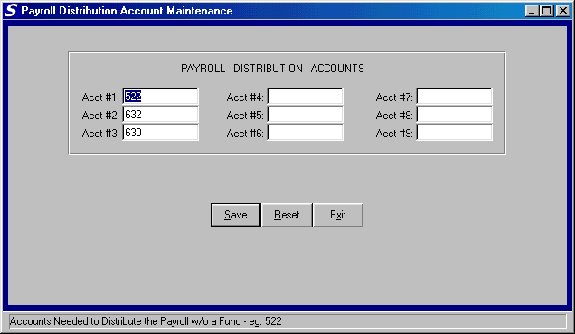

Below is a sample set-up for payroll distribution accounts. With these accounts, FM2000 will fill the 522 amounts (along with the subsidiary amounts) automatically with the proper expenditures for each fund and then prompt the user to distribute the offsets as they see fit. Using this sample, for the A fund, the user will enter the amount of TRS contributions as a credit to the A632 account (Due to TRS) and the balance of the general fund gross payroll to the A630 account. This sets up 2 liabilities: one is for TRS, holding TRS contributions in the general fund until they have been deducted from State Aid and the other is for the amount of money to be transferred to Trust & Agency in order to distribute funds for the payroll. Any other funds should not contain the 632 account and therefore will not prompt the user to enter an amount for this account, but instead we will simply create the liability (630) for funds to be transferred later by check or EFT.

Below is a sample set-up for payroll distribution accounts. With these accounts, FM2000 will fill the 522 amounts (along with the subsidiary amounts) automatically with the proper expenditures for each fund and then prompt the user to distribute the offsets as they see fit. Using this sample, for the A fund, the user will enter the amount of TRS contributions as a credit to the A632 account (Due to TRS) and the balance of the general fund gross payroll to the A630 account. This sets up 2 liabilities: one is for TRS, holding TRS contributions in the general fund until they have been deducted from State Aid and the other is for the amount of money to be transferred to Trust & Agency in order to distribute funds for the payroll. Any other funds should not contain the 632 account and therefore will not prompt the user to enter an amount for this account, but instead we will simply create the liability (630) for funds to be transferred later by check or EFT.

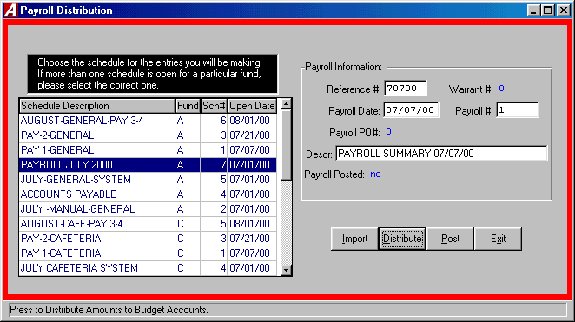

Importing Payroll Expenditures: Once the demographic information has been filled in, click on Import. FM2000 will now ask for a range of dates to look at for payroll checks to record the expenditures for. While simply using the actual payroll date will get the expenditures for a particular payroll, some districts have found it more useful to use a date range from the day after a previous payroll to the date of the payroll being distributed. By doing this, they are able to combine expenditures for any checks that were done outside of the normal payroll without actually distributing them separately. The key to doing this is to make sure you proof your totals and perform the distribution based on payroll reports which use the same date range (ie, in the sample below, run a transaction journal for 7/1/00 through 7/7/00).

Importing Payroll Expenditures: Once the demographic information has been filled in, click on Import. FM2000 will now ask for a range of dates to look at for payroll checks to record the expenditures for. While simply using the actual payroll date will get the expenditures for a particular payroll, some districts have found it more useful to use a date range from the day after a previous payroll to the date of the payroll being distributed. By doing this, they are able to combine expenditures for any checks that were done outside of the normal payroll without actually distributing them separately. The key to doing this is to make sure you proof your totals and perform the distribution based on payroll reports which use the same date range (ie, in the sample below, run a transaction journal for 7/1/00 through 7/7/00).

Distribution of Payroll Expenses from Payroll Manager to Accounting Manager

|

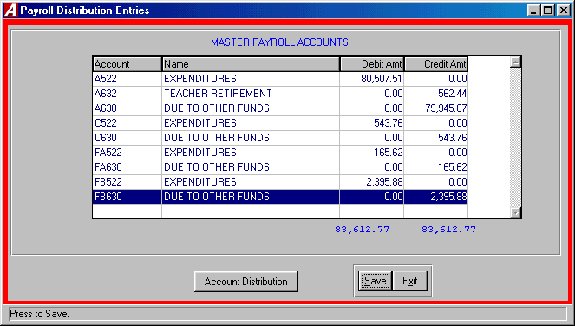

| Run the Payroll Distribution Routine (See Separate Instructions) in the Cash Disbursement sub-menu of |

| Accountng Manager to distribute the expenses to the subsidiary and post the General Ledger entry for the |

| payroll. Both the expense per fund and Due to TRS amounts can be found on the Payroll Transaction Journal. |

| The following is a sample of what will be posted to the General Ledger from the Distribution Routine. |

