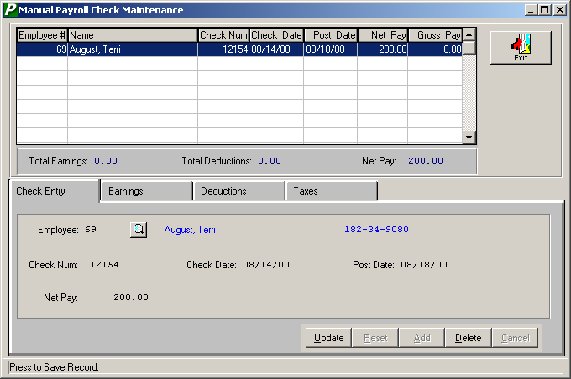

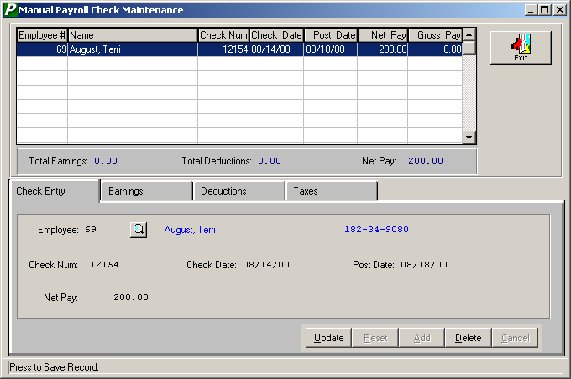

3. Select the appropriate action that you wish to perform. To enter a manual check, select Processing

ą

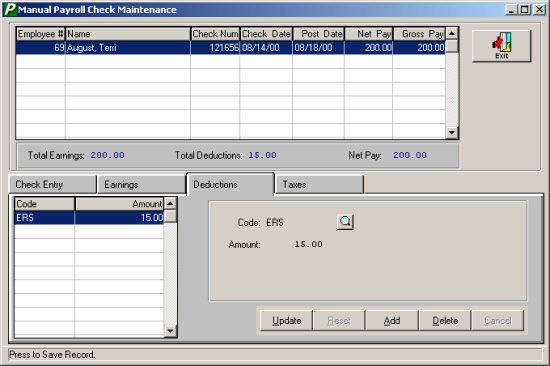

Enter Manual Check Info from the PAYROLL MANAGER Main Menu.

The top portion of the Manual Check Maintenance window contains a listing of those manual check records that have not yet been posted through the check posting process.

The middle portion of the window contains the three essential elements that must be balanced in order to complete the manual check function.

Total Earnings This system-calculated field represents the total earnings entered on the Earnings folder, with the exception of Non-Cash earnings.

Total Deductions This system-calculated field represents the total deductions entered on the Deductions and Taxes folder.

Net Pay This user-defined field represents the Net Pay amount entered on the Check Entry folder. The Total Earnings minus the Total Deductions must equal the Net Pay.

The bottom portion of the window contains the folders used to record the check entry, earnings, deductions, and taxes.

Check Entry

NOTE: If you are using the Manual Checks function to make an adjustment to an employeeās pay that has already been posted to Payroll, the Post Date should be the next posting date. If you are making an adjustment to an employeeās pay that has not yet been posted to Payroll, the Post Date should be the current posting date.

Adding a Manual Check

·

Click the Check Entry Tab.

·

Click ADD from the Update Panel.

·

Enter the employee number and press TAB. Click the magnifying glass to view a list of available employees.

·

Enter the manual check number and press TAB.

·

Enter the date of the manual check and press TAB. This should be the actual date that the manual payroll check was issued.

·

Enter the effective posting date of this manual check.

Payroll Tips:

0

The manual payroll checks will be summarized on the payroll journal for the effective posting date.

·

Enter the Net Amount of the manual check and press TAB.

·

Select the Save button to lock in the new information. The manual check record displays in the browser at the top of the window.

Payroll Tips:

If more than one manual check record displays in the browser, the system does not allow you to switch to a different manual check record until the check record being processed is in balance (Net Pay equals Total Earnings minus Total Deductions). Likewise, the system only permits you to exit the Manual Checks function when your entries are balanced.

Payroll Tips:

Use the Display/Modify Current Payroll Checks to view the manual check record. The Check Type displays as Manual with the Sequence Number of 80 or greater. The Employee Type defaults from the Information folder in Employee Maintenance. The Building defaults to the Check Delivery To building from the Tax Withholding folder in Employee Maintenance.

Editing/Changing an Employeeās Check

PAYROLL MANAGER provides the user with the ability to edit and change manual checks prior to posting

·

Click the Manual Checks tab.

·

Select the individual check from the listing

·

Click the Maintenance tab.

·

Click UPDATE from the Update Panel.

·

Press TAB until the desired information to be changed is selected.

·

Enter in the correct data and click SAVE. PAYROLL MANAGER will automatically replace the old data.