ACCOUNT

|

Debit

|

Credit

|

| A522 | A Fund Expense | $80,507.51

|

||

| A632 | TOTAL TRS Contributions | $562.44

|

||

| A630 | Due to Other Funds (TA) | $79,945.07

|

||

$80,507.51

|

$80,507.51

|

|||

ACCOUNT

|

Debit

|

Credit

|

| C522 | C Fund Expense | $543.76

|

||

| C630 | Due to Other Funds (TA) | $543.76

|

||

$543.76

|

$543.76

|

|||

ACCOUNT

|

Debit

|

Credit

|

| FA522 | FA Fund Expense | $165.62

|

||

| FA630 | Due to Other Funds (TA) | $165.62

|

||

$165.62

|

$165.62

|

|||

ACCOUNT

|

Debit

|

Credit

|

| FB522 | FB Fund Expense | $2,395.88

|

||

| FB630 | Due to Other Funds (TA) | $2,395.88

|

||

$2,395.88

|

$2,395.88

|

|||

| Total Gross Payroll | $83,612.77

|

$83,612.77

|

Transfer of Gross Payroll from the Funds to Trust & Agency

|

| Run checks from each fund to cover distribution of gross payroll. (Use amounts above that are also found |

| on the Payroll Transactions Journal summary). These checks may be manual or computer generated. |

| Fund | Account Check is Posted to:

|

Check Amount

|

| A | A630 | Due to Other Funds (TA) | A Fund Gross Less TRS | $79,945.07

|

| C | C630 | Due to Other Funds (TA) | C Fund Gross | $543.76

|

| FA630 | Due to Other Funds (TA) | F Fund Gross | $2,561.50

|

|

| F | FB630 | |||

$83,050.33

|

| Net Effect on General Ledger from Cover Checks: |

ACCOUNT

|

Debit

|

Credit

|

| A630 | Due to Other Funds (TA) | $79,945.07

|

||

| A200 | A Fund Cash | $79,945.07

|

||

| C630 | Due to Other Funds (TA) | $543.76

|

||

| C200 | C Fund Cash | $543.76

|

||

| FA630 | Due to Other Funds (TA) | $165.62

|

||

| FB630 | Due to Other Funds (TA) | $2,395.88

|

||

| FA200 | F Fund Cash | $165.62

|

||

| FB200 | F Fund Cash | $2,395.88

|

||

$83,050.33

|

$83,050.33

|

|||

Receipt of Payroll into Trust & Agency

|

| The following is a sample of the Cash Receipt entry which should be made to receive Gross Payroll into TA |

ACCOUNT

|

Debit

|

Credit

|

| TA200 | Gross Less TRS | $83,050.33

|

||

| TA10 | NET PAYROLL | $43,412.62

|

||

| TA22 | FED | $10,142.24

|

||

| TA21 | STATE | $3,145.30

|

||

| TA26 | MED | $1,212.42

|

||

| TA26 | FICA | $5,184.05

|

||

| TA29 | TSA'S | $905.00

|

||

| TA18 | ERS | $752.27

|

||

| TA27 | ERS LOANS | $402.00

|

||

| TA85 | DIRECT DEPOSIT | $17,666.74

|

||

| TA24 | ASSOCIATION DUES | $227.69

|

||

$83,050.33

|

$83,050.33

|

|||

Transfer of Net Payroll From TA Cash to Payroll Account

|

| Cut a check to transfer the Net Payroll to the special payroll account which will have the following affect |

| on General Ledger: |

ACCOUNT

|

Debit

|

Credit

|

| TA10 | Net Payroll | $43,412.62

|

||

| TA200 | TA Cash | $43,412.62

|

||

$43,412.62

|

$43,412.62

|

|||

Transfer of Employer Related Expenses to Trust & Agency

|

| Cut a check to Trust & Agency from each Fund to transfer Employer's share of FICA/Medicare using custom |

| FICA/Medicare report (See sample on page 12) in Payroll Manager. |

| A Fund | A9030800000000 | FICA-DIST | $4,991.15

|

|

| A9030800000000 | MED-DIST | $1,167.28

|

$6,158.43

|

|

| C Fund | C9030800000000 | FICA-DIST | $33.72

|

|

| C9030800000000 | MED-DIST | $7.88

|

$41.60

|

|

| FA Fund | FA90308000000 | FICA-DIST | $10.33

|

|

| FA90308000000 | MED-DIST | $2.42

|

$12.75

|

|

| FB Fund | FB90308000000 | FICA-DIST | $148.85

|

|

| FB90308000000 | MED-DIST | $34.84

|

$183.69

|

|

| Total FICA | $5,184.05

|

|||

| Total Medicare | $1,212.42

|

$6,396.47

|

||

Receipt of Employer's Share of FICA/Medicare into Trust & Agency

|

ACCOUNT

|

Debit

|

Credit

|

| TA200 | TA Cash | $6,396.47

|

||

| TA26 | FICA/Medicare | $6,396.47

|

||

$6,396.47

|

$6,396.47

|

|||

Produce Disbursements from Trust & Agency

|

| Use the following steps to prepare checks for Trust & Agency: |

| 1. Set up a TA disbursement schedule |

| 2. Post computer generated check for each vendor using the proper TA account # |

| on the detail screen. |

| 3. Print and proof the checks to be printed report. | ||

| 4. Print and post the Trust & Agency checks. |

| The following are sample resulting entries in Trust & Agency from these checks: |

ACCOUNT

|

Debit

|

Credit

|

| TA29 | Annuities | $905.00

|

||

| TA24 | Association Dues | $227.69

|

||

| TA85 | Direct Deposit | $17,666.74

|

||

| TA200 | $18,799.43

|

|||

$18,799.43

|

$18,799.43

|

|||