Removing a Manual Check

·

Select the individual check from the Manual Check Tab listing.

·

Click the Maintenance tab.

·

Select DELETE from the Update Panel.

·

PAYROLL MANAGER will ask you āDelete this manual check?ā

·

Click āYesā to remove the check.

·

Click āNo" to keep the check.

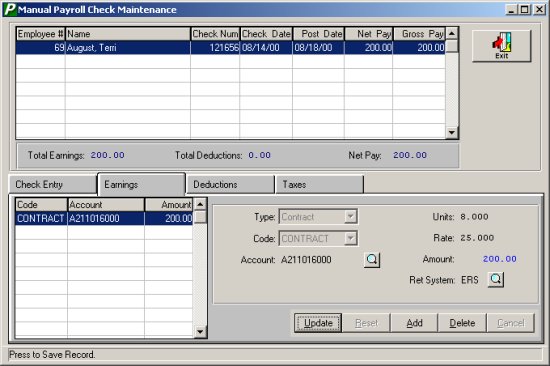

Earnings

The Earnings folder is used to enter the earnings information associated with the manual check. Earnings records are created by Type (Contract, Supplemental, Hourly, or Per Diem).

If the earnings type is Contract, the earnings code must be either Contract, Contract Adjustment, Docked or Retro.

If the earnings type is Supplemental, you may select any of the earnings codes from the Earnings Code File.

If the earnings type is Hourly, the earnings code must be any one of the following: Regular, Extra, Overtime, Doubletime, Holiday, Vacation, Differential, or Standby.

If the earnings type is Per Diem, the system defaults the earnings code to PER DIEM.

Adding Earnings Information

·

Click the Add button from the update panel.

·

Select the Earning Type from the drop down menu.

·

Select the Earning Code from the drop down menu.

·

Enter the account code or click the magnifying glass to select from a list of available account codes.

·

Enter the number of units and press TAB.

·

Enter the rate of pay and press TAB.

·

Enter the Retirement System or click the magnifying glass to select from a list of available Retirement System Codes.

·

Click the Save button to lock in the new information. The sum of all earnings records, except for Non-Cash, are displayed in the Total Earnings field.

Editing/Updating the Earnings Information

·

Click UPDATE from the update panel.

·

Select the information to be changed.

·

Enter the new information and click SAVE. FINANCE MANAGER will automatically replace the old information with the new.

Deleting an Earnings Record

·

Highlight the earnings record that you wish to delete.

·

Click the Delete button from the update panel.

·

PAYROLL MANAGER will ask āAre you sure you want to delete?ā

·

Click YES to delete the earnings record. Click NO to keep the earnings record.

Deductions

The Deductions folder is used to enter the voluntary deduction information associated with the manual check. The system only allows entry of deductions already defined for the employee on the Deductions folder in Employee Maintenance.

Adding Deductions Information

·

Click the Add button from the update panel.

·

Enter the Deduction code or click the magnifying glass to select form a list of available deduction codes.

·

Click the Save button to lock in the new information. The sum of all entered deductions are included in the Total Deductions field.

Editing/Updating the Deduction Information

·

Click UPDATE from the update panel.

·

Select the information to be changed.

·

Click SAVE to lock in the new information. PAYROLL MANAGER will automatically replace the old information with the new.

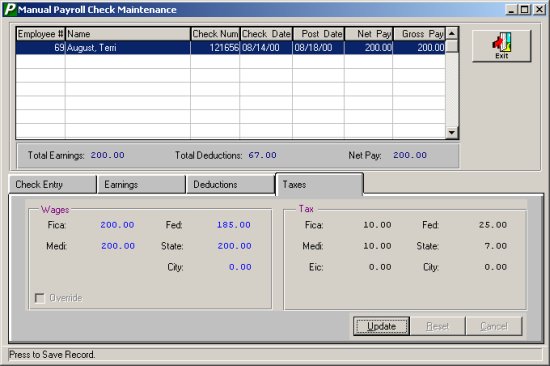

Taxes

The Taxes folder is used to enter the mandatory tax deduction information associated with the manual check.

The left-hand side of the folder contains the Wages which are used for W2 reporting and are system-calculated as follows:

FICA Wage Gross minus Flex deductions (not to exceed the yearly maximum).

Federal Wage Gross minus (Flex, Annuity, and Retirement deductions)

Medicare Wage Gross minus Flex deductions

State Wage Gross minus (Flex and Annuity deductions)

City Wage Gross minus (Flex and Annuity deductions) (Calculated only if the City W/H flag is checked on the Tax Withholding folder in Employee Maintenance.)

Payroll Tips:

During the Update mode, you may use the Override button to change and save any of the system-calculated Wages.

Adding Tax Deductions

·

Click the Update button.

·

Enter all appropriate tax deduction information.

·

Use the Override button if necessary to change any of the system-calculated Wages.

·

Click the Save button to lock in the new information. The sum of all entered tax deductions are included in the Total Deductions field.

Payroll Tips:

0

Once entered, the manual check(s) must still be posted to the employeeās records. (Please refer to Posting Payroll Checks).

Override an Employeeās Wages

PAYROLL MANAGER provides user the ability to override the calculated wages. Any modifications to an employeeās wages should be documented and reported on the necessary federal, state, and local wages reports.

·

Click the OVERRIDE button.

·

PAYROLL MANAGER will prompt the user for a password. Enter in the System Supervisor Password to continue.

·

Enter the desired gross, FICA, Medicare, Federal or State wages

·

When a user has selected to override a payroll checks wages, PAYROLL MANAGER will internally mark the check with the time, date, and user identification for audit control purposes

Exiting the Manual Checks Module

Selecting EXIT from the Update Panel will return the user to the PAYROLL MANAGER Main Menu.

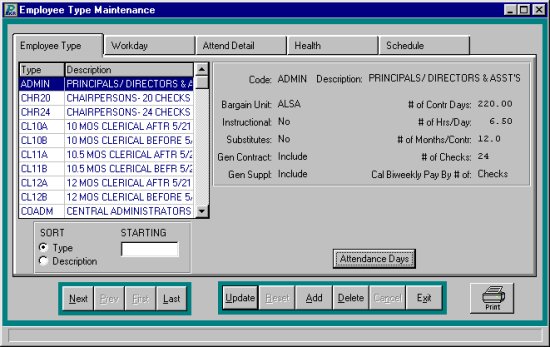

Employee Types

Employee types provide the user with the ability to create, edit, and define categories to classify all of the employees. Employees may be classified for reporting purposes and allow for uniform changes in basic payroll assumptions.

Select Maintenance

ą

Employee Types from the Payroll Maintenance Menu to enter the listing of employee types. A listing of employee types will be displayed in alphabetic order.

Adding an Employee Type

·

Click ADD from the Update Panel.

·

Type the employee type code (up to a maximum of five characters) and press TAB.

·

Enter the description and press TAB.

·

Enter a name of the bargaining unit for this employee type and press TAB.

·

If the employee type is instructional type āYā and press TAB.

·

If the employee type is substitute type āYā and press TAB. This will enable employees to be seen as available substitutes in attendance record data entry (please refer to HUMAN RESOURCES MANAGER, attendance data entry).

·

If the employee type is to be included in the current payroll Generation and Supplemental Earnings, type āIā for āIncludeā and press TAB.

·

Enter the length of the contract year in days and press TAB. This amount should represent the total, regular working days for the entire fiscal year for this employee type.

·

Enter the normal hours per day and months per year for the employee type and press TAB.

·

Enter the Default number of months in the contract and press TAB.

·

Enter in the default number of checks per fiscal year the employee type will be paid in and press TAB.

·

Enter the method of biweekly pay calculation, āDā if based upon the Daily Rate or āCā if based upon the number of Checks.

·

Click the Attendance Days button.

·

Enter in the number of sick, personal, vacation, and comp units earned per year, the maximum limit this employee type may accumulate, and the rate the time accrues at and press TAB. The accrue rate is used by the accrual utility as the default rate for each type.

·

Enter in the number of units, if any per fiscal year granted the employee type for personal reasons and comp time and press TAB. If the days convert to sick days at the end of the fiscal year, type āYā for yes and click the SAVE button to lock in the information.

Finding an Employee Type

In order to edit/change or remove an employee type, it is necessary to locate it. The SORT method assists the user in locating employee type by three search options.

TYPE Allows the user to type in the employee type code being searched

DESCRIPTION Allows the user to search by description.

Editing/Changing an Employee Type

PAYROLL MANAGER provides the user with the ability to edit and change employee types.

·

Select the employee type from the listing.

·

Click UPDATE from the Update Panel.

·

Press TAB until the information to be changed is selected.

·

Enter in the correct data and click SAVE. PAYROLL MANAGER will automatically replace the old data.

Removing an Employee Type

·

Select the individual employee type from the listing.

·

Select DELETE from the Update Panel.

·

PAYROLL MANAGER will ask you āARE YOU SURE?ā

·

Click āYESā to remove the type.

·

Click āNOā to keep the type.

HUMAN RESOURCES Tips

0

If employees are associated with the selected type, deletion is not allowed.

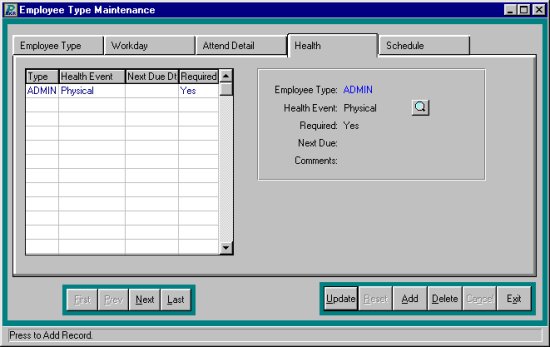

Employee Type Health

The Health screens are used to keep track of various medically related events (e.g. physicals). From the Employee Types listing, select the employee type that you wish to update. Select the HEALTH tab.

ADD...

·

Click ADD on the Update Panel.

·

Enter a new Health Event, or click the magnifying glass to view a list of available events.

·

Answer āYā if it is required, āNā if not required.

·

Enter a Next Due Date for employees of this type, if one standard date is to be used.

·

Enter any special instructions for this employee type.

VIEW...

·

Select a Health Event from the listing.

·

The Health Event information will be displayed on the right side of the screen.

CHANGE...

·

Select a Health Event from the listing.

·

Click UPDATE on the Update Panel.

·

Press TAB until the information to be changed is highlighted.

·

Click SAVE to lock in the changes.

REMOVE...

·

Select a Health Event from the listing.

·

Click DELETE on the Update Panel.

·

Enter āYā and press Enter to remove the record.

·

Enter āNā and press Enter to keep the record.

HUMAN RESOURCES Tips:

0

If you delete the Health Event, you will also delete this event from the employee's records.

PRINTā¦

·

If you enter a next due date, you may print a report of the health events due by clicking on the print icon.

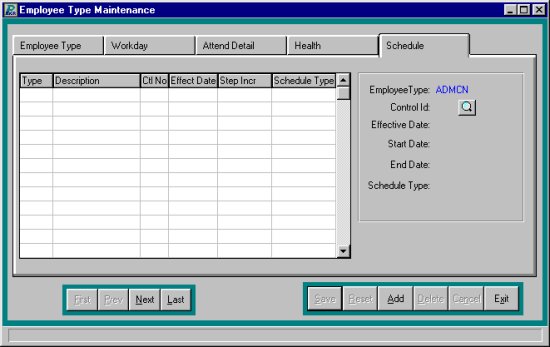

Employee Type Salary Schedule

The path to the Employee Type Salary Schedule is Maintenance

ą

Employee Type

ą

Schedule. Salary schedule information can be set for each employee.

·

Select the desired employee type from the Employee Types tab.

·

Click the Schedule tab.

Adding a Salary Schedule

·

Click ADD from the Update Panel to add a new schedule

·

Enter the control ID or click the magnifying for a list of available Salary Schedules.

·

Enter the effective date for this schedule.

·

Enter the Start date.

·

Enter the End date.

·

Enter the Schedule type.

·

Click SAVE to lock in the new schedule.

Editing/Changing a Salary Schedule

·

Click the desired schedule from the list.

·

Click the UPDATE button from the update panel.

·

Press TAB until the information to be changed is highlighted.

·

Enter the new information and click SAVE. PAYROLL MANAGER will automatically replace the old data with the new data.

Removing a Salary Schedule

·

Select the individual salary schedule from the listing.

·

Click DELETE on the Update Panel.

·

PAYROLL MANAGER will ask you āDelete this record?ā

·

Click āYesā to remove the schedule.

·

Click āNo" to keep the schedule.

PRINTā¦

·

If you enter a salary schedule, you may print a report of the salary schedules by clicking on the print icon.

Exiting the Salary Schedule Module

Selecting EXIT will return the user to the PAYROLL MANAGER Main Menu.

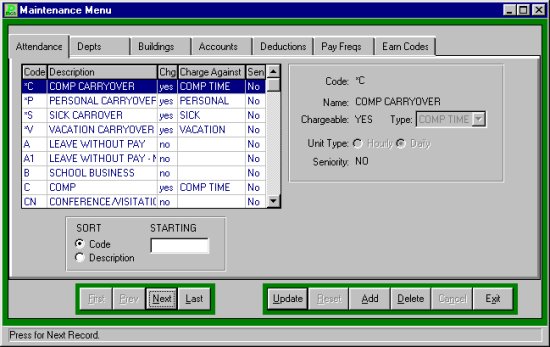

Attendance Codes

To categorize employee attendance records uses PAYROLL MANAGER attendance codes. These codes are used to maintain employee sick, vacation, compensation and leave time records.

Select Maintenance

ą

Attendance Code from the main screen to enter the attendance codes module. The Attendance Codes Screen will be displayed, listing all codes in alphabetic order.

Adding a Code

·

Click ADD on the Update Panel.

·

Type the attendance code (up to a maximum of two characters) and press TAB.

·

Enter the description and press TAB.

·

If the absence is chargeable type āYā for āYESā and press TAB.

·

Enter the type the absence is chargeable against, āSā for sick, āVā for vacation, āPā for personal or āCā for comp time and press TAB

·

Select unit type, Hourly or Daily.

·

Enter āYā or āNā if it applies to Seniority Calculation.

·

Click SAVE to lock in the new attendance code.

HUMAN RESOURCES Tips:

0

There are five fixed attendance codes, *S, *P, *V, *C, and LV. The * codes are accrual codes used to grant employees units earned. The LV code is used to record extended period of unpaid leave. Any recorded leave is used in the calculation of seniority dates.

Finding an Attendance Code

In order to edit/change or remove an attendance code, it is necessary to locate it. The SORT method assists the user in locating the attendance code.

CODE Allows the user to sort by the attendance code being searched.

DESCRIPTION Allows the user to sort by code description.

Editing/Changing an Attendance Code

PAYROLL MANAGER provides the user with the ability to edit and change attendance codes.

·

Select the attendance code from the listing.

·

Select UPDATE from the Update Panel.

·

Press TAB until the information to be changed is highlighted.

·

Enter in the correct data and click SAVE. PAYROLL MANAGER will automatically replace the old data.

Removing an Attendance Code

·

Select the individual attendance code from the listing.

·

Select DELETE from the Update Panel.

·

PAYROLL MANAGER will ask you āDelete this attendance code?ā

·

Click āYes" to remove the code.

·

Click āNo" to keep the code.

Exiting the Attendance Code Module

·

Click the EXIT button to return to the PAYROLL MANAGER main menu.

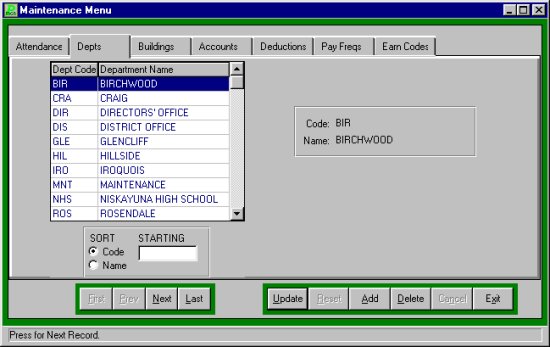

Departments

A department is an individual segment, such as a specific division or department, of the municipal entity that is segregated for reporting purposes. A department code is assigned to each employee record in Employee Information Maintenance. Users may want to create and maintain departments to enhance the relevance of data in PAYROLL MANAGER.

The departments module provides the user with the ability to create, edit, and define department codes used within its system. Select Maintenance

ą

Departments from the PAYROLL MANAGER main screen. The Department Maintenance Screen will be displayed, listing all department codes in alphanumerical order.

Adding a Department

·

Click ADD from the Update Panel.

·

Type in the department number or code and press TAB.

·

Enter the department name and click SAVE to lock in the new code.

Finding an Existing Department

In order to edit/change or remove a department code, it is necessary to locate it. The SORT method assists the user in locating department codes by two search options.

CODE Allows the user to type in the department code number being searched.

NAME Allows the user to search by department name.

Editing/Changing Department Codes

PAYROLL MANAGER provides the user with the ability to edit and change department names. Department codes cannot be edited.

·

Select the individual department from the schedule listing.

·

Click UPDATE from the Update Panel.

·

Press TAB until the information to be changed is highlighted.

·

Enter in the correct name and click SAVE. PAYROLL MANAGER will automatically replace the old name.

Removing a Department

·

Select the individual department from the schedule listing.

·

Click DELETE from the Update Panel.

·

PAYROLL MANAGER will ask you āDelete this department?"

·

Click āYes" to remove the department.

·

Click āNo" to keep the department.

Payroll Tips:

0

If the department code has employees attached deletion will not be allowed.

Exiting the Departments Module

Selecting EXIT from the Update Panel will return the user to the PAYROLL MANAGER main screen.

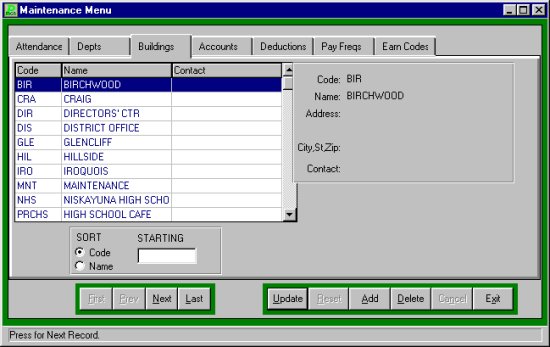

Buildings

The buildings listing provides the user with the ability to create, edit, and define the individual building codes used within the system. Building Codes are used to help categorize or group employee by building for payroll and personel reporting and sorting purposes. You may also choose to print payroll checks by building. A Building Code is assigned to each employee record in Employee Information Maintenance. Select Maintenance

ą

Buildings from the PAYROLL MANAGER main screen to enter the Building Maintenance Screen, which lists all building codes in alphanumerical order.

Adding a Building

·

Click ADD from the Update Panel.

·

Type in the building code number and press TAB.

·

Enter the building name and press TAB.

·

Enter the building address and primary contact person. This address should be the shipping and/or mailing address of the building.

·

Click SAVE to lock in the new information.

Finding an Existing Building

In order to edit/change or remove a building code, it is necessary to locate it. The SORT method assists the user in locating building codes by two search options.

CODE Allows the user to type in the building code being searched

NAME Allows the user to type in the name of the building being searched.

Editing/Changing a Building

PAYROLL MANAGER provides the user with the ability to edit and change building names and addresses. Building codes cannot be edited.

·

Select the individual building code from the schedule.

·

Click UPDATE from the Update Panel.

·

Press TAB until the desired information to be changed is selected.

·

Enter in the correct data and click SAVE. PAYROLL MANAGER will automatically replace the old data.

Removing a Building

·

Select the individual building code from the schedule.

·

Click DELETE from the Update Panel.

·

PAYROLL MANAGER will ask you āDelete this building?ā

·

Click āYesā to remove the building.

·

Click āNo" to keep the building.

Payroll Tips:

0

If the building code has employees attached, deletion will not be allowed.

Exiting the Buildings Module

Selecting EXIT from the Update Panel will return the user to the PAYROLL MANAGER main screen.

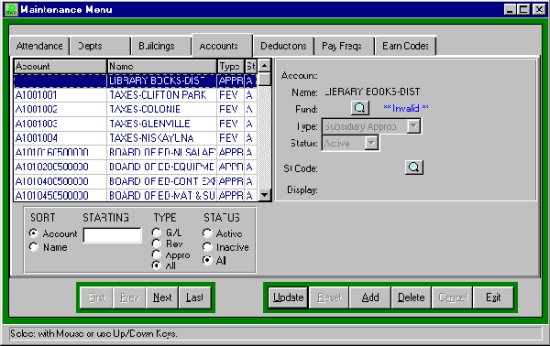

Chart of Accounts

The chart of accounts provides the user with the ability to create, edit, and define the individual budgetary account codes used within its system. Select Maintenance

ą

Chart of Accounts from the PAYROLL MANAGER main screen to enter the chart of accounts. The Chart of Account Maintenance Screen will be displayed, listing all account codes in alphanumeric order.

Adding an Account

·

Select ADD from the Update Panel.

·

Type the account number and press TAB.

Accounting Tips:

0

Account numbers should begin with the individual fund letter followed by the account number as indicated by the New York State Uniform Chart of Accounts. Your fundās specific account number format is designated under the specifications of each fund. (Please refer to ACCOUNTING MANAGER: Maintenance - Funds). Be sure to follow your specified account code format.

·

Enter the account name and press TAB.

·

Enter the fund or click the magnifying glass to select from the Fund look-up listing.

·

Enter the account type and press TAB. Enter G for a general ledger account, S once for a subsidiary revenue account, or S twice for a subsidiary appropriation account.

·

Enter the Account Status, A for Active or I for Inactive, and press TAB.

·

Enter a State Consolidation Code to consolidate the account to for New York State reporting purposes. Be sure to enter in a valid State reporting code or click the magnifying glass to select from the State Consolidation look-up listing. After all new accounts have been entered click SAVE to lock in the new information.

Finding an Existing Account

In order to edit/change or remove an account code, it is necessary to locate it. The SORT method assists the user in locating account codes by four search options.

ACCOUNT Allows the user to type in the account number being searched

NAME Allows the user to type in the name of the account being searched.

TYPE Allows the user to sort by account type.

STATUS Allows the user to sort by account status.

Editing/Changing an Account

PAYROLL MANAGER provides the user with the ability to edit and change account codes. The account code and type cannot be changed once entries exist for the account code.

·

Select the individual account code from the schedule listing.

·

Click UPDATE from the Update Panel

·

Press TAB until the information to be changed is selected.

·

Enter in the correct data and click SAVE. PAYROLL MANAGER will automatically replace the old data.

Removing an Account

Unused account codes may be removed from the system provided no activity exists in the account history.

·

Select the individual account code from the schedule listing.

·

Click DELETE from the Update Panel.

·

PAYROLL MANAGER will ask you āDelete this account?ā

·

Click āYesā to remove the code.

·

Click āNoā to keep the account.

Exiting the Chart of Accounts Module

Selecting EXIT will return the user to the Maintenance Menu

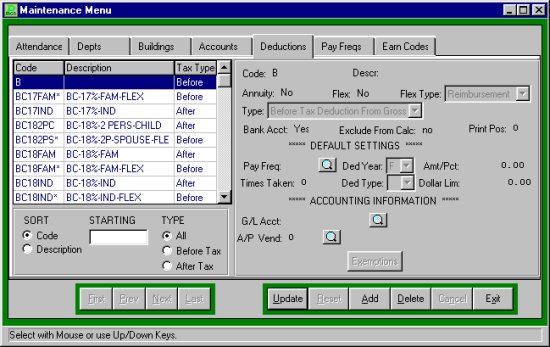

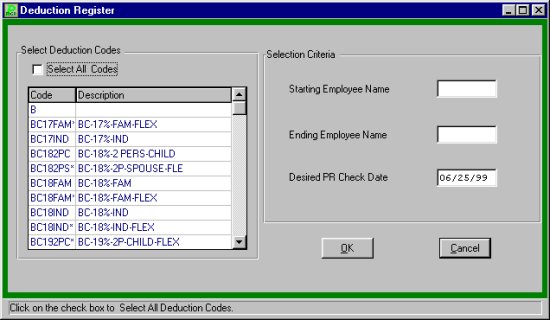

Deduction Codes

To categorize and standardize employee payroll deductions PAYROLL MANAGER uses deduction Codes. Deduction Codes are assigned to employee records in Employee Deduction Information Maintenance.

Select Maintenance

ą

Deduction Codes from the PAYROLL MANAGER main screen to enter the Deduction Codes module. The Deduction Codes Screen will be displayed, listing all codes in alphabetic order.

Adding a Deduction Code

·

Select ADD from the Update Panel.

·

Type the Deduction Code (up to a maximum of eight characters) and press TAB.

·

Enter the description and press TAB.

·

If the deduction is an annuity, type āYā and press ENTER

·

If the deduction is a cafeteria or flex plan, type āYā and press TAB.

·

If a flex deduction, enter the necessary flex plan code, āDā for dependent care, āMā for medical, or āRā for reimbursement, and press TAB.

·

Enter the deduction type, āBā for deduction before taxes or āDā for after taxes, and press TAB.

·

Indicate whether the deduction requires a bank account number by entering āYESā or āNOā and press TAB.

·

If the deduction is to be excluded from the current payroll calculation, type āYā for āYESā and press TAB.

·

Enter the proper print position for this deduction. This field is active only if the Use P/R box number for P/R Deductions flag is checked in the System Parameters Preference Maintenance Function.

·

Enter the default settings for this deduction code. These defaults will be used every time the deduction is added to an employeeās master information. Defaults exist for the pay frequency, times taken per year, deduction year, deduction type, fixed amount, and year-to-date dollar limit.

·

Enter the general ledger account code the deduction is to be recorded in, if any, and press TAB. Click the magnifying glass to view available account codes from the Account look-up screen.

·

If this deduction is payable to a single accounts payable vendor, enter the desired vendor number. Click the magnifying glass to view available vendors from the Vendor Maintenance screen.

·

If the deduction is before taxes, indicate the tax withholdings the deduction is exempt from by clicking the Exemptions buttons.

Finding an Deduction Code

In order to edit/change or remove a deduction code, it is necessary to locate it. The SORT feature assists the user in locating deduction codes by three search options.

CODE Allows the user to type in the deduction code being searched.

DESCRIPTION Allows the user to type in the description of the deduction code being searched.

TYPE Allows the user to sort the listing by type.

Editing/Changing a Deduction Code

PAYROLL MANAGER provides the user with the ability to edit and change deduction codes.

·

Select the deduction code from the listing.

·

Click UPDATE from the Update Panel.

·

Press TAB until the information to be changed is selected.

·

Enter in the correct data and click SAVE. PAYROLL MANAGER will automatically replace the old data.

·

If a T&A code exists which matches this deduction, the user must decide whether or not to also update the related T&A code (see T&A codes in ACCOUNTING MANAGER).

Removing a Deduction Code

Unused deduction codes may be removed from the system provided no activity exists in the account history.

·

Select the individual deduction code from the listing.

·

Click DELETE from the Update Panel.

·

PAYROLL MANAGER will ask you āDelete this deduction?ā

·

Click āYesā to remove the code.

·

Click āNo" to keep the code.

Exiting the Deduction Module

Selecting EXIT will return the user to the Maintenance Menu.

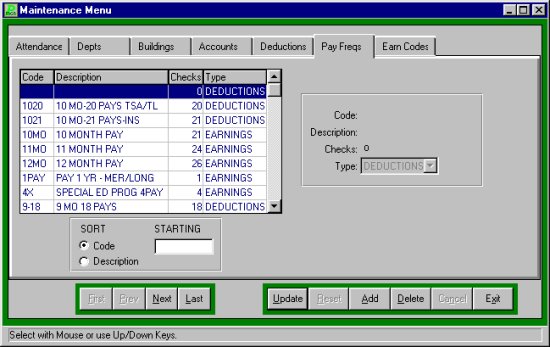

Pay Frequencies

PAYROLL MANAGER uses pay frequency codes to categorize when employee supplemental earnings and voluntary deductions are earned or taken. The frequencies serve as switches that can be turned on when the earning or deduction is desired. Frequencies are assigned to each employee deduction record in Employee Pay Freqeuncies Information Maintenance.

Select Maintenance

ą

Pay Frequencies from the PAYROLL MANAGER main screen to enter the Pay Frequencies module. The Pay Frequencies Screen will be displayed, listing all codes in alphabetic order.

Adding an Pay Frequency

·

Select ADD from the Update Panel.

·

Type the frequency code (up to a maximum of four characters) and press TAB.

·

Enter the description and press TAB.

·

Enter the number of checks, per fiscal year, to be paid to the employees in this pay frequency.

·

Select the type of frequency. Enter āDā for deductions only, āEā for earnings only, or āBā for both deductions and earnings.

·

Click SAVE to lock in the new information.

Finding an Pay Frequency

The Sort method assists the user in locating frequency codes by two search options.

CODE Allows the user to type in the frequency code being searched.

DESCRIPTION Allows the user to type in the description of the pay frequency being searched.

Editing/Changing a Pay Frequency

PAYROLL MANAGER provides the user with the ability to edit and change pay frequency codes.

·

Select the pay frequency from the listing.

·

Click UPDATE from the Update Panel.

·

Press TAB until the information to be changed is highlighted.

·

Enter in the correct data and click SAVE. PAYROLL MANAGER will automatically replace the old data.

Removing a Pay Frequency

·

Select the individual frequency code from the listing.

·

Click DELETE from the Update Panel.

·

PAYROLL MANAGER will ask you āDelete this pay frequency?ā

·

Click āYesā to remove the code.

·

Click āNo" to keep the code.

·

If the pay frequency is in use, it can not be removed.

Exiting the Pay Frequency Module

Selecting EXIT will return the user to the Maintenance Menu.

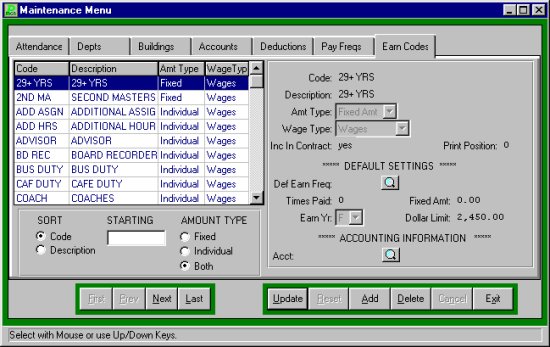

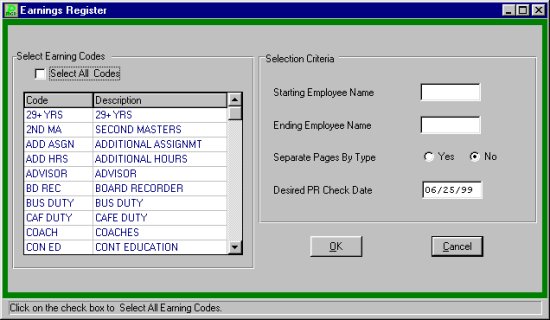

Earning Codes

To categorize employee earnings and assist in budgetary reporting PAYROLL MANAGER uses earning codes. Payroll information defined in earning codes is used in calculating payroll for those earning situations. Earnings Codes are assigned to employee records in Employee Earnings Information Maintenance.

Select Maintenance

ą

Earning Codes from the PAYROLL MANAGER main screen to enter the earning codes module. The Earning Codes Screen will be displayed, listing all codes in alphabetic order.

Adding an Earning Code

·

Select ADD from the Update Panel.

·

Type the earning code (up to a maximum of eight characters) and press TAB.

·

Enter the description and press TAB.

·

Select the amount type, fixed or individual, and press TAB.

·

Select the wage type, wages or reimbursement, and press TAB.

·

Enter "Yes" or "No" to have the earning code included in contractual calculations.

Payroll Tips:

0

Reimbursement earning codes may be used to reimburse employees for valid business expenses through the payroll system. They are used in lieu of direct payments from the General Fund through the accounts payable system the reimbursements are reported on the employeeās Form W-2 at year-end.

·

Enter the proper print position for this Earning. This field is active only if the Use P/R box number for P/R Deductions flag is checked in the System Parameters Preference Maintenance Function.

·

Enter the default settings for this earning code. Defaults exist for the pay frequency, times paid per year, earning year, fixed amount, and year-to-date dollar limit.

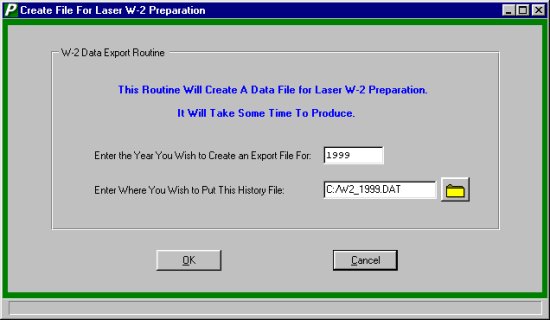

·